- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Does Marathon Petroleum’s 41% Rally in 2025 Still Offer Value for Investors?

Reviewed by Bailey Pemberton

- Curious whether Marathon Petroleum is a bargain at today's price, or just riding recent market momentum? Let's break down what really matters for long-term investors looking for value.

- After a year-to-date gain of 41.1% and a five-year return that tops 430%, Marathon Petroleum has certainly rewarded shareholders, even with a recent week in the red at -0.3%.

- This price action comes as traders react to developments like evolving energy market supply dynamics and persistent chatter over U.S. fuel demand, as well as sector-wide regulatory shifts. These factors have kept Marathon in the spotlight and helped drive attention to its fundamentals beyond headlines and speculation.

- On our 6-point valuation checklist, Marathon scores a 3. This is not quite a slam dunk, but not overpriced either. We'll dive into how various valuation methods judge the stock, but stick around to see the insight that could matter most before making any buy or sell moves.

Approach 1: Marathon Petroleum Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollar value. This approach aims to capture the value of Marathon Petroleum based on the money the company is expected to generate for shareholders over time.

Marathon Petroleum reported a latest twelve months Free Cash Flow of approximately $5.1 billion. Analysts forecast steady growth, with projections showing Free Cash Flow could reach about $6.9 billion by the end of 2028. Looking further ahead, extrapolated estimates suggest this figure could approach $9.0 billion a decade from now. These projections are all in USD and reflect both analyst estimates for the near-term as well as model-based extrapolations for the long-term.

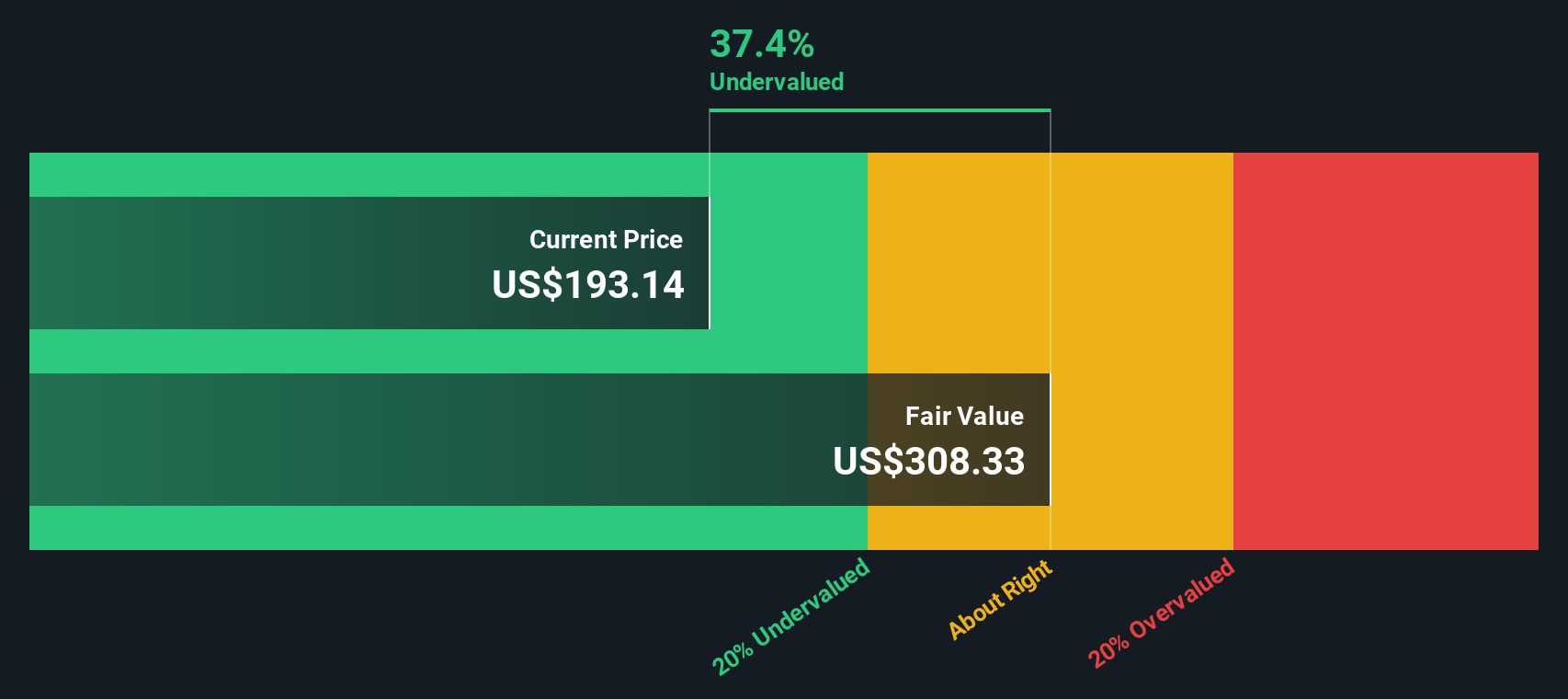

By discounting all these future cash flows, the DCF model calculates an intrinsic value of $565.46 per share for Marathon Petroleum. This implies the current share price is trading at a substantial 64.7% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marathon Petroleum is undervalued by 64.7%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Marathon Petroleum Price vs Earnings

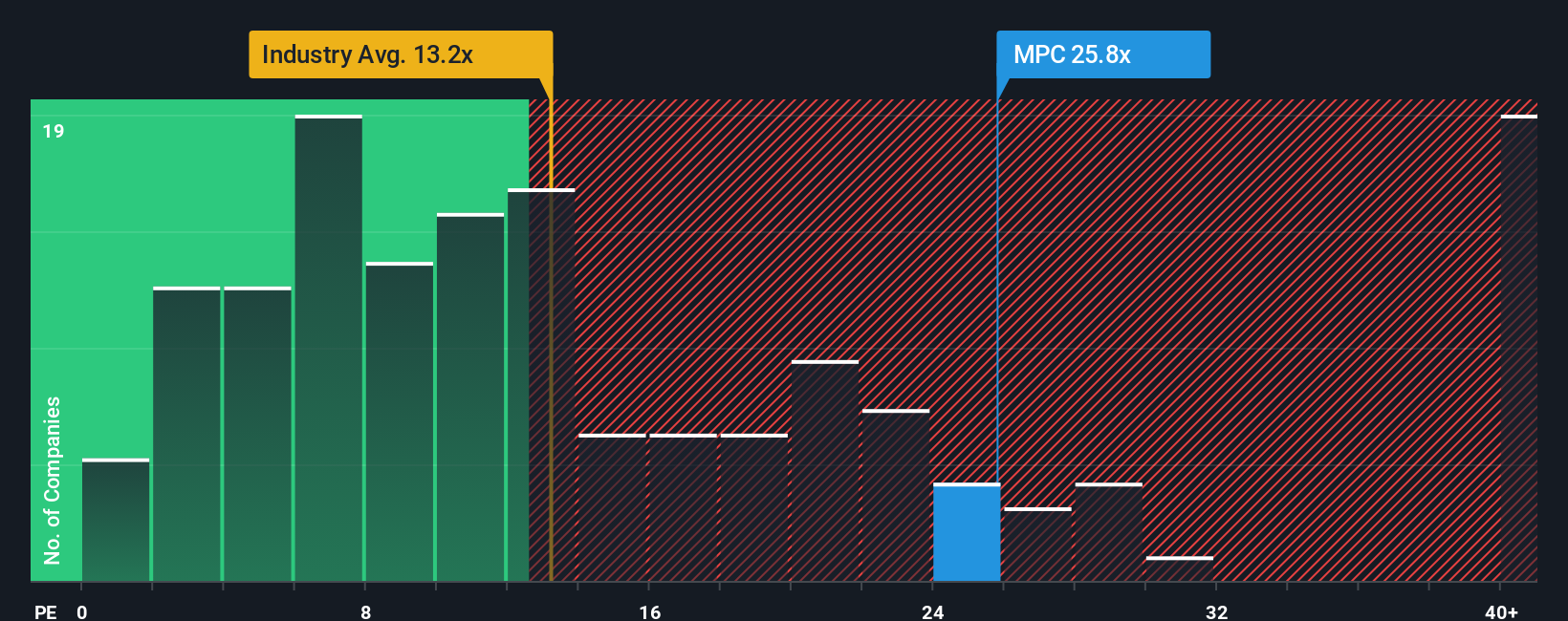

For established, profitable companies like Marathon Petroleum, the Price-to-Earnings (PE) ratio is often the go-to measure for evaluating valuation. The PE ratio offers a snapshot of how much investors are willing to pay for each dollar of earnings the company generates, making it particularly telling for businesses with reliable profits.

It is important to note that what counts as a "fair" or "normal" PE ratio is not static. Growth expectations and perceived business risks both play significant roles. Faster growth or lower risk often justify higher PE multiples, while volatile earnings or industry headwinds can pull the numbers lower.

Currently, Marathon Petroleum trades at a PE ratio of 20.8x, which is comfortably below both the peer average of 30.0x and the broader Oil and Gas industry average of 13.5x. To add more perspective, Simply Wall St calculates a proprietary "Fair Ratio" of 20.1x for Marathon, which factors in not just industry and peer context, but also Marathon’s growth outlook, profit margins, company size, and risk profile.

Relying on the Fair Ratio is often more insightful than simple peer or industry comparisons, since it is tailored to Marathon’s unique mix of strengths and challenges. This customized benchmark helps investors avoid misjudging value based solely on comparison points that may not truly match the company’s trajectory.

With the current PE ratio almost exactly matching the Fair Ratio, the evidence suggests that Marathon Petroleum’s shares are trading at a price that fairly reflects its earnings power and prospects right now.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marathon Petroleum Narrative

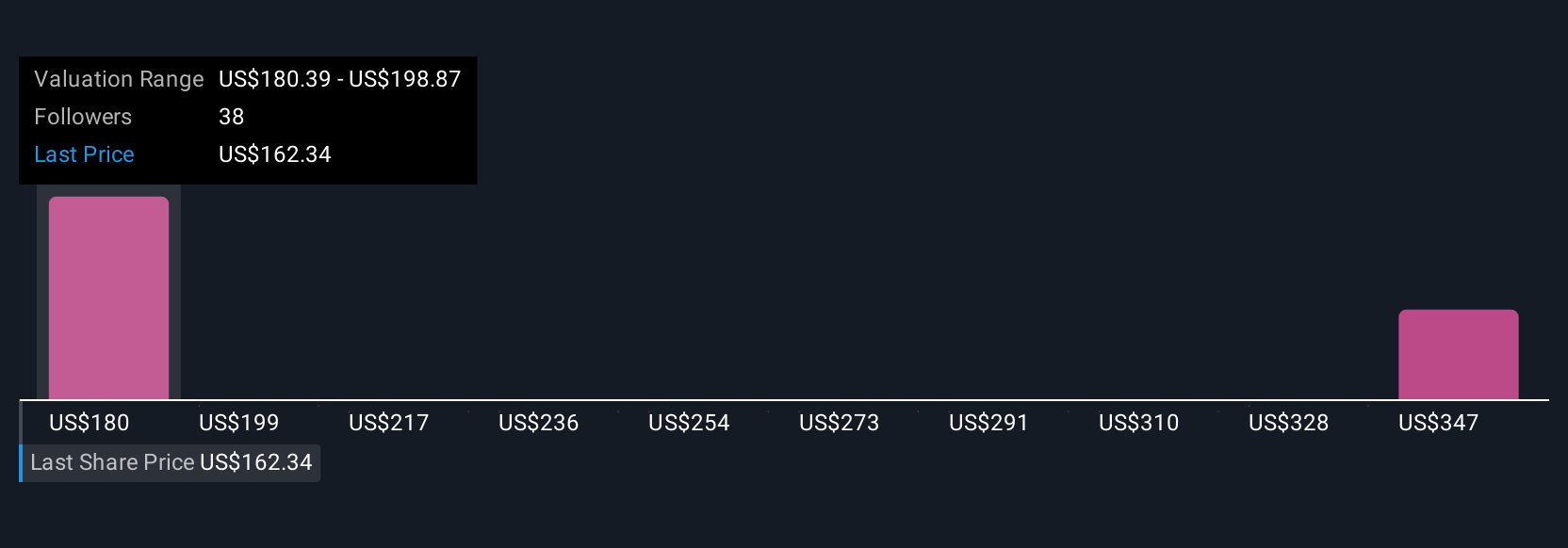

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a personal story you build around a company—your unique perspective on where the business is headed and why—that links your assumptions about future revenue, earnings, and profit margins directly to a fair value estimate. By connecting the company's story to real numbers and a rational forecast, Narratives transform abstract data into actionable insights.

Narratives are available on Simply Wall St's Community page, making it easy for anyone to personalize their investment approach, see what drives the numbers, and update their outlook as new information emerges. With Narratives, anyone can assess whether a stock is a buy, hold, or sell by watching how their fair value changes compared to the actual share price, especially as fresh news or earnings reports are released.

For example, with Marathon Petroleum, some investors may build an optimistic Narrative around strong capital returns and refinery upgrades, leading to a fair value above $206.00. Others may focus on risks from renewables and see fair value closer to $142.00. This highlights how Narratives empower you to make investment decisions that reflect your own beliefs and research.

Do you think there's more to the story for Marathon Petroleum? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives