- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Did Marathon Petroleum’s (MPC) Dividend Hike Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Marathon Petroleum's board of directors recently approved a quarterly dividend increase to US$1.00 per share, up about 10% from the previous dividend, payable December 10, 2025, to shareholders of record as of November 19, 2025.

- This move highlights management's confidence in the company's cash flow discipline and ongoing commitment to delivering returns to shareholders.

- We'll explore how this substantial dividend increase signals management’s outlook and what it could mean for Marathon Petroleum’s investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Marathon Petroleum Investment Narrative Recap

To own shares of Marathon Petroleum, you need to be comfortable with significant exposure to U.S. fuel demand, the company’s refining investments, and the ongoing energy transition. The recently announced 10% dividend hike reinforces Marathon's narrative of strong cash flow priorities, but does not materially affect the biggest near-term catalyst, resilient regional refining margins, or reduce key risks such as policy-driven demand declines and asset impairment potential.

Among recent developments, the company’s ongoing share buybacks stand out, with Marathon repurchasing nearly US$700 million of stock last quarter alone. This capital return activity relates directly to Marathon’s short-term catalysts, supporting shareholder value even as refining sector headwinds and long-term uncertainties persist.

However, despite the reliable yield, investors should also pay close attention to evolving regulatory risks that could…

Read the full narrative on Marathon Petroleum (it's free!)

Marathon Petroleum's narrative projects $123.8 billion in revenue and $4.2 billion in earnings by 2028. This requires a 2.6% annual revenue decline and a $2.1 billion increase in earnings from $2.1 billion today.

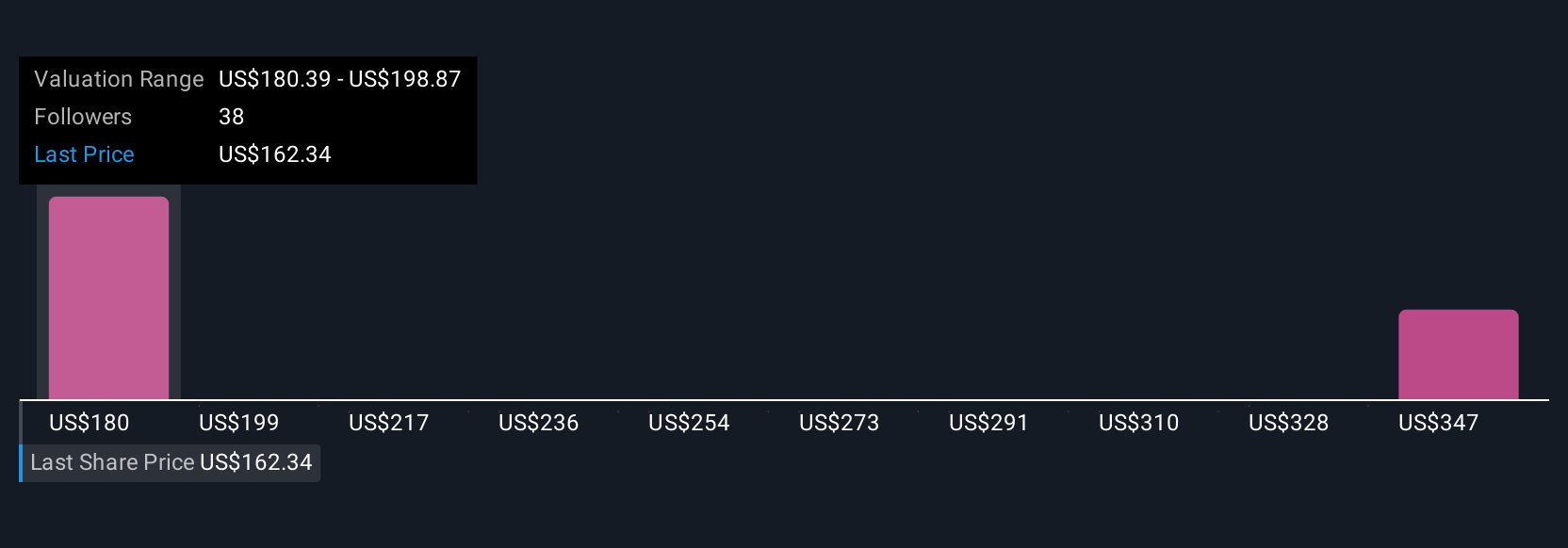

Uncover how Marathon Petroleum's forecasts yield a $196.11 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates for Marathon Petroleum from the Simply Wall St Community span US$196 to US$535 based on four distinct analyses. Views differ widely, reflecting debate about the lasting impact of decarbonization trends on future earnings and refinery asset values; consider exploring all these perspectives for a fuller view.

Explore 4 other fair value estimates on Marathon Petroleum - why the stock might be worth over 2x more than the current price!

Build Your Own Marathon Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marathon Petroleum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marathon Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marathon Petroleum's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives