- United States

- /

- Oil and Gas

- /

- NYSE:LNG

Cheniere’s Long-Term LNG Contracts and Capacity Growth Might Change The Case For Investing In LNG

Reviewed by Sasha Jovanovic

- Cheniere Energy, the largest LNG producer in the U.S. and second largest worldwide, is undergoing significant capacity expansions to address increasing global demand and has secured 95% of its production with long-term contracts through the mid-2030s.

- This extensive contract coverage provides revenue visibility and stability, underpinning confidence in the company’s financial outlook despite broad market uncertainties.

- We’ll look at how Cheniere’s long-term contracts and expansion plans support the company’s investment narrative and future opportunities.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cheniere Energy Investment Narrative Recap

Being a Cheniere shareholder is fundamentally about believing in the long-term need for US liquefied natural gas on the world stage and the stability provided by firm, long-term contracts. The news of 95% capacity booked through the mid-2030s is reassuring for revenue security and short-term confidence, but does not materially affect the biggest near-term catalyst, timely completion and ramp-up of new trains, or the key risk of global LNG oversupply as new projects go live.

Among recent updates, Cheniere’s substantial completion of Train 1 at its Corpus Christi Stage 3 project stands out as directly supporting additional capacity and the ongoing expansion thesis. This milestone is a relevant indicator for near-term progress on growth catalysts, tying the contracting news to concrete operational advances and future revenue visibility.

Yet, even with robust contracts in place, investors should be mindful that should LNG market oversupply put pressure on prices or contract terms...

Read the full narrative on Cheniere Energy (it's free!)

Cheniere Energy's outlook anticipates $24.1 billion in revenue and $3.1 billion in earnings by 2028. Analysts are assuming this will require 9.8% annual revenue growth, but a decline in earnings of $0.7 billion from the current $3.8 billion.

Uncover how Cheniere Energy's forecasts yield a $270.67 fair value, a 23% upside to its current price.

Exploring Other Perspectives

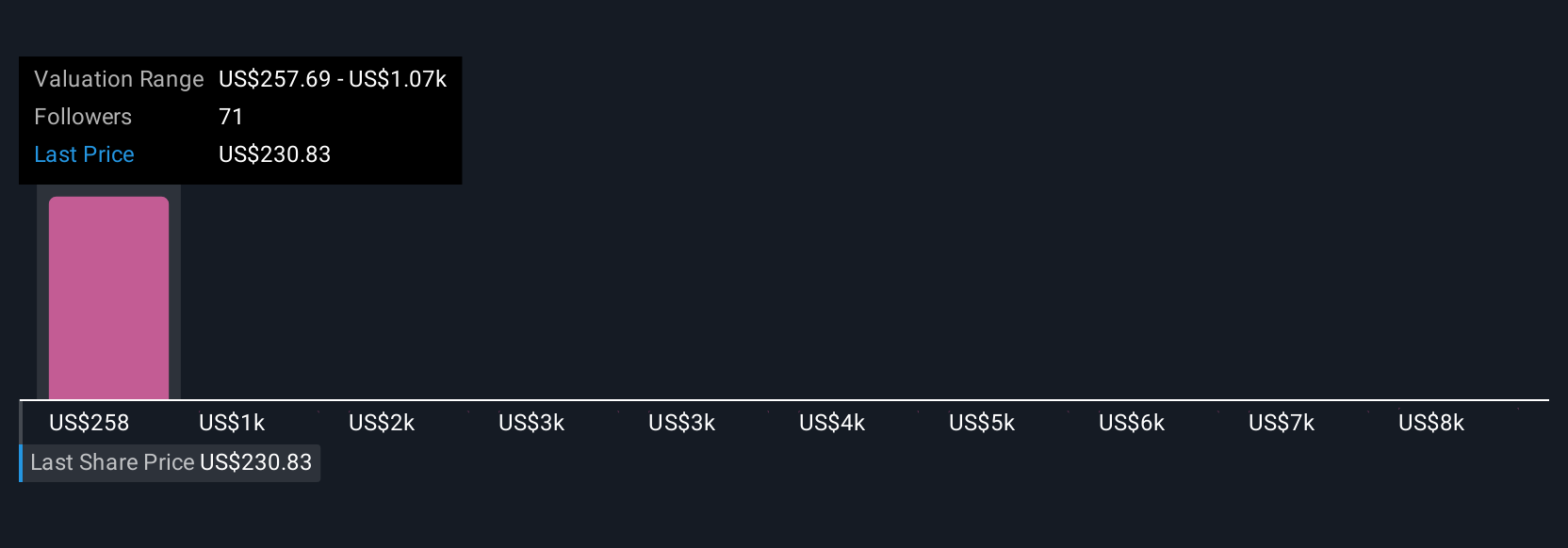

Five individual fair value estimates from the Simply Wall St Community range from US$270 to an outlier of US$6,591 per share. While most participants see the high contract coverage as a strength, new global liquefaction capacity coming online could test this optimism; review different viewpoints to see what this could mean for future returns.

Explore 5 other fair value estimates on Cheniere Energy - why the stock might be a potential multi-bagger!

Build Your Own Cheniere Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cheniere Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNG

Cheniere Energy

An energy infrastructure company, primarily engages in the liquefied natural gas (LNG) related businesses in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives