- United States

- /

- Oil and Gas

- /

- NYSE:LNG

Cheniere Energy (LNG) Is Up 5.9% After Expanding LNG Capacity and Securing New EU Trade Commitments

Reviewed by Simply Wall St

- In recent days, Cheniere Energy announced major LNG capacity expansions and celebrated new trade commitments between the U.S. and European Union that may increase American LNG exports to Europe.

- An interesting development is Cheniere's pursuit of government tax credits for its tankers, a move adding complexity as the company scales operations amid increased international demand.

- We'll explore how Cheniere's LNG capacity expansion plans, highlighted in the recent news, may influence its investment narrative going forward.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cheniere Energy Investment Narrative Recap

To be a Cheniere Energy shareholder, you need to believe in the ongoing global shift to liquefied natural gas and the company's ability to add new capacity and secure export markets, despite revenue and earnings volatility. The recent announcements around expanded LNG capacity and strengthened U.S.-EU trade ties are relevant but do not materially alter the fact that earnings risk, especially from volatility in global gas prices and narrowing margins, remains the most pressing short-term catalyst and risk for investors.

The most relevant announcement is Cheniere’s decision to move forward with Corpus Christi Midscale Trains 8 and 9, expanding its annual capacity to almost 73 million tonnes. As the company ramps up exports and integrates new capacity, short-term financial performance is likely to be closely tied to how well Cheniere manages costs and anticipates shifts in international demand, particularly in light of headline-grabbing trade deals.

But with European gas markets always shifting, investors should also pay close attention to the risk that...

Read the full narrative on Cheniere Energy (it's free!)

Cheniere Energy is projected to deliver $23.0 billion in revenue and $3.0 billion in earnings by 2028. This outlook implies an annual revenue growth rate of 11.1%, but a decrease in earnings of $0.1 billion from current earnings of $3.1 billion.

Uncover how Cheniere Energy's forecasts yield a $267.67 fair value, a 11% upside to its current price.

Exploring Other Perspectives

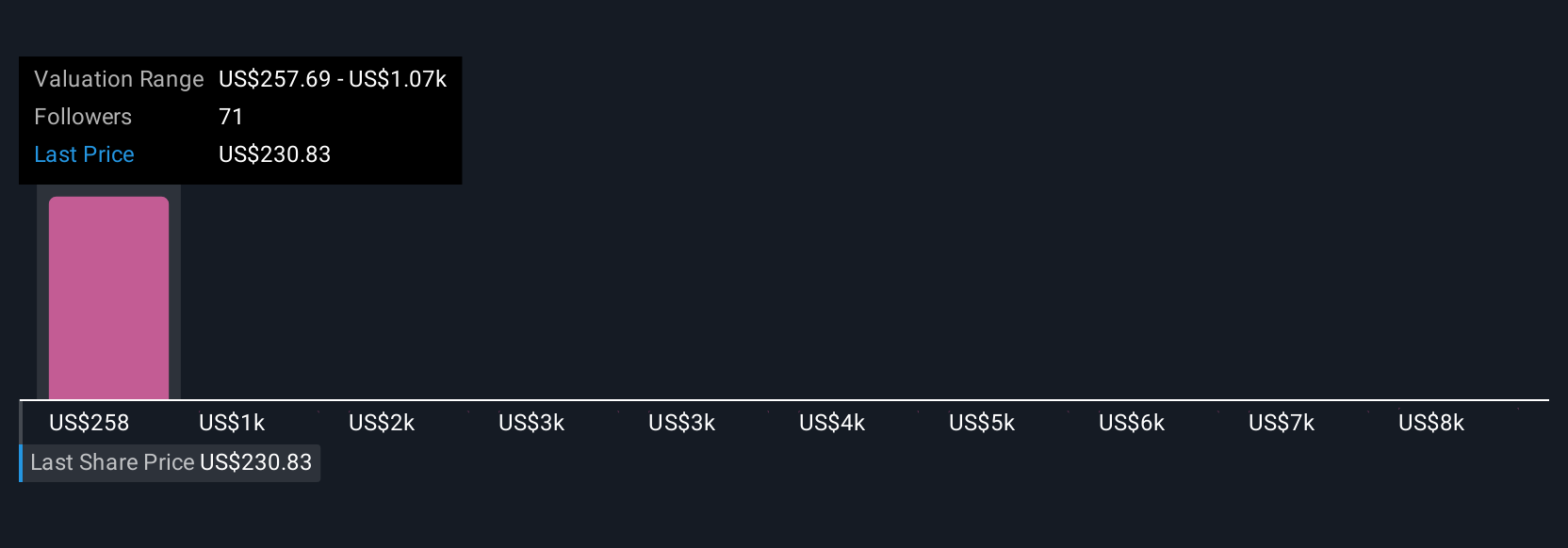

Simply Wall St Community members have created 6 fair value estimates for Cheniere Energy ranging from US$257.69 up to a striking US$8,336.80. While analyst consensus focuses on new project capacity as a catalyst, this wide spread shows how opinions about future cash flows and market risks can lead to very different views, so take time to consider several alternative perspectives when assessing the company’s outlook.

Explore 6 other fair value estimates on Cheniere Energy - why the stock might be worth just $257.69!

Build Your Own Cheniere Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cheniere Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNG

Cheniere Energy

An energy infrastructure company, primarily engages in the liquefied natural gas (LNG) related businesses in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives