- United States

- /

- Oil and Gas

- /

- NYSE:KRP

Kimbell Royalty Partners (KRP): Assessing Valuation Following Lower Q3 Income, Distribution Cut, and Analyst Response

Reviewed by Simply Wall St

Kimbell Royalty Partners (KRP) has just announced third quarter results, highlighting a dip in net income and a lower cash distribution to unitholders as management prioritizes debt reduction. This shift is drawing attention from investors and analysts alike.

See our latest analysis for Kimbell Royalty Partners.

Despite the company tightening distributions and reporting reduced net income for the quarter, Kimbell Royalty Partners’ share price has shown resilience. Shares now trade at $13.79, close to this year’s lows. However, recent momentum is building, with a 7% share price return over the past month. Taking a longer view, total shareholder return remains robust, with five-year gains above 200%, even though the 12-month total return is slightly negative.

If news around Kimbell has you reevaluating your portfolio, this could be a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With shares hovering near their yearly lows and analysts still expressing optimism, the question remains: is Kimbell Royalty Partners undervalued at current prices, or is the market already factoring in future growth prospects and risks?

Most Popular Narrative: 19.8% Undervalued

Compared to Kimbell Royalty Partners’ last close of $13.79, the most popular narrative places fair value notably higher and suggests considerable upside from current levels. This figure is based on forward-looking assumptions around growth, margins, and capital returns over the next few years.

“Kimbell's disciplined, accretive acquisitions in high-quality, diversified basins like the Permian and Haynesville continue to expand its production base and royalty volumes. This should drive revenue and distributable earnings higher. The company's asset-light business model and recent reductions in cash G&A per BOE enhance operating leverage, translating into higher and more sustainable net margins and cash distributions.”

Want to know what drives this projected upside? Behind this valuation is a dramatic shift in future profit expectations and a soaring profit margin target. You won’t believe how ambitious some of these underlying assumptions are. Click through to see the numbers and learn how analysts connect the dots from today’s losses to tomorrow’s growth.

Result: Fair Value of $17.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected production growth or higher acquisition costs could quickly challenge even the most optimistic outlook for Kimbell’s earnings trajectory.

Find out about the key risks to this Kimbell Royalty Partners narrative.

Another View: Multiples Tell a Different Story

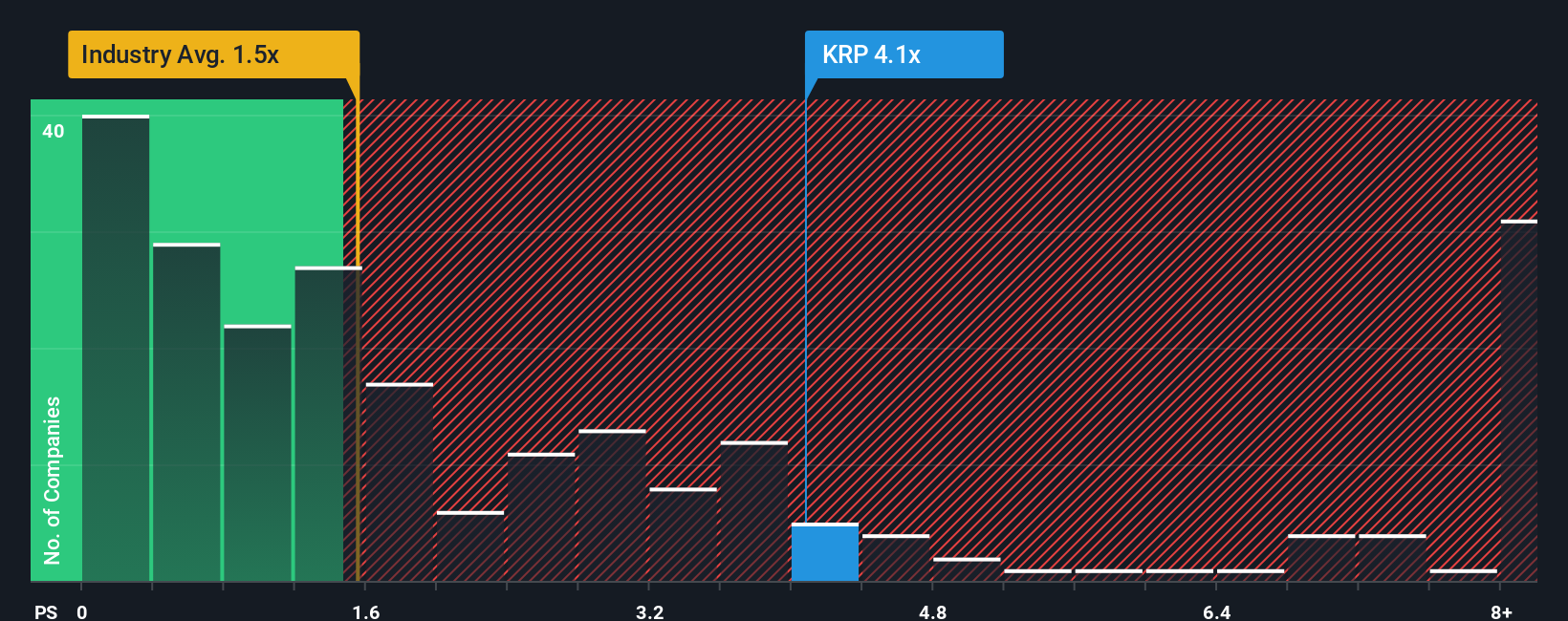

While the analyst consensus points to significant upside, Kimbell Royalty Partners actually trades at a much higher price-to-sales ratio than its industry peers. The ratio stands at 4.1x compared to the sector average of 1.6x, and it is also above a fair ratio of 3.2x. This valuation gap could signal increased risk if market sentiment shifts, leaving investors exposed should prices revert closer to the industry norm. Does this multiple suggest the stock is already pricing in much of its future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kimbell Royalty Partners Narrative

If you think the popular narratives miss the mark or want to dive into your own research, it only takes a few minutes to piece together your perspective. Do it your way

A great starting point for your Kimbell Royalty Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on fresh opportunities. If you want to get ahead, act now and uncover stocks making waves with the Simply Wall Street Screener.

- Unlock potential high-yield income opportunities by scanning these 16 dividend stocks with yields > 3%, which consistently reward shareholders with strong dividend histories and stable returns.

- Spot promising early-stage innovators and seize the chance to invest in these 3577 penny stocks with strong financials, which are poised for breakout growth in emerging industries.

- Jump into tomorrow’s breakthroughs by checking out these 31 healthcare AI stocks, offering pioneering tech solutions across the healthcare landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimbell Royalty Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRP

Kimbell Royalty Partners

Owns and acquires mineral and royalty interests in oil and natural gas properties in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives