- United States

- /

- Oil and Gas

- /

- NYSE:KRP

A Look at Kimbell Royalty Partners’s (KRP) Valuation After KeyBanc Downgrade and Sector Headwinds

Reviewed by Simply Wall St

Kimbell Royalty Partners (NYSE:KRP) has seen its stock come under pressure after KeyBanc downgraded the company. The downgrade was attributed to ongoing volatility in oil prices, limited growth projections for the Permian basin, and increasing competition in the mineral space.

See our latest analysis for Kimbell Royalty Partners.

The recent downgrade by KeyBanc triggered a sharp reaction for Kimbell Royalty Partners, with the share price sliding nearly 26% year-to-date amid ongoing volatility in oil prices and uncertainty surrounding growth in the Permian basin. Despite a five-year total shareholder return of nearly 140%, momentum has clearly faded in the short term as risk appetite for smaller mineral players has cooled given the current industry headwinds.

If you’re curious about other opportunities beyond energy, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading well below their recent highs and analysts pointing to a significant discount versus price targets, the question arises: is Kimbell Royalty Partners currently undervalued, or is the market already pricing in subdued growth prospects?

Most Popular Narrative: 27.6% Undervalued

Compared to its recent closing price of $12.45, the most widely followed narrative places Kimbell Royalty Partners’ fair value much higher. This suggests the stock trades at a significant discount and raises key questions about whether market caution overshoots the underlying fundamentals.

Kimbell's disciplined, accretive acquisitions in high-quality, diversified basins like the Permian and Haynesville continue to expand its production base and royalty volumes. This trend may drive revenue and distributable earnings higher. The company's asset-light business model and recent reductions in cash G&A per BOE enhance operating leverage, which can translate into higher and more sustainable net margins and cash distributions.

Want to know what powers this robust valuation? The calculations bank on a future financial milestone and a margin trajectory that could surprise even seasoned investors. Get the full story to uncover the ambitious assumptions and projected metrics that drive this eye-catching price target.

Result: Fair Value of $17.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including natural declines in key basins and rising acquisition costs. Both of these factors could challenge future revenue and margin growth.

Find out about the key risks to this Kimbell Royalty Partners narrative.

Another View: Multiples Tell a Different Story

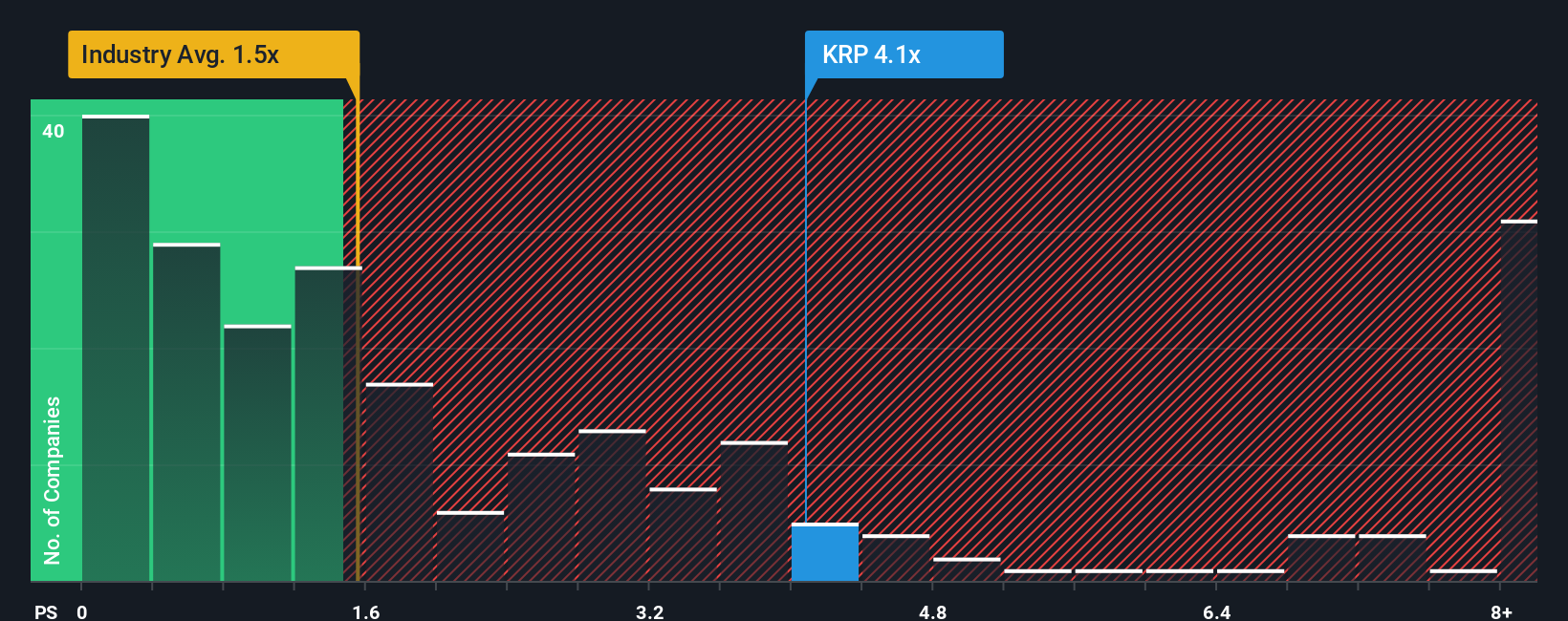

Looking at value from a price-to-sales ratio, Kimbell Royalty Partners appears less attractive. The company trades at 3.7x sales, which is above the US Oil and Gas industry average of 1.5x and its calculated fair ratio of 3.3x. This difference suggests its stock could be overvalued on this basis, raising caution for investors. Are the optimistic growth forecasts already priced in, or is there still a bargain hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kimbell Royalty Partners Narrative

If you want to dig deeper or have your own point of view, it’s easy to analyze the data and form your own perspective in just a few minutes. Do it your way

A great starting point for your Kimbell Royalty Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Capitalize on the momentum of your research and get ahead of the crowd by targeting sectors and trends where opportunity is moving quickly. Start your search now, or you might miss what the smart money is spotting early.

- Jump on emerging trends by scanning these 25 AI penny stocks powering breakthroughs in artificial intelligence and shaping tomorrow’s tech landscape.

- Secure reliable income streams and spot strong yields with these 15 dividend stocks with yields > 3% that offer compelling payout potential for long-term growth.

- Gain an edge in the digital revolution as you analyze these 81 cryptocurrency and blockchain stocks built around blockchain innovation and cryptocurrency adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimbell Royalty Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRP

Kimbell Royalty Partners

Owns and acquires mineral and royalty interests in oil and natural gas properties in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026