- United States

- /

- Oil and Gas

- /

- NYSE:KNTK

Kinetik Holdings (KNTK): Evaluating Valuation After Q3 Earnings and Completion of Share Buyback Program

Reviewed by Simply Wall St

Kinetik Holdings recently released its third-quarter earnings, showing revenue gains but a notable dip in net income compared to last year. At the same time, the company finalized a sizable share buyback program, which has drawn attention from investors.

See our latest analysis for Kinetik Holdings.

It’s been a volatile stretch for Kinetik Holdings, with its recent earnings update and the completion of the share buyback program prompting heightened attention. Despite positive revenue growth, the stock’s momentum has faded. This is reflected by a 30-day share price return of -12.06% and a steep year-to-date decline. While the 3-year total shareholder return is still positive at 24.45%, the 1-year total return stands at -38.29%. This signals meaningful headwinds in the short term even as management continues to focus on shareholder value.

If you’re curious about what other opportunities are unfolding in the market, now’s a great time to explore fast growing stocks with high insider ownership.

With shares trading at a steep discount to analyst price targets and valuation scores signaling potential upside, the question now is whether Kinetik Holdings is an overlooked bargain or if the market has fully priced in its future prospects.

Most Popular Narrative: 34.1% Undervalued

With a narrative fair value of $49.92 compared to Kinetik Holdings' last close of $32.89, the current price leaves room for substantial upside according to consensus expectations. This perspective is shaped by a blend of infrastructure expansion, sector tailwinds, and anticipated margin improvement over the coming years.

Kinetik's upcoming and recently completed infrastructure projects in the Northern Delaware Basin, especially Kings Landing and the associated acid gas injection capacity, are expected to unlock significant incremental volumes of treated sour gas. This is anticipated to support multiyear revenue and earnings growth as producers ramp up drilling and send higher volumes through Kinetik's systems.

Want to know what powerhouse assumptions are behind this valuation? Hint: Rapid revenue lift, margin expansion, and eye-popping future profit multiples drive the narrative. Which forecasts really make the model tick? See which bold estimates analysts are betting on and why the upside could surprise you.

Result: Fair Value of $49.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and possible slowdowns in upstream drilling could challenge Kinetik Holdings' margin expansion and near-term growth outlook.

Find out about the key risks to this Kinetik Holdings narrative.

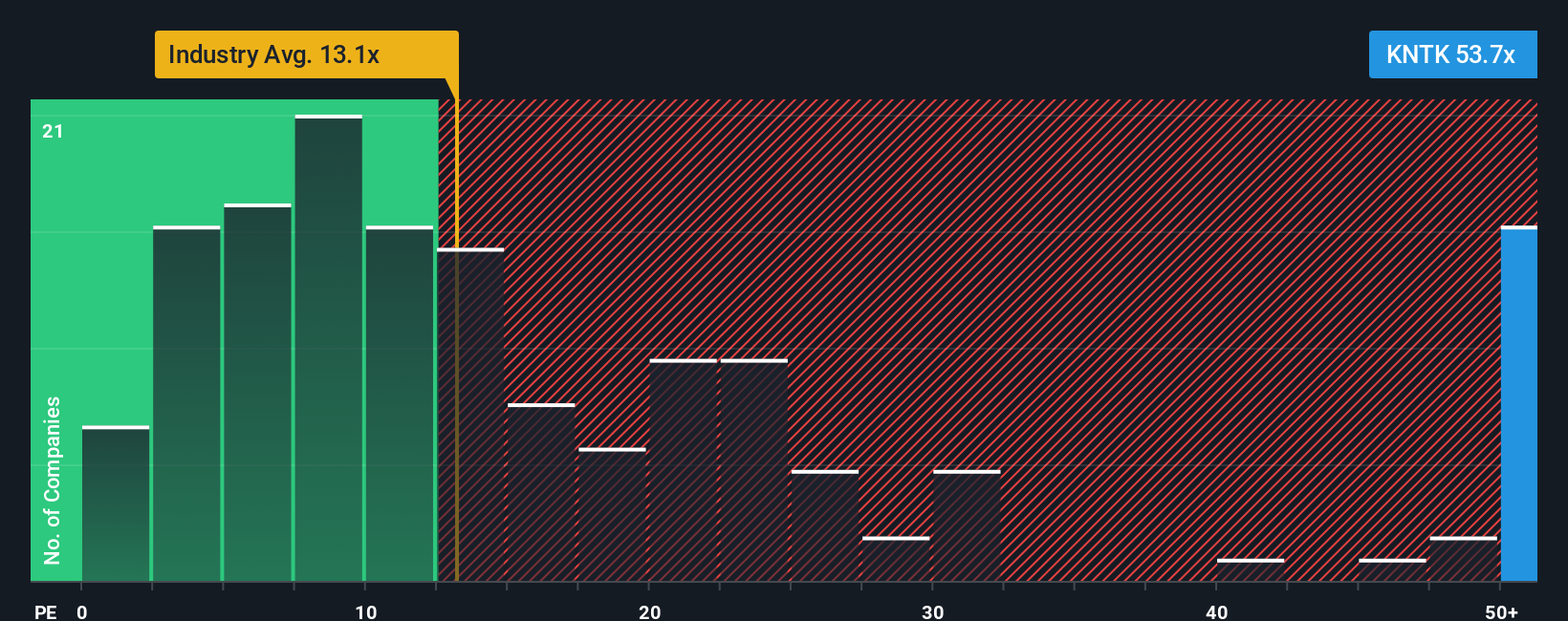

Another View: High Multiples Raise Fresh Questions

Looking through the lens of earnings-based valuation, Kinetik Holdings trades at a striking 82.5 times recent earnings. This is much higher than peers averaging 29.9 and far beyond the sector’s 13.5 benchmark. The market’s lofty ratio stands apart from a much lower fair ratio of 32.9, implying a valuation risk if investor expectations reset. Could sentiment shift if these multiples normalise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinetik Holdings Narrative

If you have a different angle or want to dig into the numbers yourself, it only takes a few minutes to shape your own perspective. Do it your way.

A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by checking out handpicked opportunities the market is buzzing about. Don't let your next big winner slip away; smart investing means always staying one step ahead.

- Unlock untapped growth potential by tapping into these 876 undervalued stocks based on cash flows that the market may be overlooking right now.

- Accelerate your returns as artificial intelligence transforms industries with these 26 AI penny stocks on the leading edge of innovation.

- Capture impressive yields for your portfolio by evaluating these 15 dividend stocks with yields > 3% offering reliable and attractive income opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetik Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNTK

Kinetik Holdings

Through its subsidiaries, operates as a midstream company in the Texas Delaware Basin.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives