- United States

- /

- Oil and Gas

- /

- NYSE:KNTK

Does Kinetik Holdings’ (KNTK) Dividend Highlight Management’s Confidence or Indicate Limited Reinvestment Plans?

Reviewed by Simply Wall St

- On July 15, 2025, Kinetik Holdings Inc. declared a cash dividend of US$0.78 per share, payable on August 1, 2025 to shareholders of record as of July 25, 2025.

- This dividend declaration highlights Kinetik Holdings' emphasis on returning capital to shareholders, an aspect that often interests income-oriented investors.

- We'll examine how the affirmed cash dividend informs Kinetik Holdings' investment narrative and signals management's confidence in the business.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

Kinetik Holdings Investment Narrative Recap

To be a shareholder in Kinetik Holdings, one needs to believe in the company’s ability to generate sustained cash flows through its gas gathering and processing assets in the Delaware Basin, capitalize on long-term natural gas demand, and manage operational and pricing risks such as those from unexpected negative Waha gas prices. The recent dividend affirmation reinforces management’s confidence and commitment to shareholder returns, but it does not materially change the central short-term catalyst, the startup and ramp-up of the Kings Landing Complex, nor does it address the ongoing risk around margins and power costs. Among recent announcements, the May 9, 2024, 15-year gas gathering and processing agreement in New Mexico stands out as particularly relevant. This long-term contract complements Kinetik’s push to drive revenue through expansion and organic growth, serving as foundational support for its dividend policy and strategic ambitions. However, it also highlights the execution risk associated with new projects and the need for disciplined cost control as Kinetik scales up its processing capacity. By contrast, investors should be aware that the affirmed dividend does not reduce the pressure from rising electricity expenses, leaving Kinetik exposed to ...

Read the full narrative on Kinetik Holdings (it's free!)

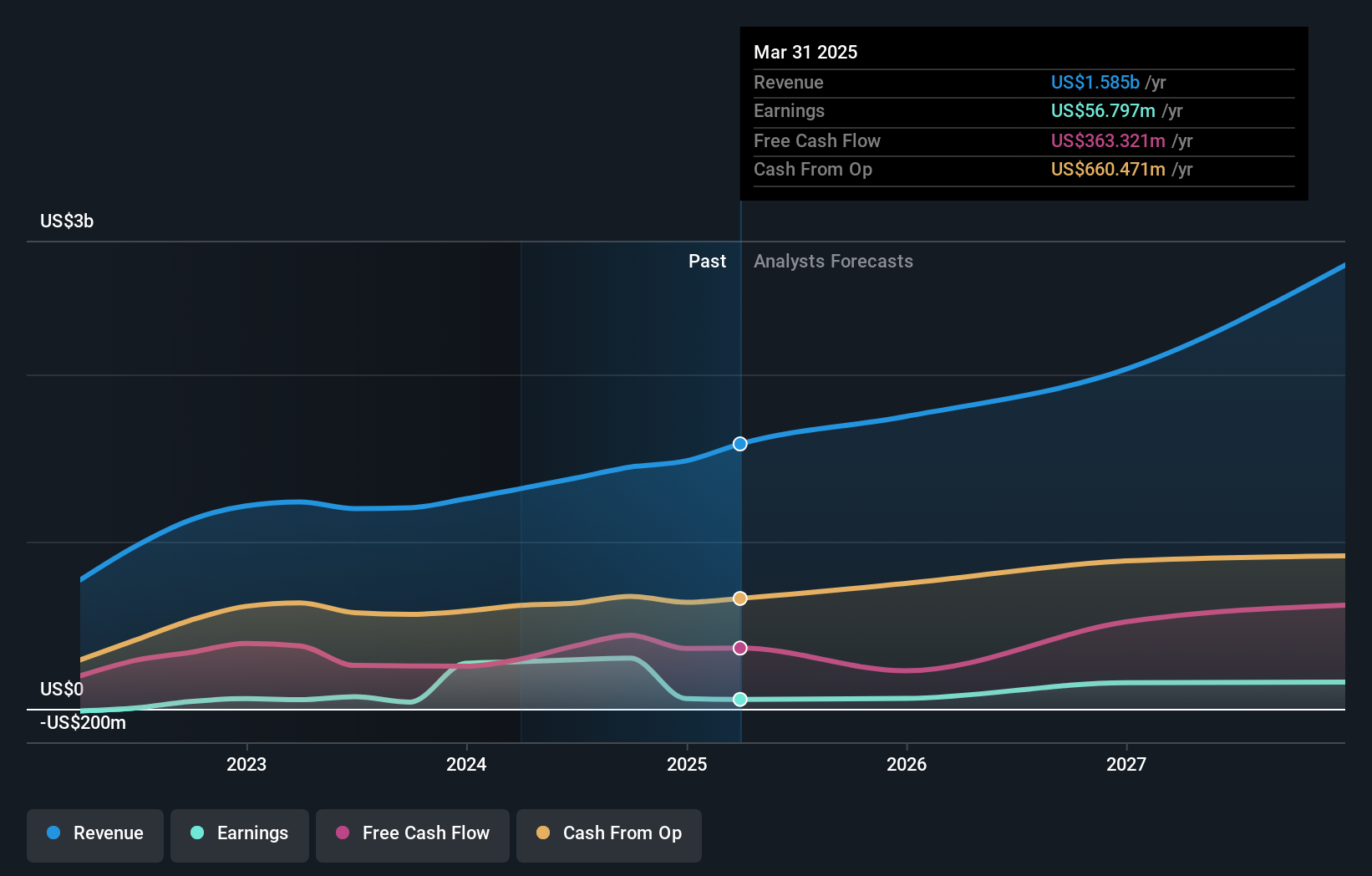

Kinetik Holdings' narrative projects $2.6 billion in revenue and $221.3 million in earnings by 2028. This requires 17.8% yearly revenue growth and a $164.5 million increase in earnings from the current level of $56.8 million.

Uncover how Kinetik Holdings' forecasts yield a $52.92 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for Kinetik Holdings between US$52.92 and US$65.71, reflecting just two perspectives. While the dividend decision appears strong, margin risks due to operational costs remind us that company performance and investor opinions can diverge significantly. Consider exploring more viewpoints on Kinetik's outlook.

Explore 2 other fair value estimates on Kinetik Holdings - why the stock might be worth just $52.92!

Build Your Own Kinetik Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Kinetik Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinetik Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetik Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNTK

Kinetik Holdings

Through its subsidiaries, operates as a midstream company in the Texas Delaware Basin.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives