- United States

- /

- Oil and Gas

- /

- NYSE:KMI

Kinder Morgan (KMI): Evaluating Valuation Strength After 26% 1-Year Total Return

Reviewed by Kshitija Bhandaru

See our latest analysis for Kinder Morgan.

This kind of steady run, topped off by a 1-year total shareholder return above 26%, points toward momentum building around Kinder Morgan. Even as the recent share price has hovered near $28 with only modest near-term movement, it is clear long-term holders have seen much stronger gains than short-term traders. This highlights renewed confidence in the company's direction and cash-generating potential.

If Kinder Morgan’s progress has you rethinking your strategy, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with the stock trading at a 10% discount to analyst price targets and still up over 26% in a year, is Kinder Morgan undervalued? Or is the market already factoring in all that future growth?

Most Popular Narrative: 9.2% Undervalued

With Kinder Morgan’s narrative fair value set at $31.06 and the last close at $28.22, the market appears to be lagging behind rising expectations for the company’s transformational infrastructure role. Here is what is fueling the optimism from the most-followed narrative.

Anticipated growth in global natural gas demand, driven by rising populations in Asia and Africa and increased energy needs from urbanization, is expected to sustain or increase utilization of Kinder Morgan's core pipeline and LNG infrastructure. This underpins long-term revenue growth through higher throughput volumes and long-term contracts.

Want to know why this valuation stands out? Analysts are considering a future where Kinder Morgan benefits from rising demand, solid margins, and notable growth projections. The full narrative explains the financial reasoning behind this outlook.

Result: Fair Value of $31.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued high leverage and the industry’s accelerating energy transition could present challenges for Kinder Morgan’s growth prospects and future revenue stability.

Find out about the key risks to this Kinder Morgan narrative.

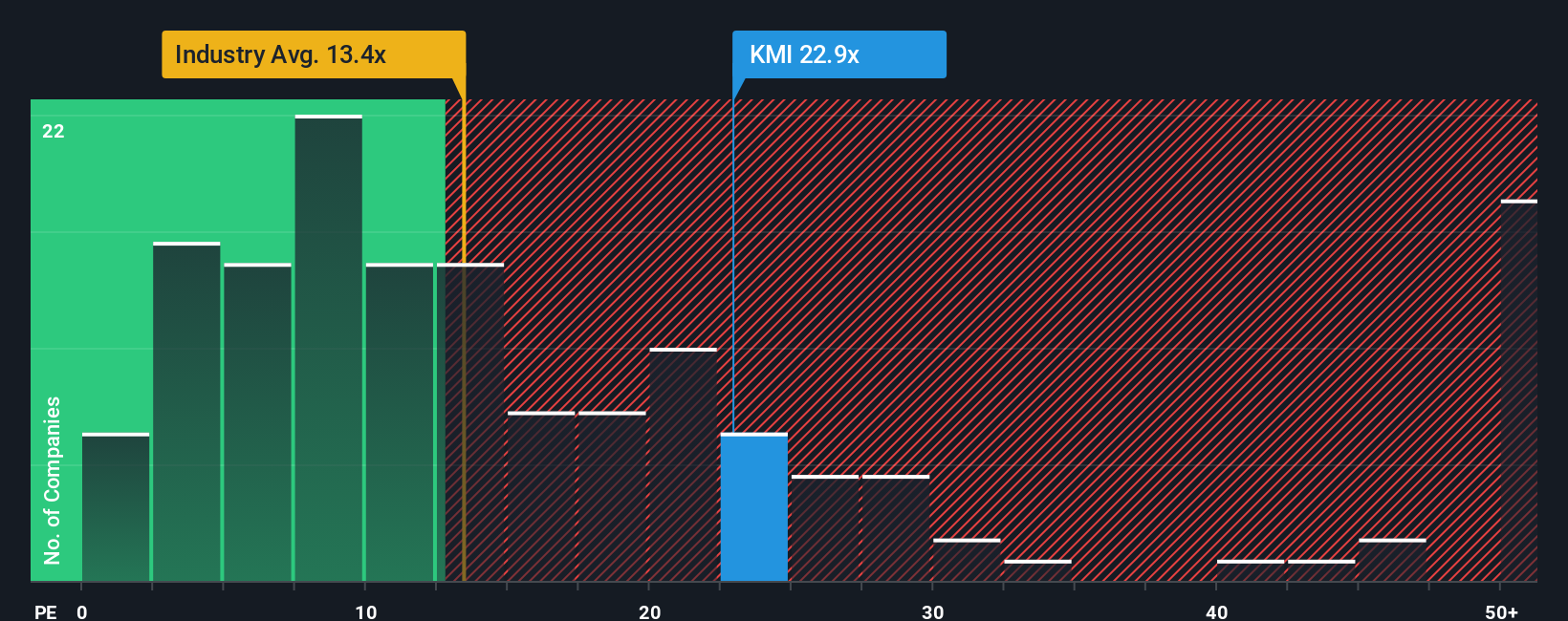

Another View: Earnings Ratio Sends Mixed Signals

Looking at valuation from an earnings perspective, Kinder Morgan’s price-to-earnings ratio sits at 23.2x. This is noticeably higher than the US Oil and Gas industry average of 13.1x, as well as peer and fair ratios in the 17.2x and 19.5x range. This premium could signal market optimism or introduce downside risk if sector sentiment shifts. Does this gap mean the stock is overvalued, or is the market rightly pricing in Kinder Morgan’s unique strengths?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinder Morgan Narrative

If the data or outlook here doesn't match your perspective, you can review the numbers and put together your own view of Kinder Morgan in just a few minutes. Do it your way

A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Opportunities?

Smart investors never limit their options. Get ahead of the market and uncover stocks with hidden momentum, strong income, or breakthrough potential using these tailored ideas:

- Reimagine your returns by tapping into steady income streams with these 19 dividend stocks with yields > 3%, which offers attractive yields and robust fundamentals.

- Accelerate your portfolio’s growth by targeting the future of healthcare with these 31 healthcare AI stocks, where AI-driven innovation meets medical advancement.

- Strengthen your watchlist by targeting genuine bargains with these 910 undervalued stocks based on cash flows, identified through rigorous analysis of underlying cash flows and value metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives