- United States

- /

- Oil and Gas

- /

- NYSE:KMI

Is the Western Gateway Pipeline Collaboration Reshaping Kinder Morgan’s (KMI) Southwest Expansion Strategy?

Reviewed by Sasha Jovanovic

- On October 20, 2025, Phillips 66 and Kinder Morgan announced the launch of a binding open season for the proposed Western Gateway Pipeline, a joint project designed to expand refined products transportation from Borger, Texas to Arizona, California, and with added connectivity to Las Vegas through Kinder Morgan’s CALNEV Pipeline.

- This collaboration is expected to increase pipeline capacity and integrate new supply routes, marking a significant advancement in midstream infrastructure for key southwestern markets.

- We’ll look at how the Western Gateway Pipeline partnership could influence Kinder Morgan’s investment narrative by strengthening market reach and infrastructure growth.

Find companies with promising cash flow potential yet trading below their fair value.

Kinder Morgan Investment Narrative Recap

To be a Kinder Morgan shareholder, you need to believe in long-term demand for fossil fuel infrastructure and the company's ability to convert that into consistent cash flow despite macro shifts toward renewables. The Western Gateway Pipeline project adds to Kinder Morgan’s reach and capacity, but does not materially change the major short-term catalyst: continued US natural gas demand growth. The largest risk remains high leverage, which could limit financial flexibility or increase vulnerability in downturns.

Of Kinder Morgan’s recent announcements, the Q3 2025 results coming on October 22 are the most relevant in the context of these catalysts. Near-term earnings growth and management commentary often provide key signals about how effectively the company is capitalizing on industry expansion and managing its capital structure.

On the other hand, investors should also be mindful of Kinder Morgan’s elevated debt load and what it means if energy demand or pricing shifts…

Read the full narrative on Kinder Morgan (it's free!)

Kinder Morgan's narrative projects $20.2 billion revenue and $3.7 billion earnings by 2028. This requires 8.2% yearly revenue growth and a $1.0 billion increase in earnings from $2.7 billion today.

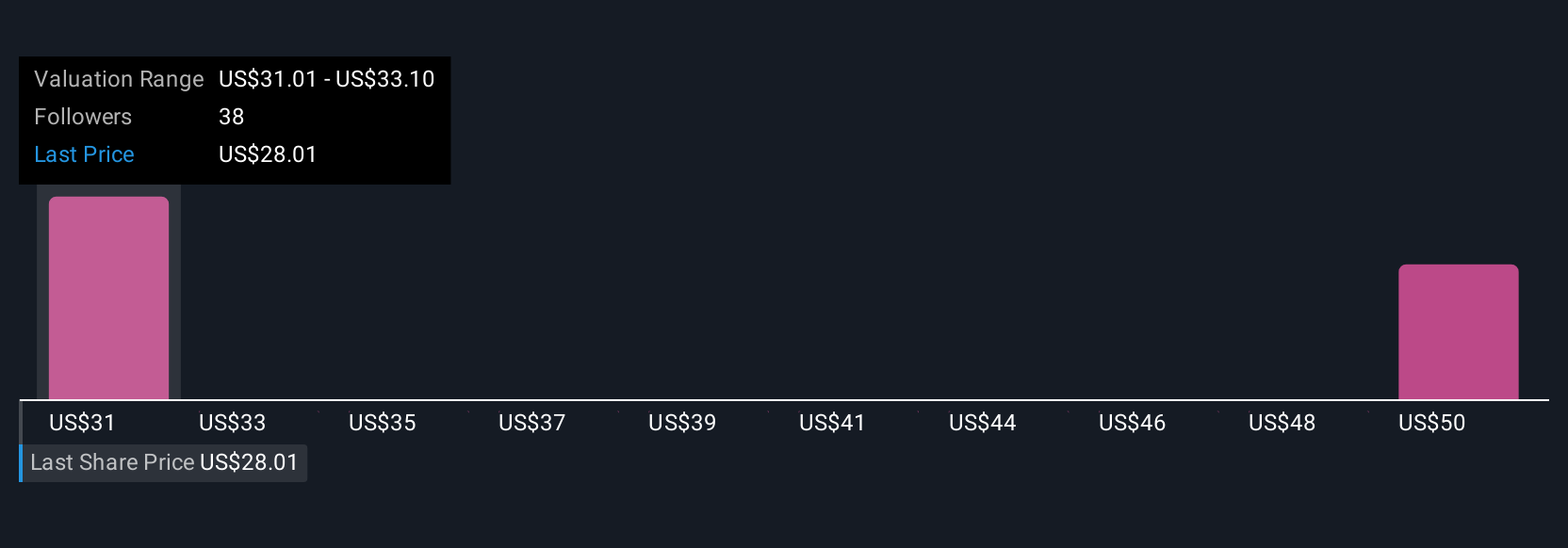

Uncover how Kinder Morgan's forecasts yield a $31.06 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set Kinder Morgan fair value estimates from US$28.06 through US$39.18, based on four diverse forecasts. While some focus on expansion potential, others point to the risk posed by Kinder Morgan’s high leverage and shifting energy markets. Explore what each perspective could mean for performance.

Explore 4 other fair value estimates on Kinder Morgan - why the stock might be worth as much as 42% more than the current price!

Build Your Own Kinder Morgan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kinder Morgan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinder Morgan's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives