- United States

- /

- Energy Services

- /

- NYSE:KGS

Kodiak Gas Services’ US$336 Million Equity Raise Might Change the Case for Investing in KGS

Reviewed by Sasha Jovanovic

- Kodiak Gas Services, Inc. recently completed a follow-on equity offering, raising US$336 million by issuing 10,000,000 shares of common stock at US$33.60 each with a US$0.279 discount per share.

- This capital infusion increases Kodiak's financial flexibility, potentially supporting growth initiatives or enhancing the company's ability to manage its capital structure in a rapidly evolving energy landscape.

- Next, we’ll assess how raising US$336 million through new equity may shift Kodiak’s investment outlook and growth considerations.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kodiak Gas Services Investment Narrative Recap

To be a shareholder in Kodiak Gas Services, you have to believe in continued robust demand for large horsepower compression, especially in the Permian Basin, as well as confidence that Kodiak can balance growth and cost control amid sector cycles. The recent US$336 million equity raise further supports Kodiak’s capital needs but does not materially change the biggest catalyst, ongoing Permian Basin expansion, or the main risk of margin pressure from labor shortages and potential overcapacity.

Among recent announcements, the Q3 2025 dividend increase to US$0.49 per share stands out. This move is especially relevant for investors focused on near-term income, suggesting that the company’s liquidity position, strengthened by the equity raise, may offer added flexibility to support dividends and maintain capital priorities despite the sector’s capital intensity.

In contrast, investors should be aware that even with a bolstered balance sheet, Kodiak’s focus on high-margin assets leaves it exposed if...

Read the full narrative on Kodiak Gas Services (it's free!)

Kodiak Gas Services' outlook anticipates revenue of $1.5 billion and earnings of $293.4 million by 2028. This is based on analysts' assumptions of a 5.8% annual revenue growth rate and a $210.2 million increase in earnings from current levels of $83.2 million.

Uncover how Kodiak Gas Services' forecasts yield a $44.20 fair value, a 31% upside to its current price.

Exploring Other Perspectives

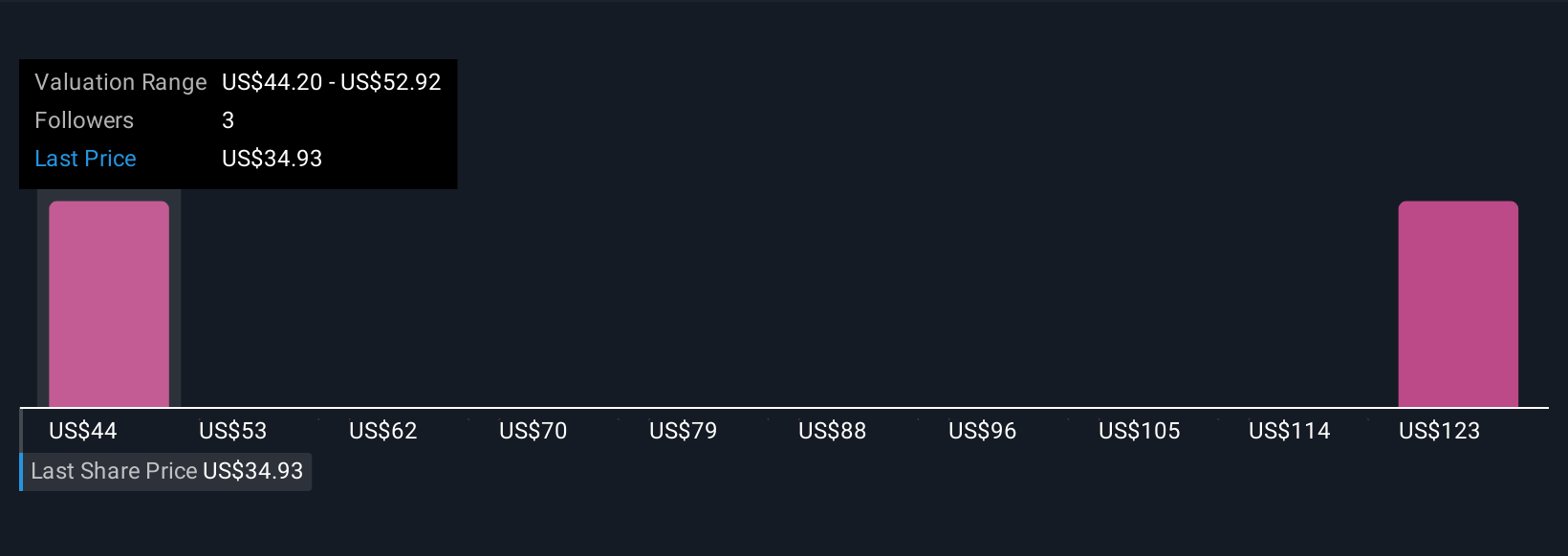

Three fair value estimates from the Simply Wall St Community span from US$44.20 to US$129.94 per share. While some participants see major upside, it remains important for you to factor in how labor market risks could affect Kodiak’s financial performance and dividend strategies before making any decisions.

Explore 3 other fair value estimates on Kodiak Gas Services - why the stock might be worth over 3x more than the current price!

Build Your Own Kodiak Gas Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kodiak Gas Services research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kodiak Gas Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kodiak Gas Services' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodiak Gas Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KGS

Kodiak Gas Services

Operates contract compression infrastructure for customers in the oil and gas industry in the United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success