- United States

- /

- Energy Services

- /

- NYSE:KGS

Is Kodiak Gas Services' (KGS) Q2 2025 Dividend Declaration Shaping Its Investment Case?

Reviewed by Simply Wall St

- Kodiak Gas Services, Inc. recently declared a cash dividend of US$0.45 per common share for the second quarter of 2025, payable on August 14, 2025 to shareholders of record as of August 4, 2025.

- This dividend affirmation highlights the company's commitment to shareholder returns and may attract income-focused investors seeking reliable cash flows.

- We'll explore how this latest dividend declaration could impact Kodiak Gas Services' investment narrative and expectations for stable cash generation.

Kodiak Gas Services Investment Narrative Recap

To be a shareholder in Kodiak Gas Services, you need confidence in the company’s ability to sustain cash generation despite a business model exposed to energy sector cycles and competitive pressures. The recent dividend affirmation of US$0.45 per share underscores Kodiak’s focus on shareholder returns, but does not materially alter the main short-term catalyst, which is continued high utilization of its compression assets, nor does it lessen the biggest current risk, cost inflation that could challenge net margins and cash flow stability.

One of the most relevant recent announcements is the 10% dividend increase initiated in April 2025, raising the quarterly payout to US$0.45 per share. This move aligns closely with income priorities and reinforces Kodiak’s narrative around delivering predictable cash returns, even as questions remain about the sustainability of these dividends in the face of potential rising capital costs and cautious contract renewals.

However, investors should also be aware that if inflationary pressures on equipment and labor intensify, then...

Read the full narrative on Kodiak Gas Services (it's free!)

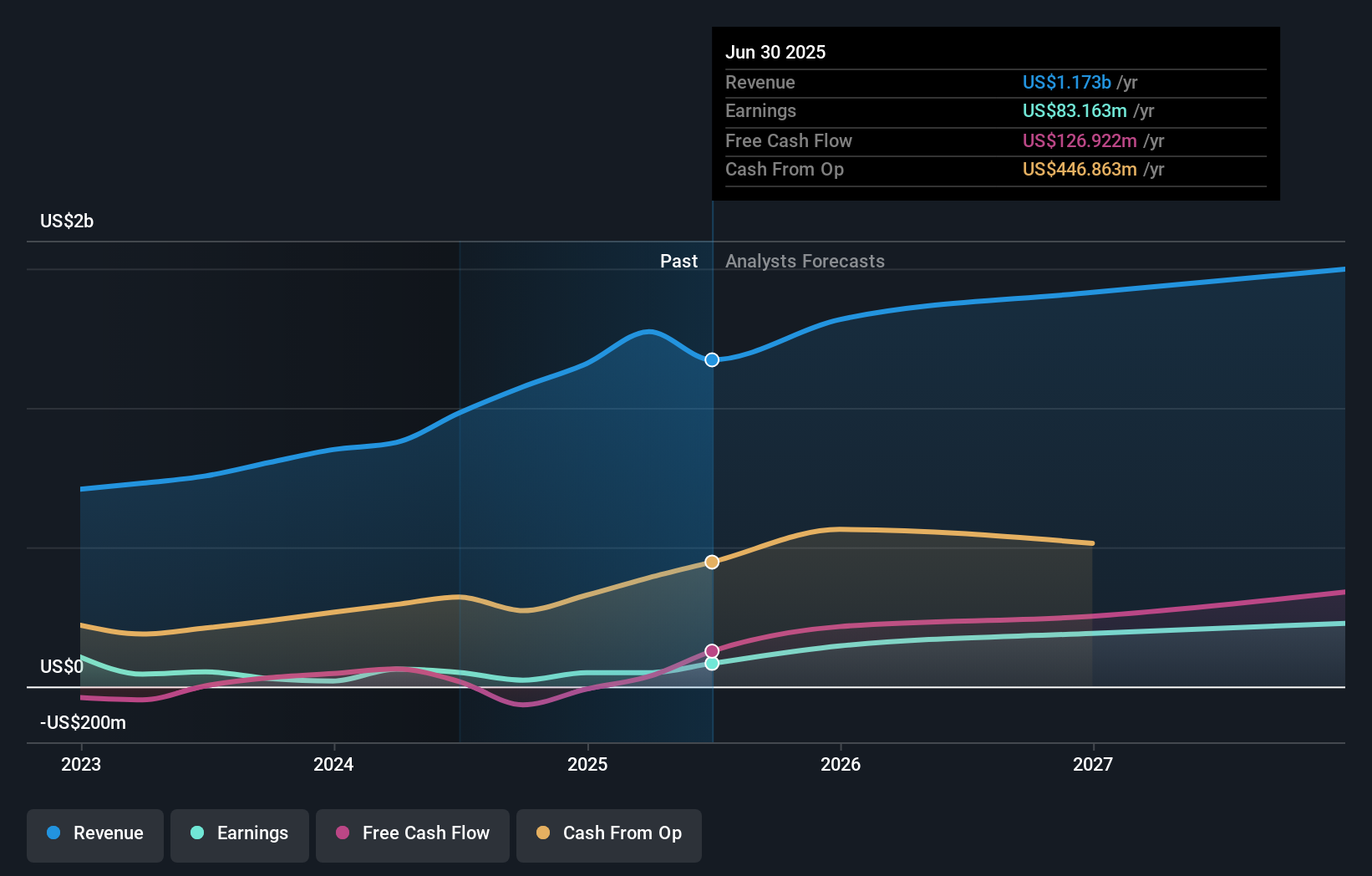

Kodiak Gas Services' outlook anticipates $1.5 billion in revenue and $282.2 million in earnings by 2028. This reflects a 6.3% annual revenue growth rate and a $232.5 million increase in earnings from the current level of $49.7 million.

Exploring Other Perspectives

The Simply Wall St Community contributed 2 fair value estimates for Kodiak Gas Services, ranging from US$44.00 to US$58.85 per share. While some see considerable upside, challenges like cost inflation could affect Kodiak’s bottom line and overall reliability, so review a wide array of market views before deciding.

Build Your Own Kodiak Gas Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kodiak Gas Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Kodiak Gas Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kodiak Gas Services' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodiak Gas Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KGS

Kodiak Gas Services

Operates contract compression infrastructure for customers in the oil and gas industry in the United States.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives