- United States

- /

- Energy Services

- /

- NYSE:INVX

Innovex International (INVX): Margin Decline Challenges Narrative of High Quality Earnings

Reviewed by Simply Wall St

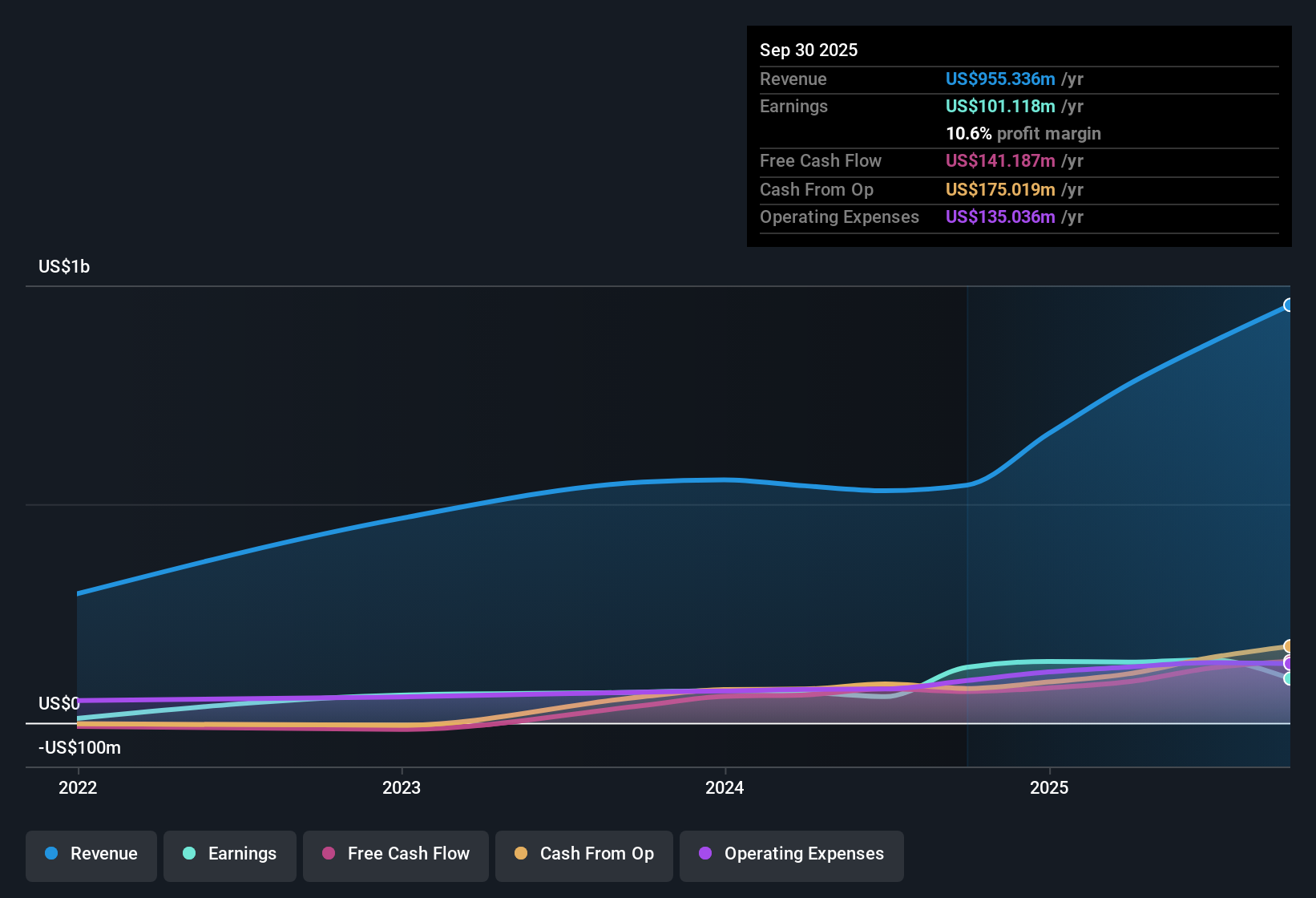

Innovex International (INVX) reported a net profit margin of 10.6%, dropping from 23.4% a year earlier, as the company posted negative EPS growth for the most recent period. Profits have historically climbed at a rapid 36% annualized pace over the last five years, but the latest results mark a shift. Forecasts call for just 4% revenue growth per year going forward, lagging the broader US market’s 10.5% projection. With INVX trading at $19.61, notably below its estimated fair value, investors are left weighing high quality earnings and attractive valuation multiples against the clear risk from compressed margins and slowing growth.

See our full analysis for Innovex International.Next up, we’ll see how these fresh figures compare with the dominant narratives among investors. Sometimes the stories match the numbers, and sometimes they do not.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slide Raises Quality Debate

- While the net profit margin declined to 10.6% from 23.4% a year earlier, profit growth averaged a robust 36% per year over the last five years, highlighting a sharp change from long-term trends.

- Bulls may point to the consistently high historical earnings growth rate to justify confidence in future recovery, but the most recent period's negative earnings growth puts pressure on that outlook.

- Profits previously showed strong expansion, yet compressed margins signal headwinds that directly challenge the notion of uninterrupted high quality earnings.

- Recent results add weight to concerns that past momentum may not easily continue if margin pressure persists.

Revenue Growth Trails U.S. Peers

- Innovex is forecast to grow revenues at just 4% per year, far behind the broader US market’s 10.5% expected rate.

- The outlook highlights worry that core operations are losing steam relative to competitors, making it harder to argue for a premium valuation just on historical averages.

- A slower pace of growth reduces the company’s ability to outpace peers, which could limit upside from future multiple expansion.

- Consensus narrative underscores that valuation appeal is tempered by growth headwinds, and careful monitoring is needed to see if Innovex can reverse this gap.

Discounted Valuation Favors Patient Buyers

- Shares trade at a price-to-earnings ratio of 13.3x compared to 16.9x for the industry and 21.1x for peers, underscoring a meaningful discount, especially as the current share price of $19.61 is well below the DCF fair value estimate of $54.04.

- This valuation gap adds support for those looking for bargains, but it remains closely linked to the risk that weaker margins and growth expectations could keep shares subdued.

- If profits stabilize or improve, the discount could close quickly, rewarding patient investors seeking value.

- However, persistent margin pressure may prevent shares from bridging the gap to fair value even at these lower multiples.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Innovex International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Innovex’s declining profit margins and slower projected revenue growth highlight risks for investors seeking reliable expansion and resilient business performance.

If you want steadier results, find companies consistently posting reliable gains and smooth earnings using our stable growth stocks screener (2079 results) to spot proven, predictable growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVX

Innovex International

Designs, manufactures, sells, and rents mission critical engineered products to the oil and natural gas industry worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives