- United States

- /

- Energy Services

- /

- NYSE:INVX

How Barclays’ Upgrade and Key Partnerships at Innovex International (INVX) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Barclays recently upgraded Innovex International, Inc., citing its consistent free cash flow growth and recent initiatives such as launching a new manufacturing facility in Saudi Arabia and forming an exclusive partnership with OneSubsea.

- This recognition follows Innovex's merger with Dril-Quip in 2024, which analysts say has supported key business wins and a stronger industry position.

- We'll explore how Barclays' recognition of Innovex's free cash flow growth may influence the company's overall investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Innovex International's Investment Narrative?

If you're looking at Innovex International today, the most important belief is in its ability to turn recent momentum, highlighted by Barclays’ upgrade and a 52-week high, into lasting growth. The market’s reaction has been strong, as investors took Barclays’ praise of Innovex’s free cash flow and its winning of exclusive partnerships as validation of its recent merger-driven strategy. This recognition could shift the company’s short-term catalysts: previously, the main focus was on solid execution of the OneSubsea contract and achieving revenue guidance, but the credibility boost from Barclays may attract fresh institutional interest and affect perceptions of fair value. Risks, however, likely remain centered on the company’s thinner profit margins and frequent board turnover, which could test investor confidence if execution stumbles. The news doesn’t erase these risks, but it may alter the balance between opportunity and uncertainty in the near term.

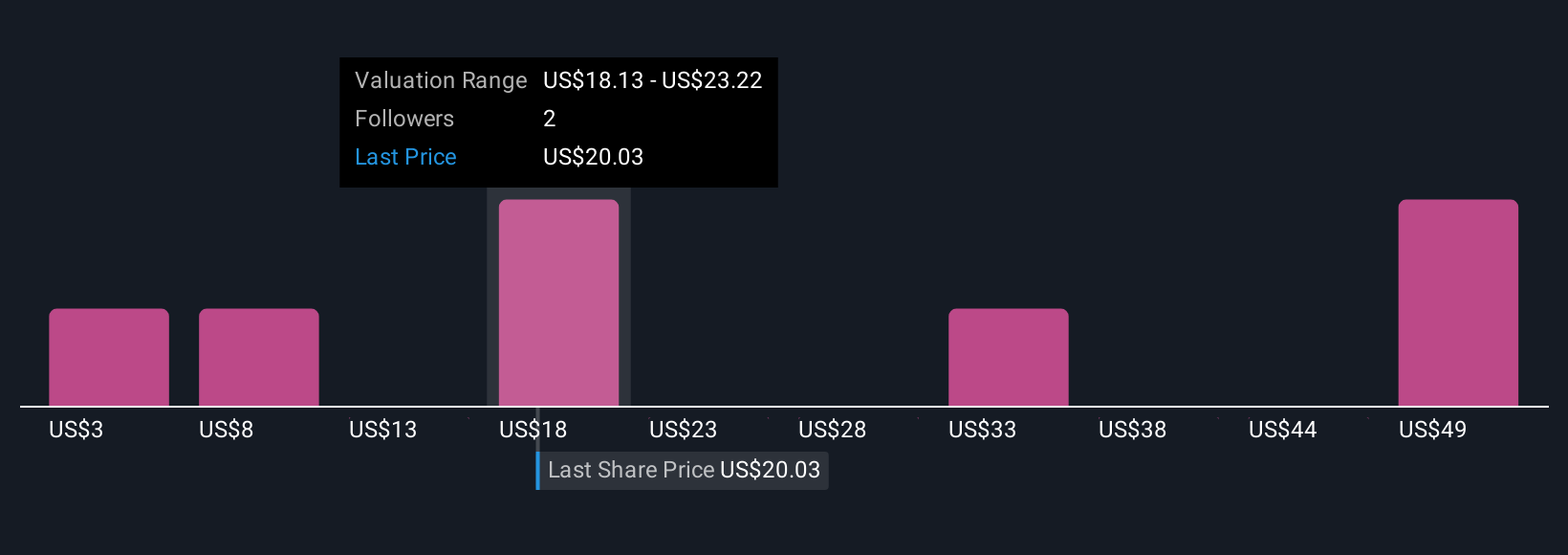

But with all this optimism, board stability is still a key risk to keep on your radar. Innovex International's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 6 other fair value estimates on Innovex International - why the stock might be worth less than half the current price!

Build Your Own Innovex International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innovex International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Innovex International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innovex International's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVX

Innovex International

Designs, manufactures, sells, and rents mission critical engineered products to the oil and natural gas industry worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success