- United States

- /

- Oil and Gas

- /

- NYSE:INSW

Assessing International Seaways After a 34% Year to Date Stock Rally

Reviewed by Bailey Pemberton

Thinking about buying, selling, or just holding onto your International Seaways stock? You are definitely not alone. After all, the past few years have been a wild ride, with the stock climbing an eye-catching 445.1% over five years and up 34.3% year-to-date. Those kinds of gains have a way of catching investors’ attention. Even in the past week, shares popped another 5.1%, hinting that momentum is hardly fading.

So what is driving all this positive energy? Over the last year, International Seaways has seen a steady drumbeat of optimistic headlines around global shipping demand and a renewed spotlight on oil tanker companies. Investors are increasingly viewing the stock as a strong candidate for both growth and income, and you can see that shift reflected in how quickly risk perceptions have changed. Not only has the price soared, but analysts and watchful investors alike keep revisiting their assumptions of what the company is really worth.

No surprise, then, that International Seaways currently boasts a value score of 5 out of 6, meaning it appears undervalued in nearly every key metric our valuation checklist considers. But of course, valuation is never quite that simple. Let’s dig into how analysts and investors typically judge a stock’s worth, and stick around, because we will explore an even more insightful way to look beyond just the numbers before we wrap up.

Approach 1: International Seaways Discounted Cash Flow (DCF) Analysis

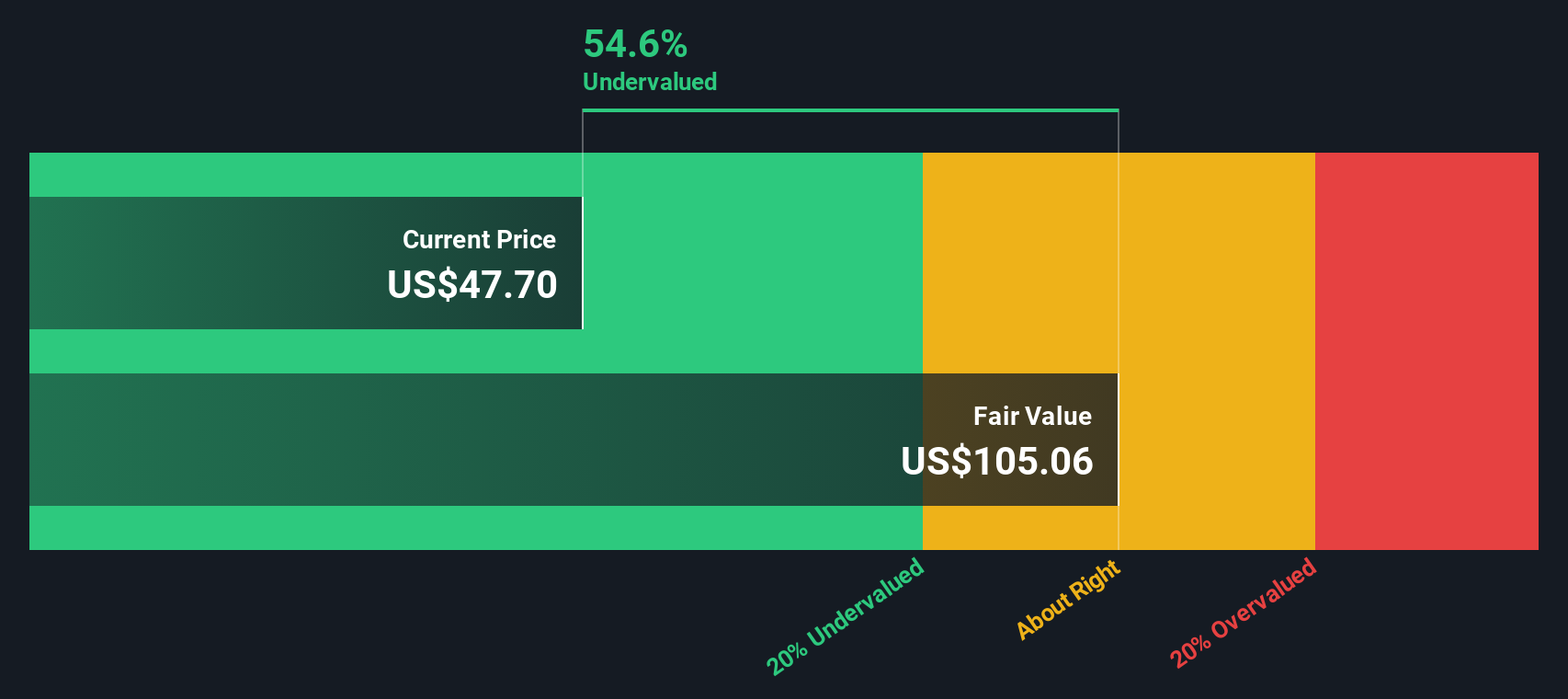

The Discounted Cash Flow (DCF) model aims to estimate what a business is really worth by projecting all of its future cash flows and then discounting them back to their present value. This approach gives investors a broad view of a company's intrinsic value, separate from daily market fluctuations.

For International Seaways, the latest reported Free Cash Flow (FCF) is $203.9 Million. Analysts forecast an increase in FCF, estimating it will reach about $277 Million by 2026. After the fifth year, projections use a gradual slowdown in growth, with Simply Wall St extrapolating figures for up to 10 years based on available data. By 2035, FCF is expected to be approximately $270.6 Million, with each year's projection discounted to its present value.

Based on this model, the resulting intrinsic value for International Seaways stock is $109.53. Compared to its current market price, this suggests the stock is trading at a 55.6% discount, indicating that it is significantly undervalued by the market today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests International Seaways is undervalued by 55.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: International Seaways Price vs Earnings

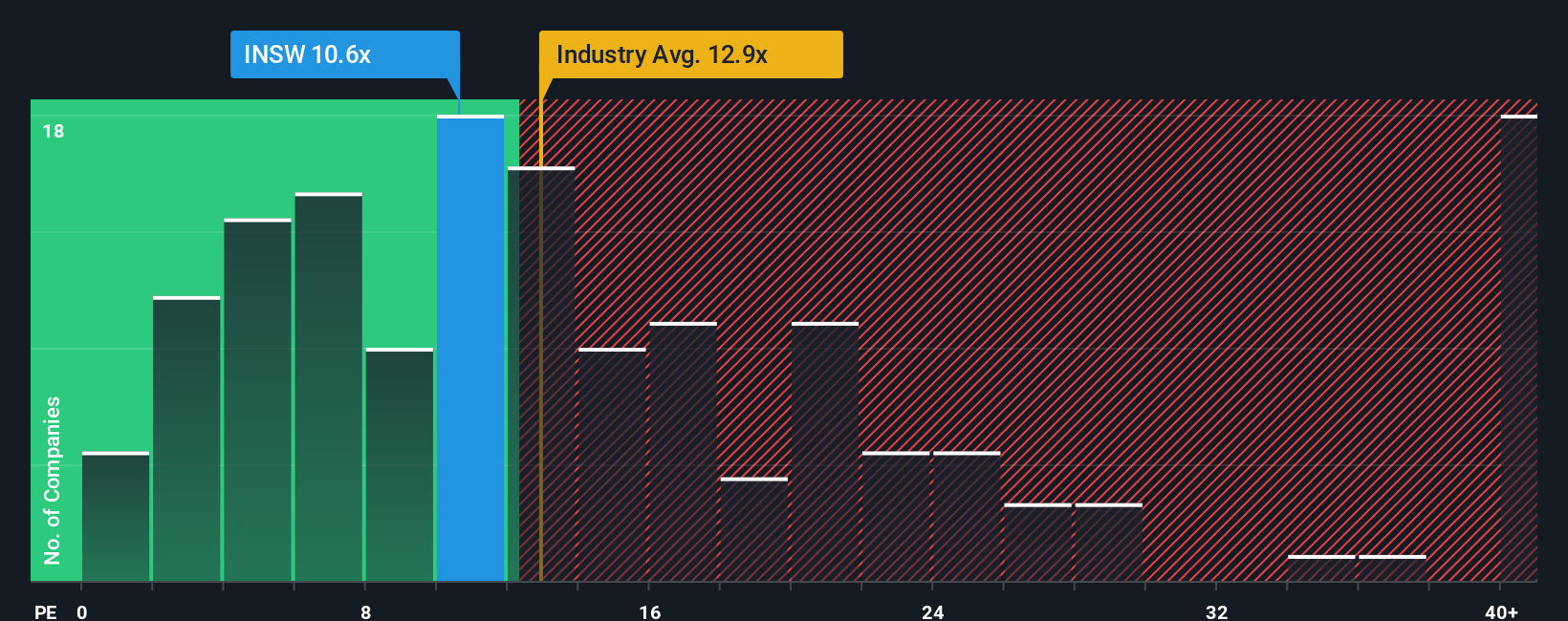

For companies like International Seaways that are generating steady profits, the Price-to-Earnings (PE) ratio is a widely accepted way to assess valuation. This simple metric tells you how much investors are willing to pay for each dollar of the company’s earnings. It helps put the company’s recent performance in context and compare it to sector peers.

A “fair” PE ratio often depends on a blend of factors, such as market expectations for earnings growth, the overall risks facing the business, and how well it is performing relative to others in its industry. Growth companies might justify a higher PE, while mature or riskier companies usually command a lower multiple.

International Seaways currently trades at a PE of 10.1x. That is nearly on par with the average for its industry, which stands at 13.1x, and also just below the average for similar peers at 10.4x. Simply Wall St’s proprietary “Fair Ratio” is 14.1x for International Seaways. This Fair Ratio goes beyond simple comparisons by analyzing growth prospects, profit margins, sector trends, company size, and other risk factors to offer a more nuanced baseline.

Because Fair Ratio takes into account the unique profile of International Seaways, rather than just comparing against averages, it offers a richer picture of what the stock “should” be worth. In this case, with International Seaways trading below its Fair Ratio, the stock appears undervalued when accounting for all those extra factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your International Seaways Narrative

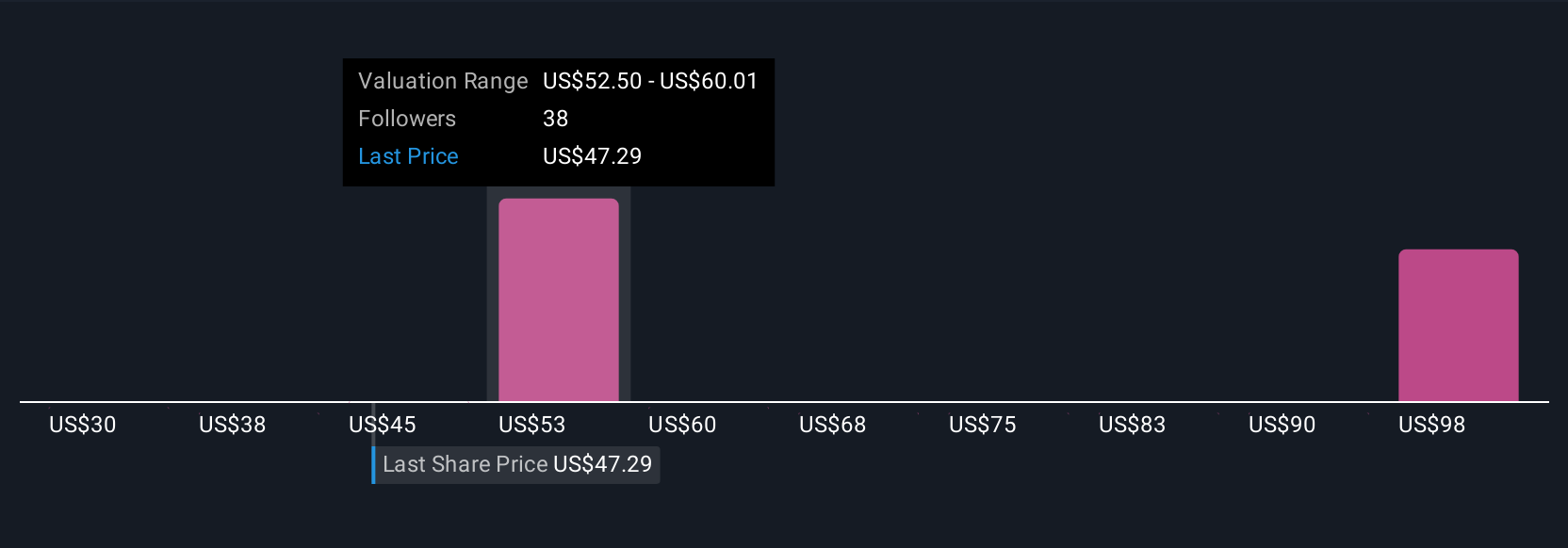

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your unique story, the way you see a company's opportunities and challenges, translated into your own financial forecast, future estimates, and a clear fair value for the stock.

Narratives link the "why" behind the numbers; they connect your personal reasoning or perspective on International Seaways to key assumptions about future revenue, earnings, and profit margins, and bring it all together into one actionable fair value. This powerful, accessible tool is available directly on Simply Wall St's Community page, where millions of investors explore and compare their Narratives for every stock, including International Seaways.

With Narratives, you can quickly see if your story supports buying, selling, or holding by comparing your calculated fair value to the current market price. Narratives on Simply Wall St are dynamically updated whenever important news or earnings are released, keeping investment decisions fresh and grounded in the latest information.

For example, the most optimistic Narratives for International Seaways might expect a price target of $64.00 based on strong earnings growth and extended shipping routes, while the most cautious see just $47.00 due to regulatory risks and industry headwinds. This shows how every investor's perspective is reflected in their Narrative and resulting valuation in real time.

Do you think there's more to the story for International Seaways? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSW

International Seaways

Owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives