- United States

- /

- Energy Services

- /

- NYSE:HLX

Helix Energy Solutions Group (HLX): Valuation in Focus After Record Q3 Results and Upgraded 2025 Outlook

Reviewed by Simply Wall St

Helix Energy Solutions Group posted its highest quarterly revenue and best EBITDA figure in over a decade. This reflects real progress across key businesses and has led to an upbeat upgrade to management’s full-year 2025 financial outlook.

See our latest analysis for Helix Energy Solutions Group.

Helix Energy Solutions Group’s stock has been on a rollercoaster this year, but signs of renewed momentum are clear. The share price climbed 12% over the past 90 days after a dip earlier in the year, coinciding with quarterly revenue records and an upgraded 2025 outlook. While the 1-year total shareholder return is still down by 25%, the robust five-year total return of 182% is a reminder that long-term investors have seen significant gains.

If this recent turnaround caught your attention, it’s worth broadening your search and discovering fast growing stocks with high insider ownership

With robust performance and a price still well below analyst targets, Helix’s outlook is rising. Does this signal an undervalued stock with room to run, or has the market already priced in this future growth?

Most Popular Narrative: 26% Undervalued

With Helix Energy Solutions Group's last close at $7.00, the most widely followed narrative points to a fair value much higher. This suggests room for upside if its forward strategy holds.

Backlog growth driven by new multiyear and framework contracts, including a recently awarded 800-day North Sea trenching contract starting in 2027 and a 3-year Exxon decommissioning agreement, positions Helix for significant revenue visibility and topline growth as energy companies ramp up offshore project activity and regulatory-driven abandonment work between 2026 and 2030.

Earnings, margins, and major global contracts in the pipeline all stand out. What is the secret projection that justifies this higher valuation? See how these bold forecasts add up to a price target that could surprise even seasoned analysts.

Result: Fair Value of $9.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market uncertainty and delays in customer spending could create near-term headwinds. This may put Helix’s current growth and margin projections at risk.

Find out about the key risks to this Helix Energy Solutions Group narrative.

Another Perspective: Valuing by Earnings

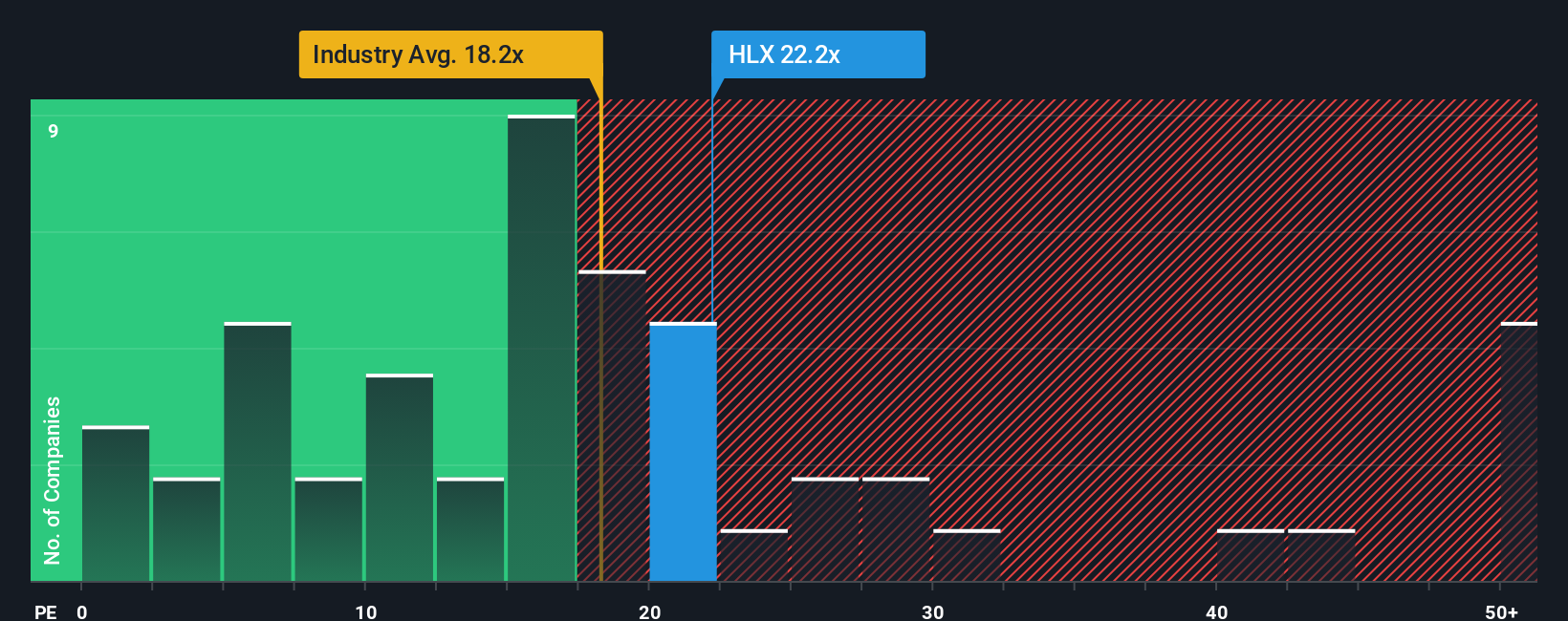

Switching focus to a traditional earnings comparison shows a different side. Helix trades at a price-to-earnings ratio of 24.1x, which is notably higher than both the industry average of 16.3x and the company’s calculated fair ratio of 19x. This suggests the market is already pricing in substantial optimism, leaving less margin for error if growth does not meet expectations. Is the premium warranted, or does it signal valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helix Energy Solutions Group Narrative

If you see things differently or want to dive deeper into the numbers, you can craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Helix Energy Solutions Group.

Looking for More Investment Ideas?

Why stop at just one opportunity? Outperform the crowd by acting now on powerfully researched ideas. See which companies are turning heads for the right reasons.

- Maximize your search for stable returns by checking out these 17 dividend stocks with yields > 3% offering yields over 3% for a more reliable income stream.

- Access the most promising disruptors in tech when you tap into these 27 AI penny stocks fueling the artificial intelligence revolution.

- Get ahead of the curve by evaluating these 28 quantum computing stocks driving breakthroughs in quantum computing and next-level innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helix Energy Solutions Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLX

Helix Energy Solutions Group

An offshore energy services company, provides specialty services to the offshore energy industry in Brazil, the United States, North Sea, the Asia Pacific, West Africa, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion