David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Hess Midstream LP (NYSE:HESM) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Hess Midstream

What Is Hess Midstream's Net Debt?

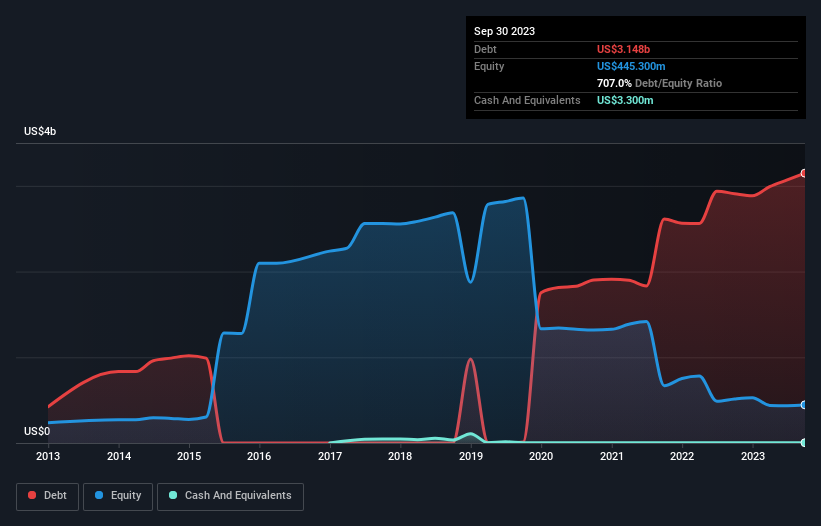

As you can see below, at the end of September 2023, Hess Midstream had US$3.15b of debt, up from US$2.91b a year ago. Click the image for more detail. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Hess Midstream's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hess Midstream had liabilities of US$173.8m due within 12 months and liabilities of US$3.16b due beyond that. Offsetting these obligations, it had cash of US$3.30m as well as receivables valued at US$122.0m due within 12 months. So its liabilities total US$3.20b more than the combination of its cash and short-term receivables.

Hess Midstream has a market capitalization of US$7.15b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Hess Midstream's debt is 3.2 times its EBITDA, and its EBIT cover its interest expense 4.7 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Notably Hess Midstream's EBIT was pretty flat over the last year. Ideally it can diminish its debt load by kick-starting earnings growth. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Hess Midstream can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Hess Midstream generated free cash flow amounting to a very robust 80% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

On our analysis Hess Midstream's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For example, its net debt to EBITDA makes us a little nervous about its debt. Considering this range of data points, we think Hess Midstream is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for Hess Midstream (1 is potentially serious) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Hess Midstream might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HESM

Hess Midstream

Owns, operates, develops, and acquires midstream assets and provide fee-based services to Hess and third-party customers in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives