- United States

- /

- Oil and Gas

- /

- NYSE:HES

Hess (HES) Is Up 6.4% After Index Removal From Russell Growth Benchmarks Has The Bull Case Changed?

Reviewed by Simply Wall St

- On June 30, 2025, Hess Corporation was removed from four major Russell growth indices, including the Russell 3000E Growth and Russell 1000 Growth Benchmarks.

- This index removal often leads to significant trading volume as index-tracking investors and funds adjust their portfolios accordingly.

- We'll look at how the index exclusion and related portfolio adjustments shape Hess's current investment narrative.

What Is Hess' Investment Narrative?

Owning Hess today means buying into a story shaped by both the ongoing Chevron acquisition process and the company's track record of long-term earnings growth. While the immediate removal from major Russell growth indices on June 30, 2025 triggered additional trading activity and some portfolio reshuffling, the modest 0.78% price move suggests the impact on core investment drivers is limited for now. The more significant catalysts remain the progress of the Chevron deal, execution on production targets, and maintenance of regular dividends, none of which appear immediately threatened by the index exits. However, the evolving index status may limit near-term demand from passive funds and introduces a bit more uncertainty around trading volumes and liquidity, especially while broader sentiment digests this change. Ultimately, it sharpens focus on fundamental strengths and any merger developments as the big levers moving Hess shares, even as the immediate index adjustment seems less material.

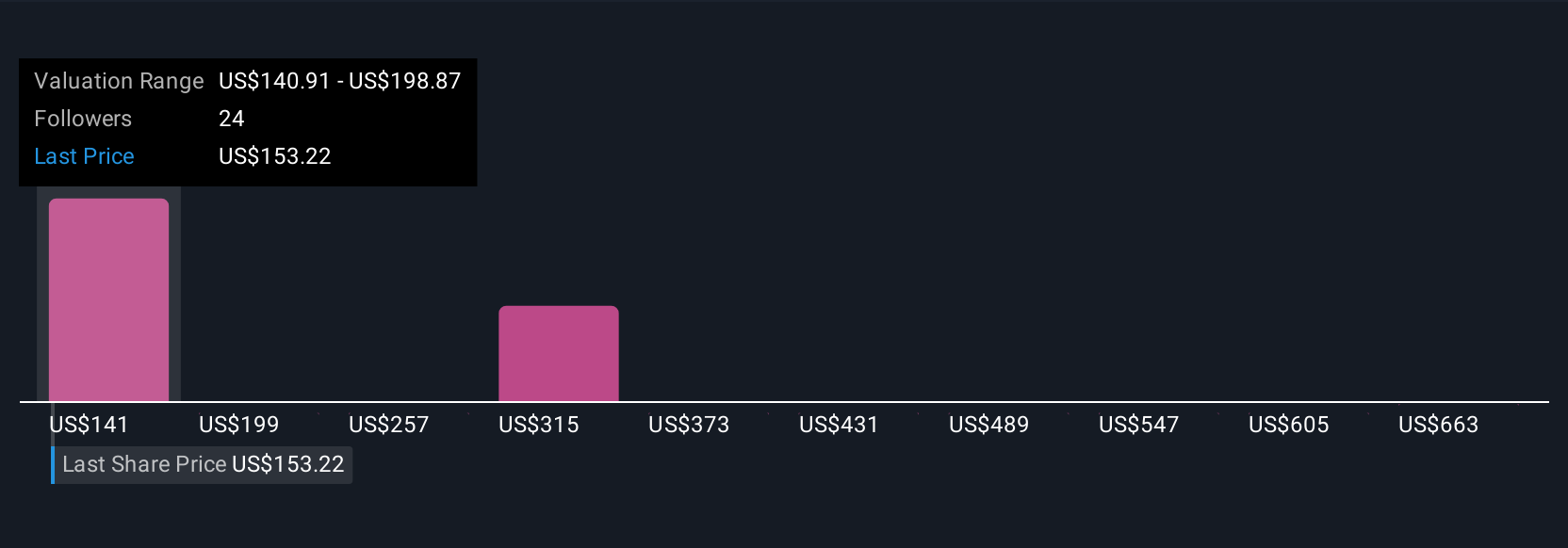

But don't overlook how loss of index inclusion might affect liquidity and passive ownership rates. Hess' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Build Your Own Hess Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hess research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hess research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hess' overall financial health at a glance.

No Opportunity In Hess?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hess might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HES

Hess

An exploration and production company, explores, develops, produces, purchases, transports, and sells crude oil, natural gas liquids, and natural gas in the United States, Guyana, the Malaysia/Thailand Joint Development Area, and Malaysia.

Solid track record with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives