- United States

- /

- Energy Services

- /

- NYSE:HAL

Why Halliburton (HAL) Is Up After Beating Q3 Estimates and Launching VoltaGrid Partnership

Reviewed by Sasha Jovanovic

- Earlier this week, Halliburton reported third-quarter 2025 results with adjusted earnings and revenue exceeding market expectations, despite headline net income being impacted by impairment charges, and announced a major partnership with VoltaGrid to deliver lower-emission power generation solutions for data centers in the Middle East.

- This move signals Halliburton's ongoing expansion beyond traditional oilfield services as it increases focus on technology-driven, sustainable energy infrastructure amid evolving global demand.

- We'll examine how Halliburton's VoltaGrid partnership for data center power solutions reshapes the company's investment narrative and growth prospects.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Halliburton Investment Narrative Recap

To own Halliburton today, investors need to believe in the company's ability to capitalize on global energy demand while managing the ongoing shift toward decarbonization and new technologies. The recent VoltaGrid partnership signals deeper diversification into sustainable infrastructure but does not materially alter the near-term primary catalyst: Halliburton’s exposure to international market growth versus the risk of a slowdown in North American oilfield services revenue, which remains a critical vulnerability.

Of Halliburton's recent announcements, the new Petrobras contracts in Brazil’s deepwater fields stand out. These contracts reinforce the company's international expansion and underscore its ability to secure large-scale, technology-driven projects, which is especially relevant as international markets are increasingly identified as a growth driver in contrast to softer conditions at home.

By contrast, what investors should be aware of is how deeper exposure to international growth could leave Halliburton facing...

Read the full narrative on Halliburton (it's free!)

Halliburton's narrative projects $22.1 billion in revenue and $2.0 billion in earnings by 2028. This requires a 0.2% annual revenue decline and a $0.1 billion earnings increase from the current $1.9 billion.

Uncover how Halliburton's forecasts yield a $27.04 fair value, in line with its current price.

Exploring Other Perspectives

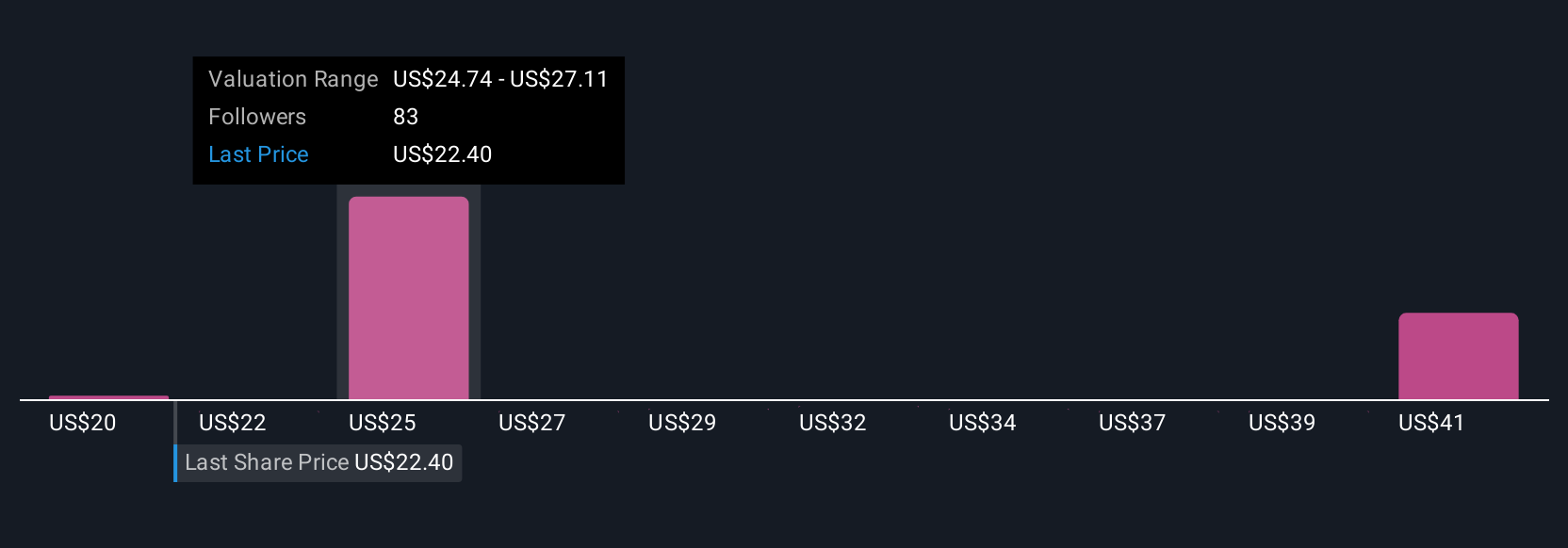

Simply Wall St Community members provided 11 fair value estimates for Halliburton, ranging from US$20 to US$43 per share. While you weigh these diverse opinions, remember the importance of Halliburton’s international expansion as a guide for its future growth potential.

Explore 11 other fair value estimates on Halliburton - why the stock might be worth as much as 58% more than the current price!

Build Your Own Halliburton Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Halliburton research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Halliburton research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Halliburton's overall financial health at a glance.

No Opportunity In Halliburton?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives