- United States

- /

- Energy Services

- /

- NYSE:HAL

Is Halliburton’s (HAL) Ongoing Buyback a Sign of Shifting Priorities Amid Lower Earnings?

Reviewed by Simply Wall St

- Halliburton recently reported its second-quarter 2025 financial results, posting revenue of US$5.51 billion and net income of US$472 million, both decreasing from the same period last year, with earnings per share at US$0.55.

- Despite overall declines, the company saw growth in its Europe/Africa/CIS region and continued its share buyback program, repurchasing nearly 12 million shares during the quarter.

- We'll explore how these lower earnings and continued buybacks may alter Halliburton’s investment narrative amid evolving market conditions.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Halliburton Investment Narrative Recap

For Halliburton, the investment case is rooted in belief that global energy demand and ongoing oilfield service needs will support gradual growth despite changing market dynamics. The latest earnings highlight short-term challenges, with both revenue and net income down year over year, but this does not materially alter the primary risk of overexposure to cyclical downturns in the North American shale market or the catalyst of international expansion.

The company's continued share buyback activity stands out, with nearly US$250 million spent to repurchase close to 12 million shares last quarter. In the context of weaker earnings, these buybacks may support the share price, yet their significance could fade if core markets remain under pressure.

But while buybacks may offset some volatility, investors should be aware that overdependence on North American shale...

Read the full narrative on Halliburton (it's free!)

Halliburton's narrative projects $22.5 billion in revenue and $2.2 billion in earnings by 2028. This requires a -0.4% yearly revenue decline and a $0.3 billion increase in earnings from $1.9 billion.

Uncover how Halliburton's forecasts yield a $27.74 fair value, a 21% upside to its current price.

Exploring Other Perspectives

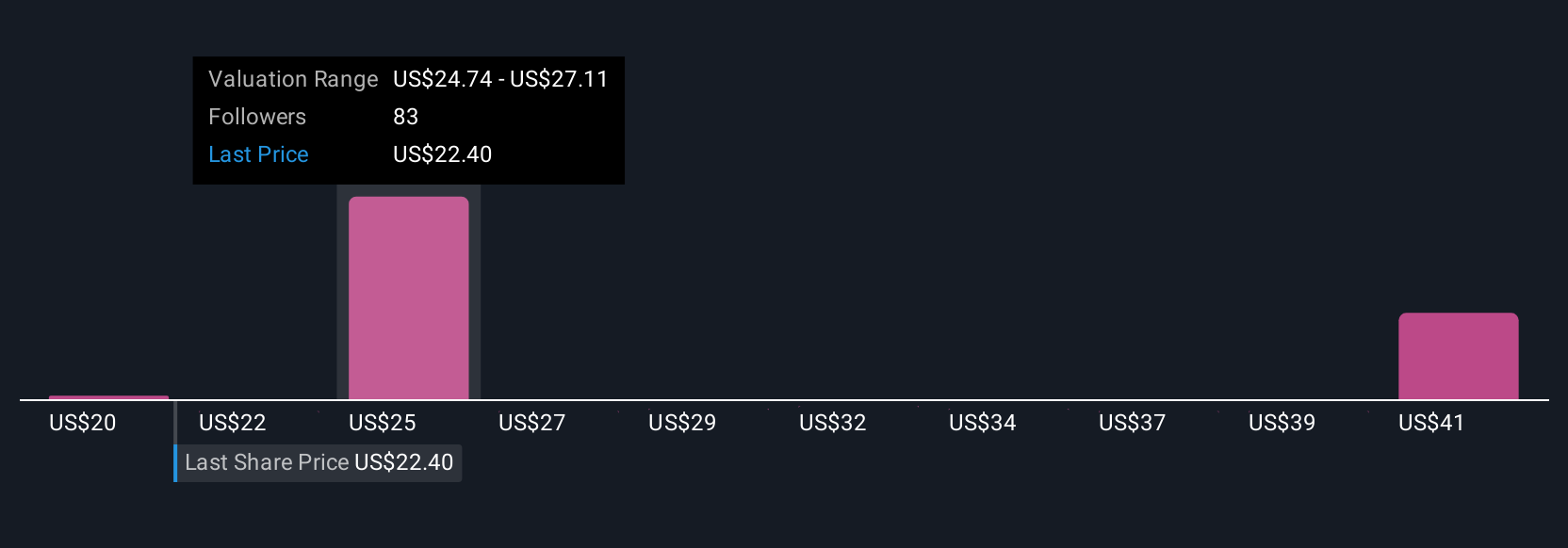

Twelve members of the Simply Wall St Community estimate Halliburton's fair value in a wide band from US$20.00 to US$43.75. Amid these diverse projections, the ongoing slowdown in US drilling remains top of mind as it shapes both risks and optimism for future results.

Explore 12 other fair value estimates on Halliburton - why the stock might be worth 12% less than the current price!

Build Your Own Halliburton Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Halliburton research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Halliburton research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Halliburton's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives