- United States

- /

- Energy Services

- /

- NYSE:HAL

How Hedge Fund Rotation Away From Halliburton (HAL) Could Shift Its Investment Narrative

Reviewed by Sasha Jovanovic

- Earlier this month, Aristotle Atlantic Core Equity Strategy announced the sale of Halliburton shares in order to fund new investments in Baker Hughes, pointing to ongoing challenges from declining U.S. onshore activity and pricing pressures in Halliburton’s domestic completion and pumping business.

- Hedge funds are rotating away from Halliburton, with the number of hedge fund portfolios holding the stock dropping in the last quarter amid growing interest in sectors like artificial intelligence.

- We’ll explore how these shifts in investor sentiment, particularly the reduced hedge fund exposure, could influence Halliburton’s broader investment narrative.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Halliburton Investment Narrative Recap

To be a Halliburton shareholder, you need to believe that global demand for oilfield services will outweigh persistent headwinds in U.S. shale and that international growth and digital innovation can offset domestic weakness. The recent move by Aristotle Atlantic and a drop in hedge fund holdings reflect concerns about U.S. onshore exposure, but do not fundamentally change Halliburton’s reliance on international projects as its key short-term catalyst, the main risk remains pressure on North American margins as activity softens. One especially relevant announcement is Halliburton’s recent contract win with Petrobras, which supports the company’s efforts to expand internationally, helping to cushion the impact of slowing U.S. markets and highlighting the critical role of overseas operations for near-term earnings stability. However, it’s important to remember that despite international progress, pricing pressure in the U.S. could…

Read the full narrative on Halliburton (it's free!)

Halliburton's outlook anticipates $22.1 billion in revenue and $2.0 billion in earnings by 2028. This is based on a projected 0.2% annual revenue decline and a $0.1 billion increase in earnings from the current $1.9 billion.

Uncover how Halliburton's forecasts yield a $29.80 fair value, a 9% upside to its current price.

Exploring Other Perspectives

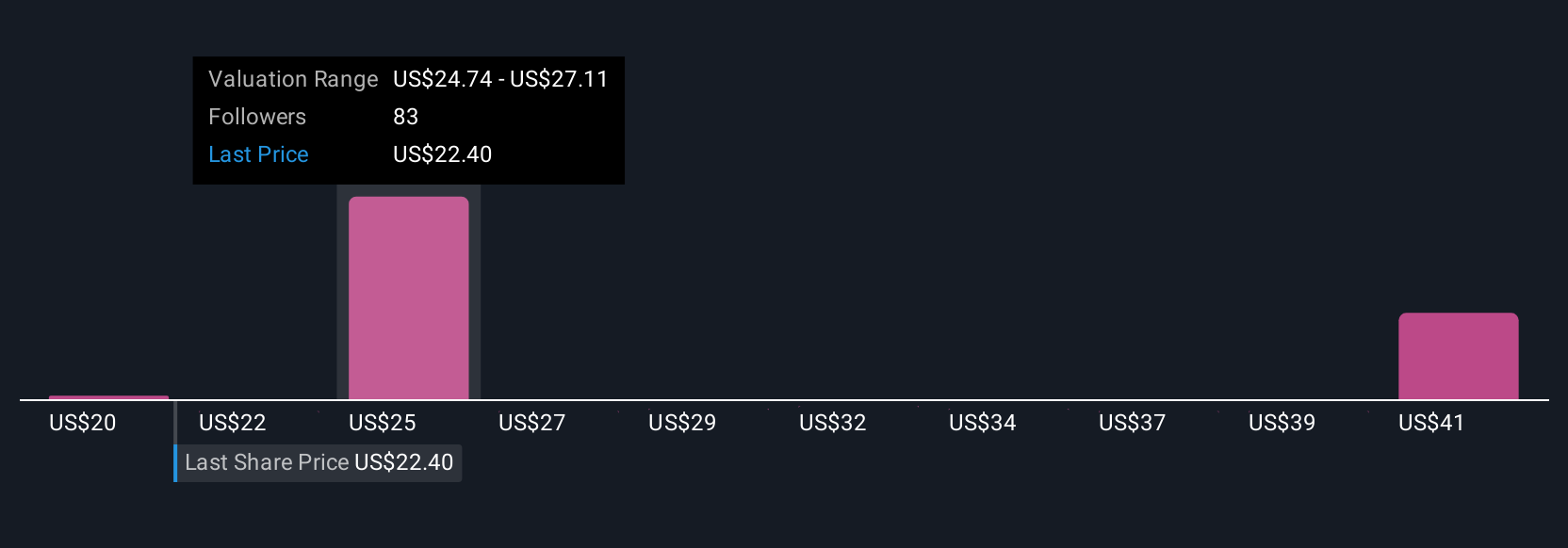

Eleven members of the Simply Wall St Community estimate fair value for Halliburton anywhere from US$20.00 to US$50.11 per share. Even with this spread of views, reliance on international growth as domestic activity falls could shape outcomes quite differently than some expect.

Explore 11 other fair value estimates on Halliburton - why the stock might be worth 27% less than the current price!

Build Your Own Halliburton Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Halliburton research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Halliburton research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Halliburton's overall financial health at a glance.

No Opportunity In Halliburton?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives