- United States

- /

- Energy Services

- /

- NYSE:HAL

Halliburton (HAL): Is the Recent Earnings Beat and Cost Savings a Turning Point for Valuation?

Reviewed by Simply Wall St

Halliburton (NYSE:HAL) climbed after posting Q3 2025 results that topped expectations. This signaled to investors that cost controls and international strength are offsetting weaker global oil demand trends. The company also unveiled new savings initiatives.

See our latest analysis for Halliburton.

After a bumpy start to the year, Halliburton’s 18.8% share price gain over the past three months stands out as investor sentiment rebounds on news of cost savings, new tech agreements, and an upbeat international outlook. While the one-year total shareholder return is still just below even, momentum has clearly tilted in the company’s favor as management pivots for future growth.

If recent momentum has you looking for the next interesting opportunity, consider expanding your scope and discover fast growing stocks with high insider ownership

With valuations still below historical averages and fresh analyst upgrades in tow, the question now is whether Halliburton’s recent surge remains an entry point for investors, or if the market has already priced in these catalysts for future growth.

Most Popular Narrative: 9.6% Undervalued

With Halliburton’s fair value estimate sitting above its last close, there is a clear case for upside if the narrative’s projections hold true. The popularity of this widely followed view points to material company changes investors may be missing. Here is a double-sentence quote at the heart of this perspective:

Halliburton's expansion and adoption of proprietary digital and automation technologies (e.g., ZEUS IQ, iCruise, LOGIX, EarthStar 3DX) are enabling higher-margin, differentiated offerings. Increased deployment and customer adoption, especially internationally, has potential to structurally improve net margins and recurring revenues over the medium to long term. The company's ongoing international diversification, growing faster in regions like Latin America, Africa, and the Middle East, and leveraging U.S.-style unconventional expertise, creates a larger, more stable revenue base and reduces earnings cyclicality, supporting both top-line growth and improved earnings predictability.

What numbers power this fair value? Behind the bullish narrative lies an ambitious margin expansion plan and a re-rating multiple that is more generous than the market gives credit for. Want to glimpse the strategic leap of faith analysts are taking, and the financial levers they expect Halliburton to pull, to justify the target price? Discover the full story and the key assumptions hiding behind the headlines.

Result: Fair Value of $29.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying global decarbonization efforts and rapid growth in renewables could limit Halliburton’s future demand and potentially challenge the current narrative for long-term upside.

Find out about the key risks to this Halliburton narrative.

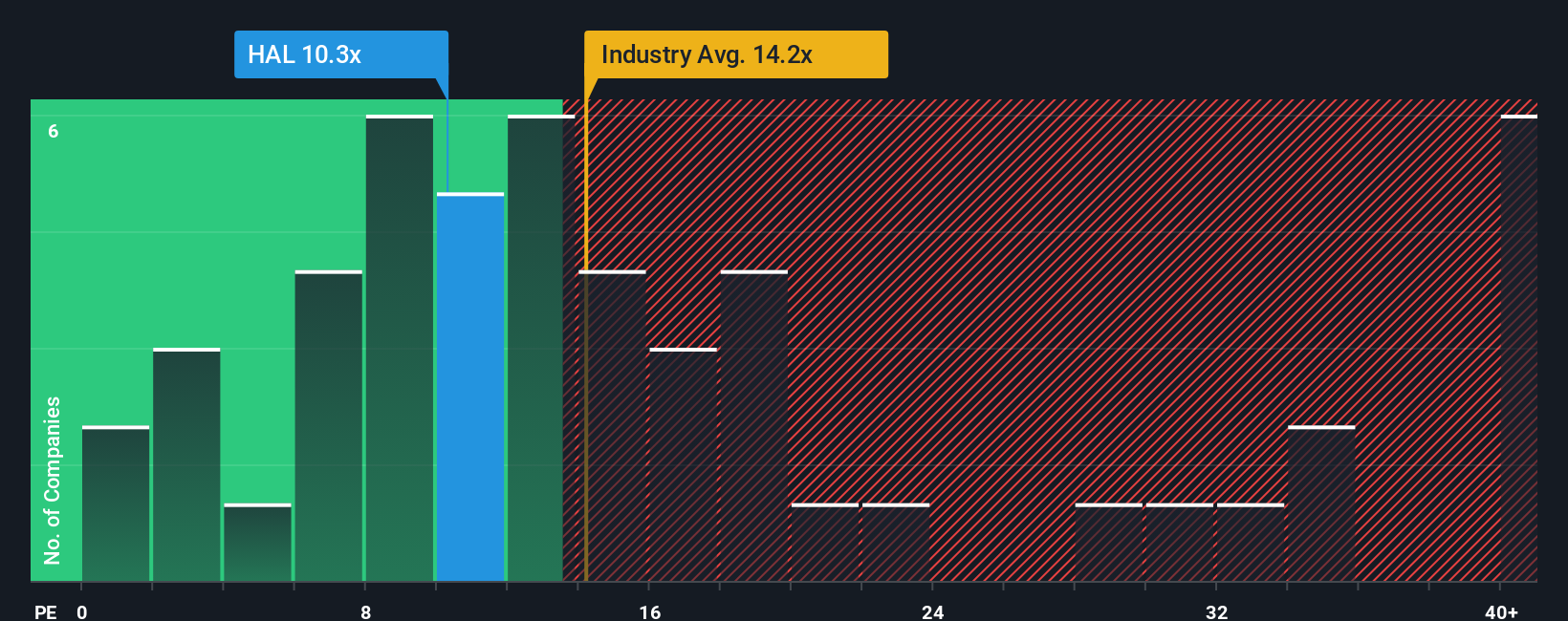

Another View: Price-to-Earnings Paints a Cautious Picture

While fair value estimates suggest Halliburton is undervalued, the market’s chosen price-to-earnings measure tells a different story. With a P/E of 17.1x, Halliburton trades above both its peer group (15.2x) and the US Energy Services industry average (16.3x), but still below its fair ratio of 19.3x. This gap offers both risk and potential upside. Will the market eventually rerate the company, or could current optimism prove fleeting?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Halliburton Narrative

Not convinced by the conclusions here, or eager to test your own take on the numbers? You can quickly run your own analysis and Do it your way.

A great starting point for your Halliburton research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Broaden your portfolio with innovative companies and sectors on the move. The Simply Wall Street Screener surfaces standouts in every market.

- Capture high potential by evaluating these 3575 penny stocks with strong financials showing strong financials and off-the-radar growth stories before they attract mainstream attention.

- Accelerate your portfolio’s tech edge by reviewing these 26 AI penny stocks positioned to benefit from the surge in artificial intelligence innovation and adoption.

- Lock in reliable payouts with these 21 dividend stocks with yields > 3%, spotlighting companies delivering dividend yields above 3% for smarter income generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives