- United States

- /

- Energy Services

- /

- NYSE:HAL

Does Halliburton’s Middle East Contract Signal a New Upside for Shares in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Halliburton stock right now? You are not alone. After a wild ride this week, with shares jumping 19.2% in just seven days, investors are taking notice again. Despite this recent surge, the stock is still down 4.3% year-to-date, and has declined about 3.3% over the past year. Yet when you zoom out, the five-year return sits at a robust 140%, so there is clearly a story beneath the surface.

This latest uptick came as the oilfield services sector reacted to fresh optimism around energy demand, and Halliburton specifically benefitted from news of a major contract win in the Middle East. While these headlines signal growth opportunities, long-term investors know that past performance, or even a string of news stories, do not tell the whole story.

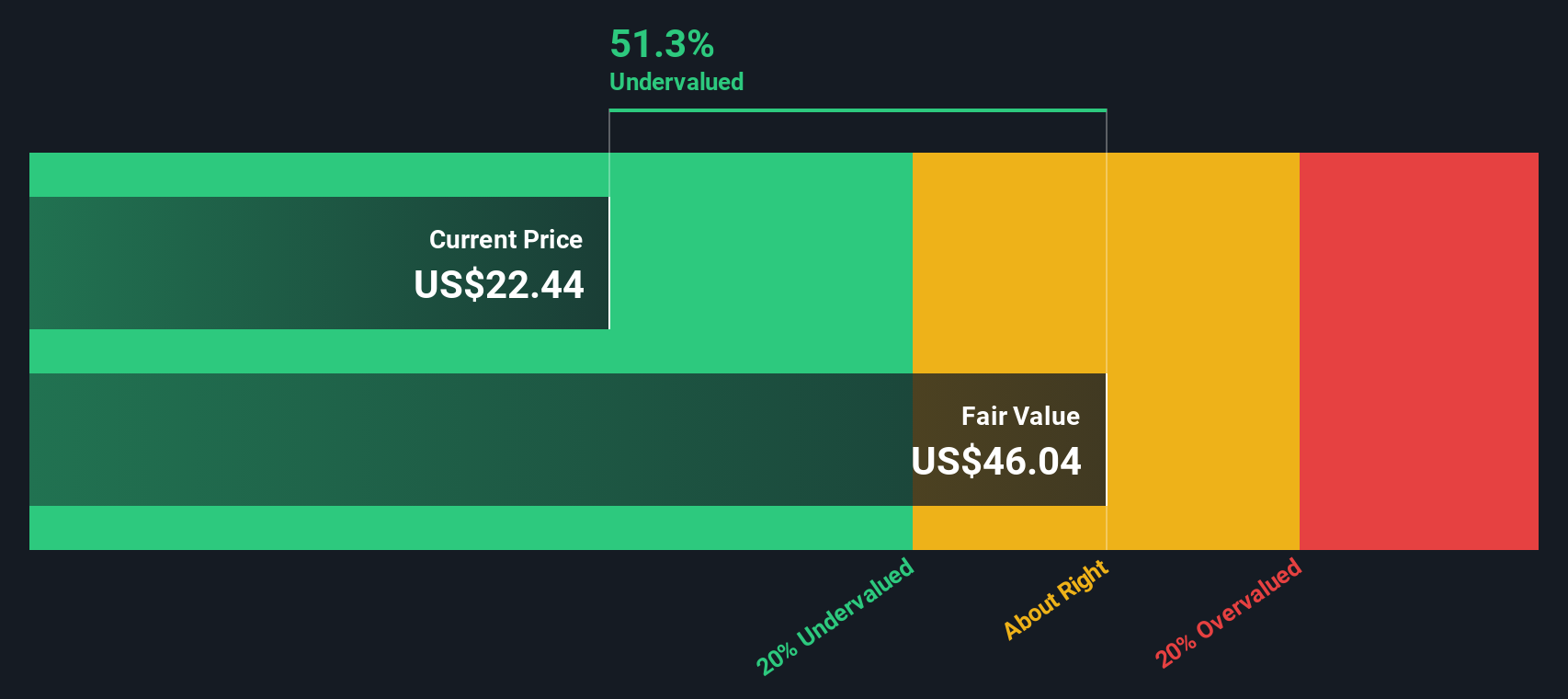

So, how cheap or expensive is Halliburton stock really? Based on a set of six key valuation checks, Halliburton scores a 3 for being undervalued in three out of six areas. That puts it right in the middle, making it worth a closer look for sure, but not an obvious bargain. In the next section, we will break down the valuation methods behind that score, and later, dig into an even more useful way of thinking about what Halliburton shares are truly worth.

Why Halliburton is lagging behind its peers

Approach 1: Halliburton Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those flows back to today's dollars. In Halliburton's case, this method uses the 2 Stage Free Cash Flow to Equity model, which starts with the company's actual and expected free cash flows and then applies a discount rate to determine what those future dollars are worth right now.

Currently, Halliburton generates an annual Free Cash Flow (FCF) of about $1.89 billion. Analyst forecasts drive near-term projections, reaching as high as $2.24 billion by 2029. Simply Wall St estimates extend this further to 2035, with continued steady growth. This combination of analyst and extrapolated figures offers a comprehensive, if somewhat optimistic, picture of Halliburton’s long-term earning potential in the energy services sector.

By calculating the total value of these projected future cash flows, Halliburton’s intrinsic fair value is estimated at $43.16 per share. When compared to the current share price, the analysis suggests Halliburton is about 38.5% undervalued using this DCF approach. This sizable margin offers a meaningful signal for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Halliburton is undervalued by 38.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Halliburton Price vs Earnings

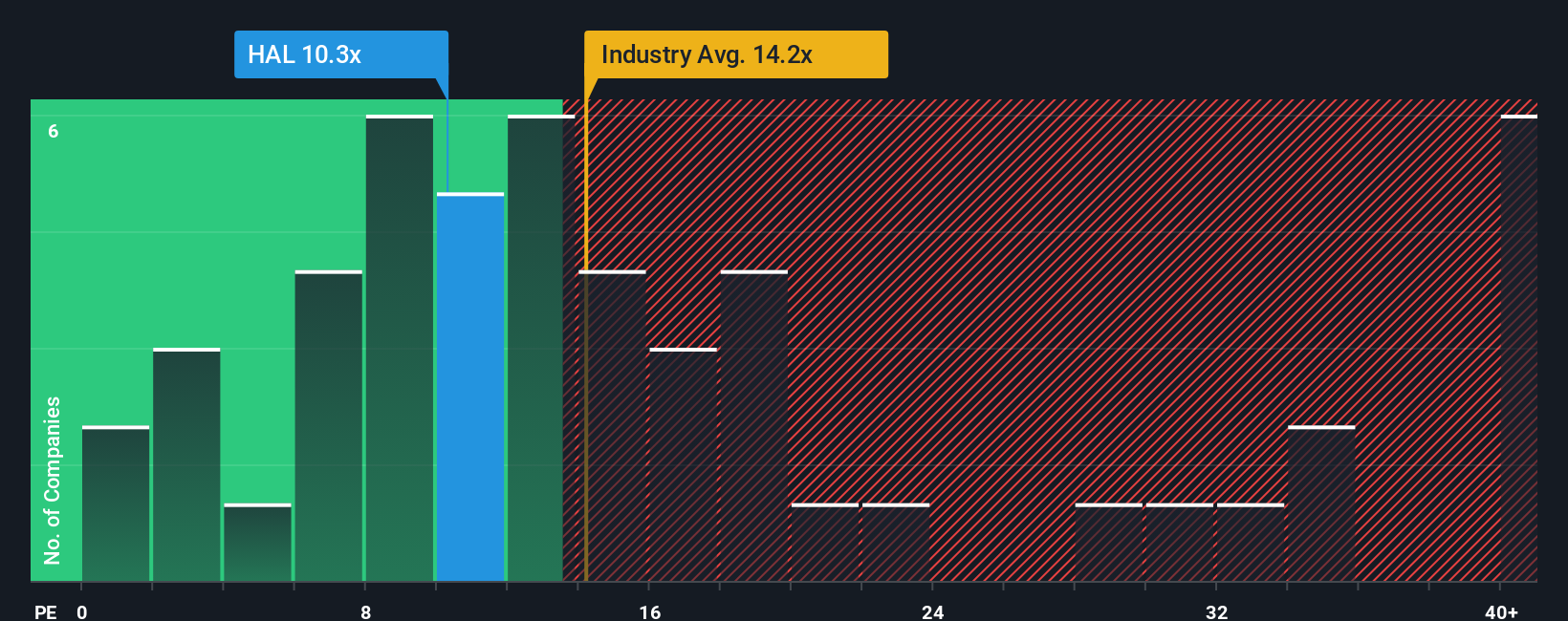

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it captures how much investors are willing to pay for each dollar of current earnings. For established, consistently profitable businesses like Halliburton, the PE ratio offers a straightforward way to gauge whether the stock is trading at a premium or discount relative to its earnings power.

Growth expectations and risk play a crucial role in determining what a "fair" PE ratio should be. Companies with higher expected earnings growth or lower risk often trade at higher PE ratios, while those facing headwinds or greater uncertainty typically command a lower multiple. Comparing Halliburton's current PE ratio of 17.1x to the industry average of 16.3x and the average of its direct peers at 14.9x, Halliburton trades at a modest premium.

Simply Wall St utilizes the concept of a “Fair Ratio,” which in Halliburton’s case is 19.2x. This proprietary metric goes far beyond a simple peer or industry comparison by factoring in key details like Halliburton’s earnings growth prospects, profit margins, market capitalization, and the specific risks faced by its business. Because of this holistic approach, the Fair Ratio provides a more tailored benchmark for assessing value.

Comparing Halliburton’s actual PE ratio of 17.1x to its Fair Ratio of 19.2x, the stock appears to be slightly undervalued using this method. The shares trade a bit below where you might reasonably expect given its growth and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Halliburton Narrative

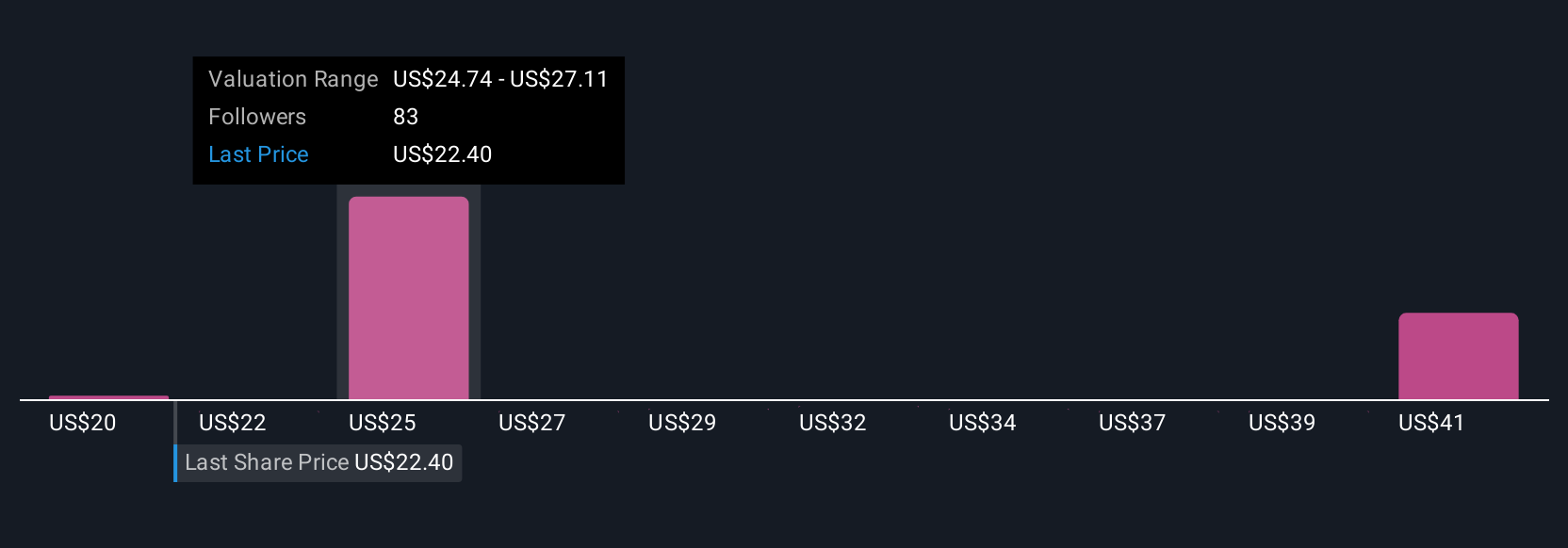

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, approachable tool that lets you add your own story—your perspective on Halliburton—alongside the financial numbers such as fair value, future revenue, earnings, and margin estimates.

Narratives connect what’s happening in Halliburton’s business and industry directly to a financial forecast, and then to a fair value. This means you are not just relying on market metrics or analyst consensus, but you are shaping your investment thesis based on your assumptions about where the company is heading.

On Simply Wall St’s Community page (trusted by millions of investors), Narratives make it easy for you to outline your expectation for Halliburton, instantly see your calculated fair value, and compare that to the market price. Narratives help you decide if and when to buy or sell. Narratives are always up-to-date, dynamically adjusting as new information such as news releases or earnings come in.

For example, some investors view Halliburton as set to benefit from global energy demand and ongoing digital innovation, leading to fair values as high as $35. Others focus on regulatory risk and see values as low as $20. This shows there is no single “right answer” and empowers you to craft your own Halliburton story.

Do you think there's more to the story for Halliburton? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives