- United States

- /

- Energy Services

- /

- NYSE:HAL

A Fresh Look at Halliburton (HAL) Valuation as International Gains Balance Regional Slowdowns and Cost Discipline Strengthens Profits

Reviewed by Simply Wall St

Recent updates show Halliburton (HAL) maintaining steady results, as international demand helps balance out softer conditions in the North American land market. The company's proactive cost-cutting efforts are further supporting its profitability during this period.

See our latest analysis for Halliburton.

Halliburton’s solid run over the past quarter has certainly caught attention, with a 27.9% 90-day share price return that reflects growing optimism after a longer spell of underwhelming total shareholder returns. The five-year total return sits at a healthy 84%, despite a 7.7% loss over the past year. Momentum appears to be building as international demand and cost controls help shift sentiment back in the company’s favor.

If you’re weighing how other companies are responding to shifting industry dynamics, it’s a good moment to broaden your perspective and discover fast growing stocks with high insider ownership

With strong returns and robust international performance balancing regional slowdowns, the key question is whether Halliburton’s stock still offers a margin of safety for investors or if the market has already taken the company’s future potential into account.

Most Popular Narrative: 9.3% Undervalued

Based on the narrative’s fair value estimate of $29.80, Halliburton’s recent closing price of $27.02 suggests room for near-term upside. The narrative weighs how improved profit margins, rising revenue estimates, and a lower risk outlook shape this updated valuation.

"Halliburton's exposure to emerging opportunities, such as data center-related services and onsite power generation projects, is considered underappreciated and could provide catalysts for further growth. Management's focus on capital efficiency and returns is viewed favorably. Improved operational discipline is believed to enhance long-term shareholder value."

Want to uncover what’s really powering this premium valuation? The story behind the price blends bold margin expansion, upgraded revenue forecasts, and a new approach to risk. Ready to dig into the assumptions driving this target? The real surprises are hidden in the numbers. Find out what’s moving the needle for Halliburton.

Result: Fair Value of $29.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory pressures and the accelerating adoption of renewables could become significant headwinds that may reshape Halliburton’s growth trajectory if trends persist.

Find out about the key risks to this Halliburton narrative.

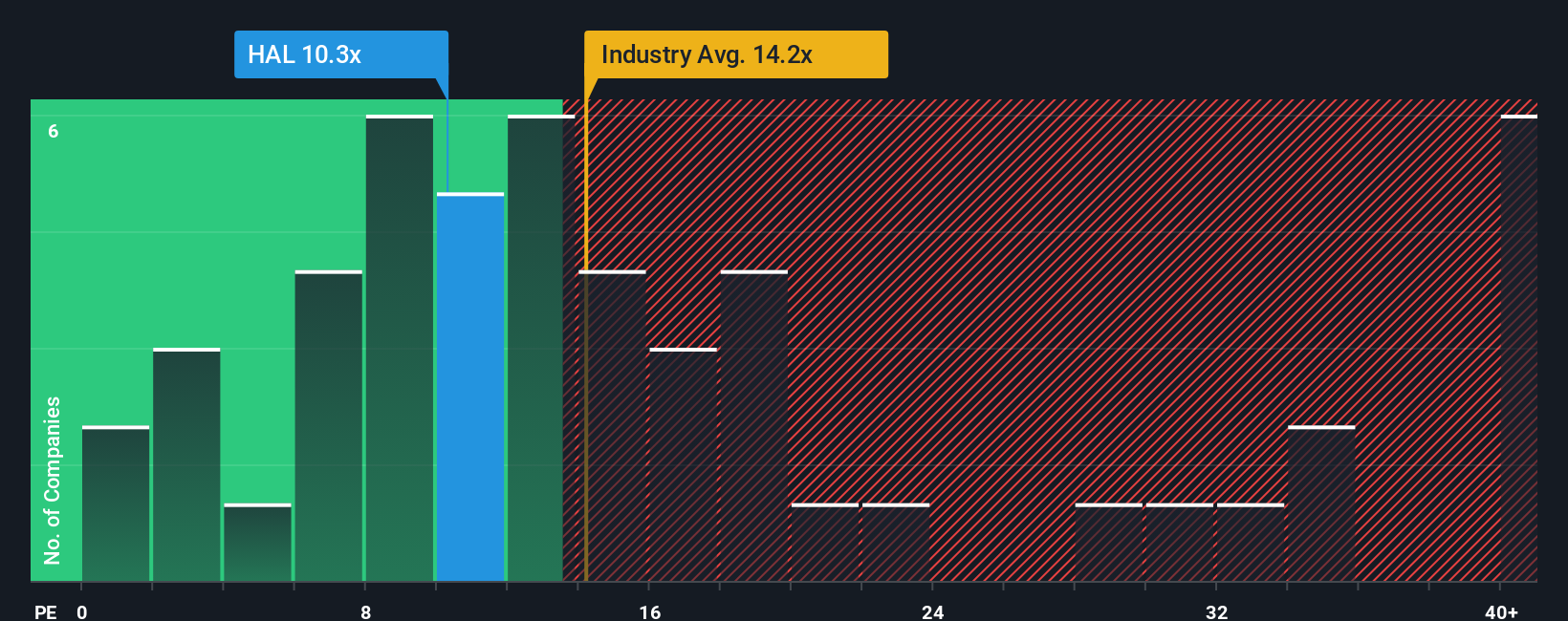

Another View: Rethinking the Price Tag

Looking at Halliburton’s price-to-earnings ratio reveals a different angle. With a current ratio of 17.4x, Halliburton trades above both its industry (16.5x) and peer (15.9x) averages. Yet, it is still below the fair ratio of 19.5x, suggesting investors may see extra value if the market re-rates the stock. Could this signal hidden opportunity, or does the premium simply raise the bar?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Halliburton Narrative

If you have your own perspective or want to delve into the details yourself, you can craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Halliburton research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Your next great stock story could be just a click away. The best investors seize opportunities before they become headlines, so give yourself the edge. These handpicked collections could spark your next winning move.

- Catch companies with consistent income potential by tapping into these 15 dividend stocks with yields > 3% offering high yields above 3% for steady returns.

- Spot the innovators shaping tomorrow through these 31 healthcare AI stocks focusing on breakthroughs at the intersection of medicine and artificial intelligence.

- Uncover hidden value plays in these 874 undervalued stocks based on cash flows that are priced below their intrinsic potential, so you don't miss a bargain hiding in plain sight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives