- United States

- /

- Oil and Gas

- /

- NYSE:GPRK

What Does The Future Hold For GeoPark Limited (NYSE:GPRK)? These Analysts Have Been Cutting Their Estimates

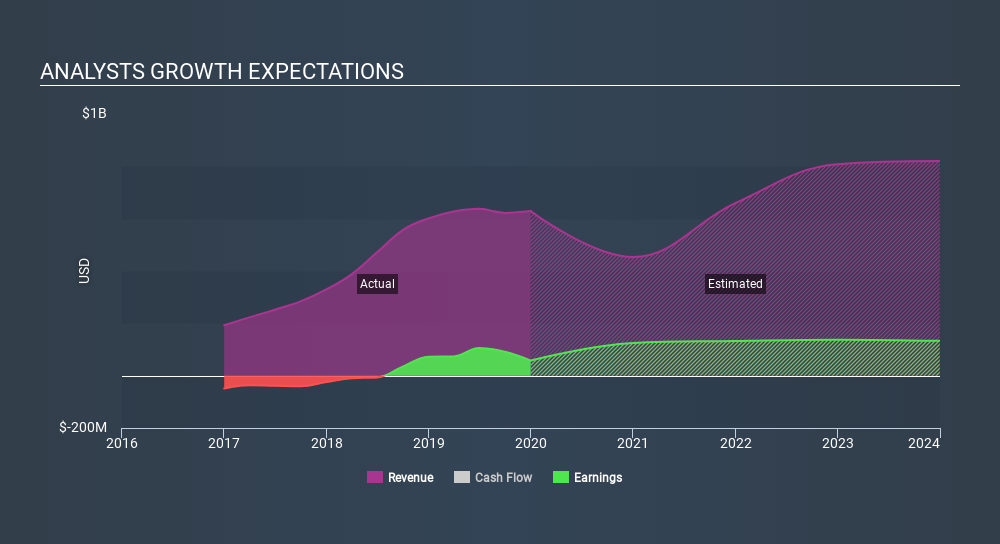

One thing we could say about the analysts on GeoPark Limited (NYSE:GPRK) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

Following the downgrade, the consensus from four analysts covering GeoPark is for revenues of US$454m in 2020, implying a stressful 28% decline in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing US$602m of revenue in 2020. It looks like forecasts have become a fair bit less optimistic on GeoPark, given the sizeable cut to revenue estimates.

View our latest analysis for GeoPark

Notably, the analysts have cut their price target 14% to US$21.00, suggesting concerns around GeoPark's valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values GeoPark at US$31.00 per share, while the most bearish prices it at US$12.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast revenue decline of 28%, a significant reduction from annual growth of 21% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 0.2% next year. It's pretty clear that GeoPark's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They're also anticipating slower revenue growth than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Given the stark change in sentiment, we'd understand if investors became more cautious on GeoPark after today.

Unfortunately, the earnings downgrade - if accurate - may also place pressure on GeoPark's mountain of debt, which could lead to some belt tightening for shareholders. You can learn more about our debt analysis for free on our platform here.

We also provide an overview of the GeoPark Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:GPRK

GeoPark

Operates as an oil and natural gas exploration and production company in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives