- United States

- /

- Energy Services

- /

- NYSE:FTI

Does TechnipFMC’s (FTI) Strong Q2 Earnings and Expanded Buybacks Support Its Shareholder Value Strategy?

Reviewed by Simply Wall St

- TechnipFMC recently reported second-quarter 2025 earnings, highlighting year-over-year growth with revenue reaching US$2.53 billion and net income rising to US$269.5 million, alongside the completion of a major share buyback and confirmation of its quarterly dividend.

- These developments show the company's focus on both financial performance and returning value to shareholders through consistent buybacks and dividends.

- We'll explore how TechnipFMC's strong earnings performance and ongoing shareholder returns influence its investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

TechnipFMC Investment Narrative Recap

To be a TechnipFMC shareholder, you need confidence in the ongoing demand for offshore oil and gas services and the company's ability to capitalize on its strong order pipeline. Recent robust Q2 2025 results reinforce its revenue momentum and continued profitability, but do not significantly alter the current main catalyst: sustained customer capital spending on Subsea projects. The biggest near-term risk remains adverse shifts in energy policy or oil prices that could delay project activity and hamper order intake, which recent news has not meaningfully changed.

Of the latest company announcements, the completion of a major share buyback, 12.72% of shares repurchased since July 2022, stands out. It underscores TechnipFMC’s commitment to returning value to shareholders and ties in with the catalyst of high-margin Subsea business performance, helping underpin confidence in ongoing shareholder returns.

Yet, despite the encouraging numbers, investors should remain alert to the possibility that exposure to geopolitically volatile regions could impact earnings stability if...

Read the full narrative on TechnipFMC (it's free!)

TechnipFMC's outlook anticipates $11.2 billion in revenue and $1.2 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 5.8% and an earnings increase of $262.5 million from the current earnings of $937.5 million.

Uncover how TechnipFMC's forecasts yield a $40.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

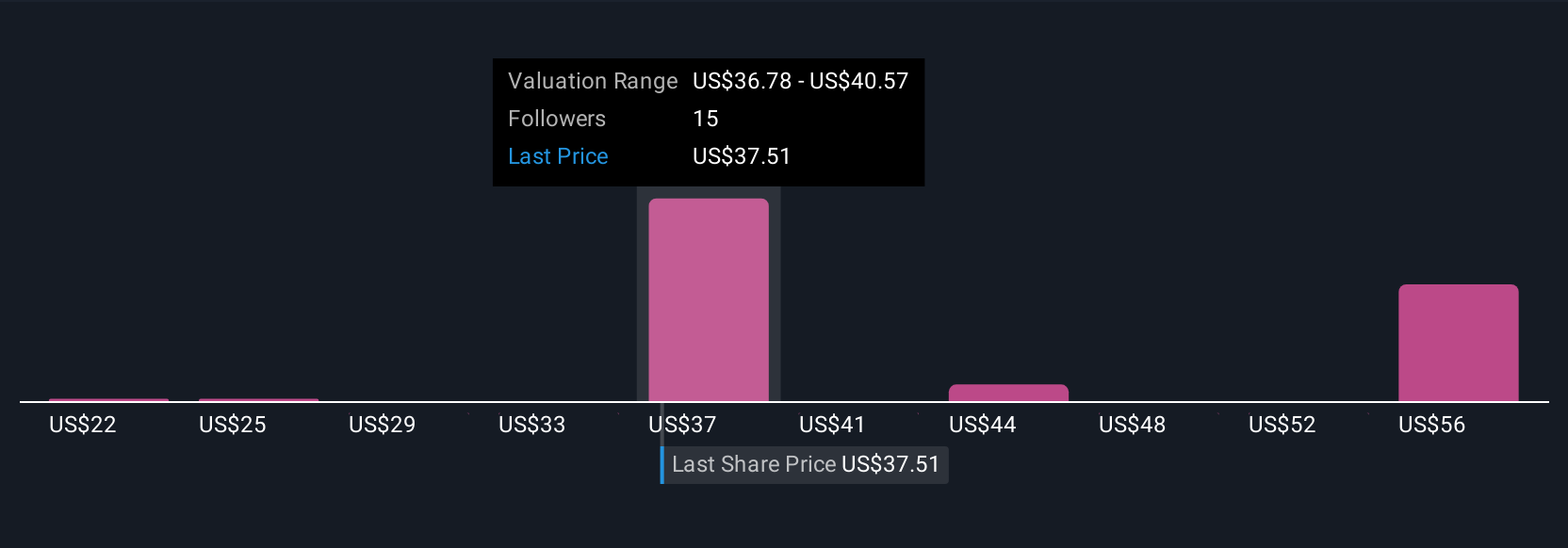

Five fair value estimates from the Simply Wall St Community range from US$21.65 to US$59.50 per share, revealing a broad mix of expectations. While many see potential, TechnipFMC’s reliance on a strong Subsea order pipeline means changes in global energy project trends could influence future returns, inviting you to consider these different viewpoints.

Explore 5 other fair value estimates on TechnipFMC - why the stock might be worth as much as 67% more than the current price!

Build Your Own TechnipFMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TechnipFMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TechnipFMC's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives