- United States

- /

- Energy Services

- /

- NYSE:FTI

Assessing TechnipFMC After Offshore Contract Wins and a 53% Share Price Rally

Reviewed by Bailey Pemberton

- Wondering if TechnipFMC could be a smart buy or potentially overhyped? You are not alone, as plenty of investors are eyeing its value story right now.

- The stock has been on a strong run lately, climbing 2.9% over the last week, 11.6% in the last month, and a remarkable 53.0% year-to-date.

- Much of this momentum comes after recent news highlighting large offshore contract wins and continued optimism around energy infrastructure spending, which have fueled bullish investor sentiment and kept TechnipFMC in the headlines for all the right reasons.

- Currently, TechnipFMC has a valuation score of 2 out of 6. This means it is undervalued on just a few of our standard checks, so let's dig into what those methods actually reveal and why there might be a better way to gauge true value by the end of this article.

TechnipFMC scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: TechnipFMC Discounted Cash Flow (DCF) Analysis

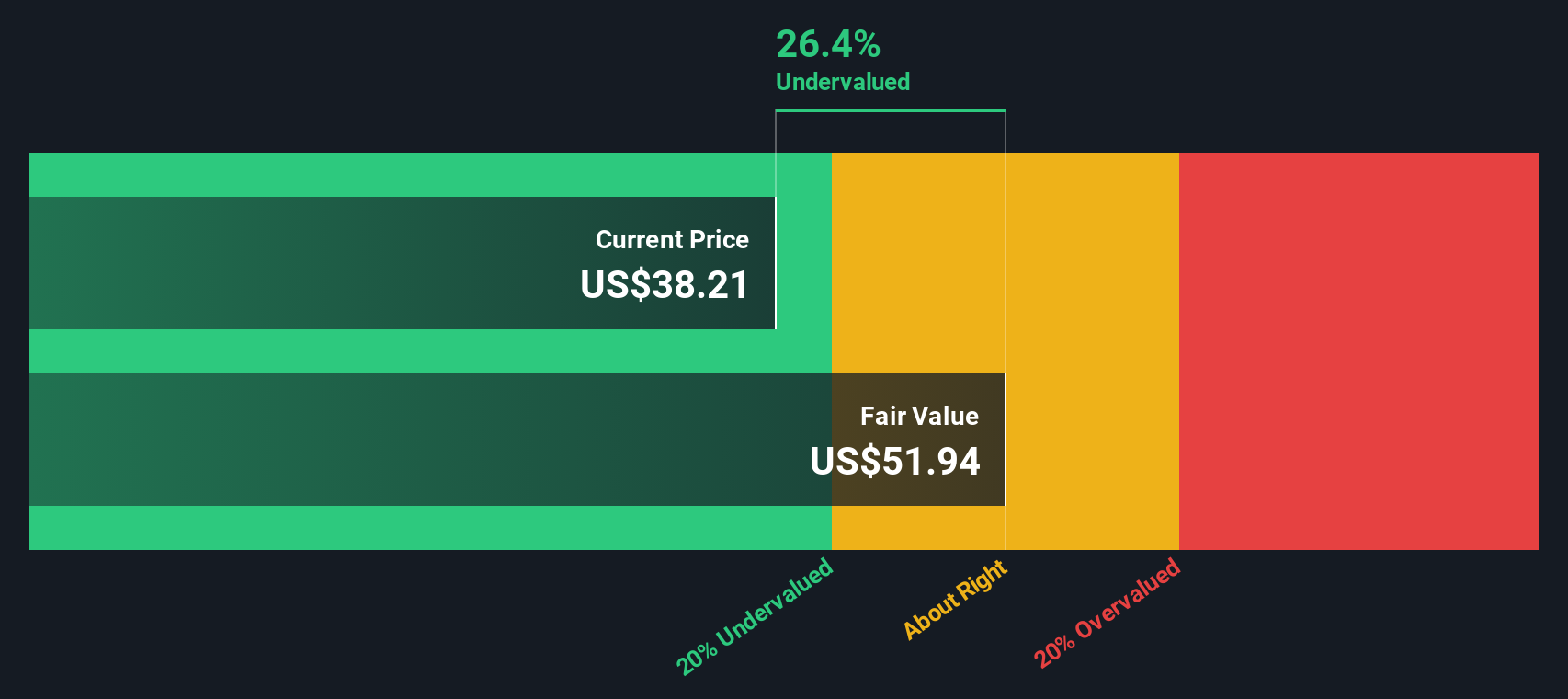

A Discounted Cash Flow (DCF) model estimates the fair value of a company by forecasting all future expected cash flows, then discounting each back to today's dollars to account for the time value of money. For TechnipFMC, this means looking at both current financial performance and projections for future growth.

Right now, TechnipFMC reports Free Cash Flow of $1.66 Billion. Analyst projections suggest steady increases in coming years. For example, FCF is projected to reach $1.19 Billion in 2026 and $1.3 Billion in 2029. It is worth noting that firm analyst estimates are available for roughly the next five years; after that, Simply Wall St extrapolates further out to 2035 to round out the DCF calculation.

Based on these cash flows, the model calculates an intrinsic value of $67.87 per share using a two-stage Free Cash Flow to Equity approach. This represents a 33.3% discount compared to TechnipFMC's current share price. In valuation terms, this signals that the market may be significantly undervaluing the company's long-term earning potential and cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TechnipFMC is undervalued by 33.3%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: TechnipFMC Price vs Earnings

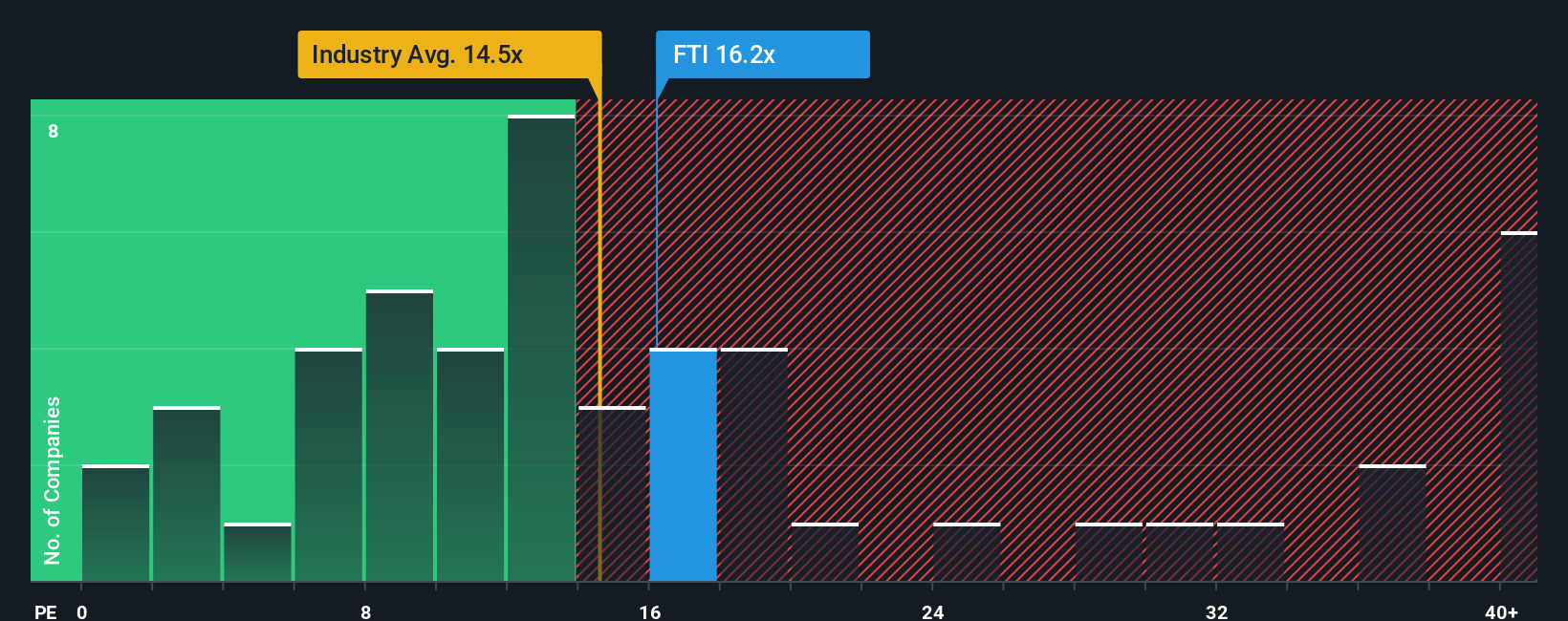

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies because it directly compares a company's stock price to its earnings. For companies like TechnipFMC generating consistent profits, PE provides a simple and intuitive measure for investors to gauge how much they are paying for each dollar of earnings.

It is important to remember that what counts as a “normal” or “fair” PE ratio varies depending on expectations for future growth and perceived risk. Companies with stronger growth outlooks or lower risk profiles often command higher PE multiples, while slower-growing or riskier businesses tend to trade at lower ratios.

Currently, TechnipFMC trades at a PE ratio of 18.8x. This is higher than both the Energy Services industry average of 16.9x and the peer group average of 15.6x. However, the "Fair Ratio" metric developed by Simply Wall St sets a specific target multiple for TechnipFMC at 16.8x. The Fair Ratio incorporates not just industry trends, but also key company-specific factors such as its growth prospects, profit margins, market capitalization, and risk profile. This offers a more nuanced perspective than just comparing with peers or sector averages.

Given TechnipFMC’s current PE of 18.8x and a Fair Ratio of 16.8x, the stock appears a bit more expensive than warranted based on its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

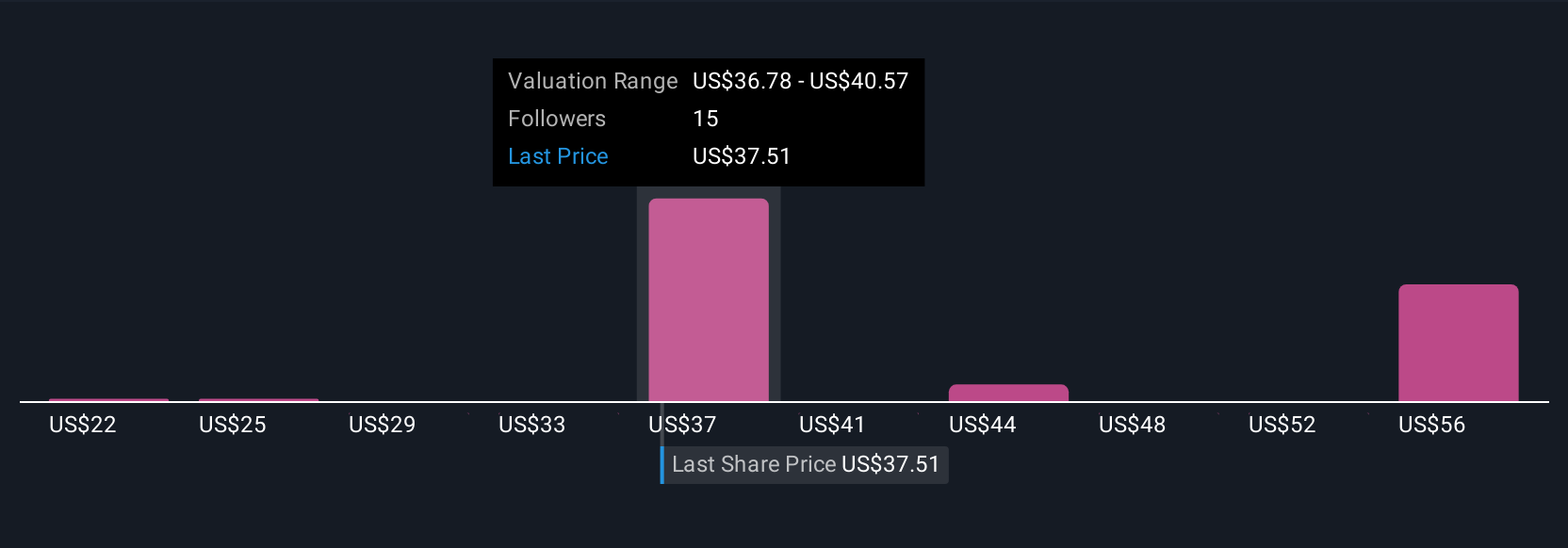

Upgrade Your Decision Making: Choose your TechnipFMC Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects your view of TechnipFMC's business story, such as its future revenue, earnings, and margins, to a financial forecast and then to an estimated fair value. On Simply Wall St's Community page, millions of investors now use Narratives to quickly translate their perspective on a company into numbers and a buy or sell decision. Narratives are simple and intuitive. You create your own storyline based on what you think will drive TechnipFMC's results, then the platform calculates a fair value for you and compares it to the current share price. Whenever news, earnings, or forecasts change, Narratives update instantly to keep your outlook relevant and actionable. For instance, some investors see robust cash flow and growing subsea margins leading to a fair value as high as $51.0 per share, while others are more cautious, assigning a bear-case value closer to $30.0 based on industry risks. Narratives put you in control, making it easier than ever to align investing decisions with your real-world view of TechnipFMC.

Do you think there's more to the story for TechnipFMC? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success