- United States

- /

- Energy Services

- /

- NYSE:FTI

A Fresh Look at TechnipFMC (FTI) Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

TechnipFMC (FTI) shares have moved up around 1% over the past day, continuing a steady upward trend this month. Investors are taking note of its solid year-to-date return as well as its overall multi-year performance.

See our latest analysis for TechnipFMC.

That upward momentum is hard to ignore, especially with TechnipFMC posting a 1.23% one-day share price gain and an impressive 47.75% share price return so far this year. The company’s one-year total shareholder return of 56% and an even more striking 650% total return over five years show that recent enthusiasm is firmly built on long-term outperformance. Strong price gains reflect growing confidence in its growth prospects and strategic execution.

If you’re tracking this kind of sustained performance, why not take the next step and discover fast growing stocks with high insider ownership?

The key question now is whether TechnipFMC is trading below its real value or if the market already factors in its rapid growth, which could leave little room for upside. Is there a genuine buying opportunity ahead, or has optimism already been priced in?

Most Popular Narrative: 2.8% Undervalued

TechnipFMC’s last close of $43.69 sits just below the narrative’s fair value estimate of $44.95. This slight gap suggests the stock is seen as holding a modestly attractive upside, even after a strong run-up in price.

Expansion and recurring tail of Subsea services revenues, driven by a growing installed base and long-duration contracts (20 to 35 years), provide predictable, high-margin income streams that underpin long-term earnings stability and net margin improvement.

Want a peek at the modeling magic behind that price? The linchpin of this narrative is a potent mix of rising cash flow and earnings power, paired with margin improvements. Curious how analysts factor in industry-demand surges and a shrinking share count? Uncover the bold building blocks of this fair value thesis.

Result: Fair Value of $44.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing volatility in oil prices and TechnipFMC's reliance on traditional energy markets could quickly shift future expectations and challenge the bullish narrative.

Find out about the key risks to this TechnipFMC narrative.

Another View: A Different Way to Value

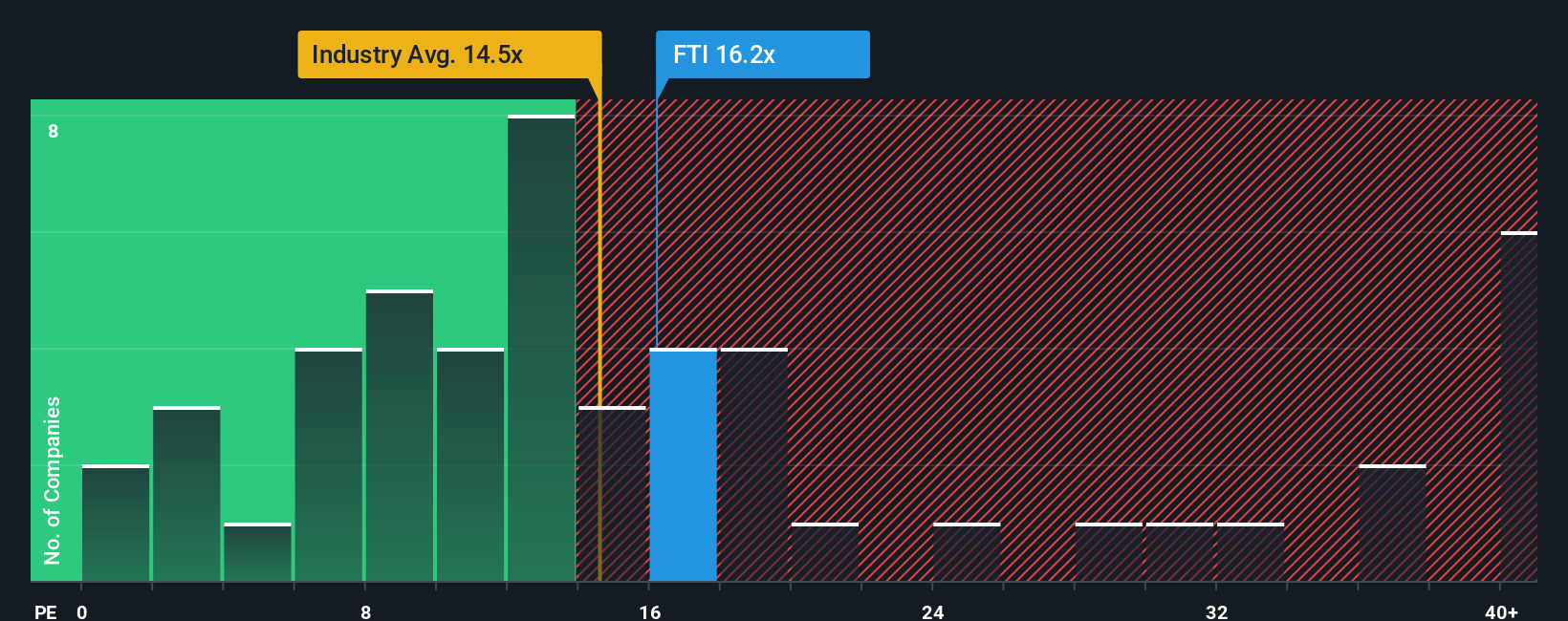

Looking at TechnipFMC through the lens of its price-to-earnings ratio tells a slightly different story. Shares currently trade at 18.2 times earnings, which is more expensive than both the US Energy Services industry average (16.6x), the peer average (16.1x), and even the fair ratio (16.8x) our research points to. This gap could signal limited upside. Are investors betting too heavily on continued outperformance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TechnipFMC Narrative

If you see things differently or want a hands-on approach, you can dive into the data and craft your own story in just a few minutes. Do it your way.

A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Shake up your watchlist and put your investment instincts to work. Great opportunities are always waiting for those who step up and search with the right tools.

- Target high potential by checking out these 897 undervalued stocks based on cash flows, which the market may be overlooking. This may offer an edge for those ready to act early.

- Capture tomorrow’s breakthroughs and get ahead of trends with these 25 AI penny stocks, which are working at the forefront of artificial intelligence innovation.

- Secure consistent income by reviewing these 16 dividend stocks with yields > 3%, delivering yields above 3% for investors who know the power of reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives