- United States

- /

- Oil and Gas

- /

- NYSE:FLNG

What Does Today’s Unexplained FLNG Surge Reveal About FLEX LNG’s Long-Term Revenue Stability?

Reviewed by Simply Wall St

- FLEX LNG experienced a significant increase in trading activity today, despite the absence of new company announcements or sector-specific news reports to explain the movement.

- This unexplained rise highlights the impact that broader market sentiment, sector rotation, or speculative trading can have on a company's stock price in the short term.

- Given the recent unexplained trading surge, we’ll assess what this means for the company's long-term revenue stability and investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

FLEX LNG Investment Narrative Recap

To believe in FLEX LNG for the long term, an investor needs to have confidence in the ongoing demand for liquefied natural gas transport and the company’s ability to secure dependable, long-term charter contracts. While today’s surge in share price was not tied to any news or company-specific catalyst, it doesn’t materially shift the biggest short term catalyst, which remains the future extension of lucrative shipping charters, nor does it reduce the main risk of persistent weak freight rates and spot market reliance.

Among recent announcements, FLEX LNG’s refinancing of the Flex Courageous vessel on June 2, 2025, stands out; the resulting $42 million in net proceeds and reduced interest costs provide extra financial flexibility. Although this move enhances the company’s ability to withstand softer markets and is relevant to near-term business stability, it is not a direct trigger for large moves in daily trading activity such as the one observed today.

Yet, against a backdrop of strong contract backlog, investors should be aware that...

Read the full narrative on FLEX LNG (it's free!)

FLEX LNG's narrative projects $366.0 million revenue and $137.7 million earnings by 2028. This requires 1.1% yearly revenue growth and a $34.5 million earnings increase from $103.2 million today.

Uncover how FLEX LNG's forecasts yield a $24.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

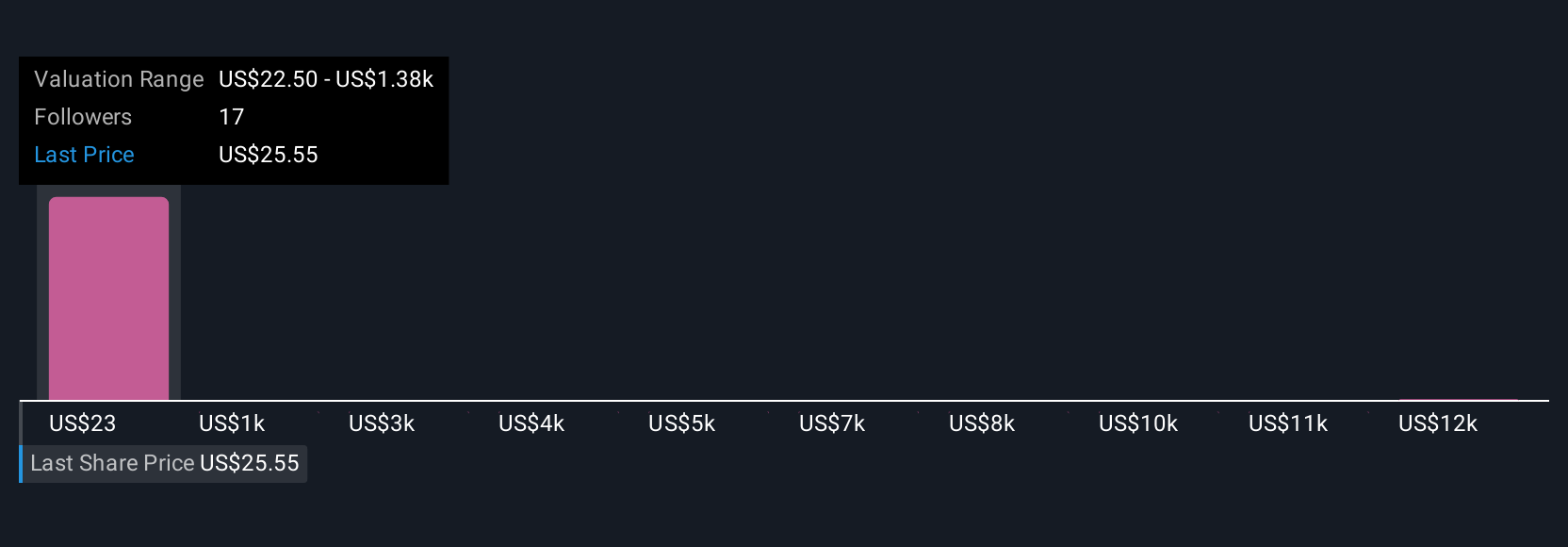

Four fair value estimates from the Simply Wall St Community range widely from US$22.50 to US$13,641.04 per share. While many see long-term contract coverage as a strength, differing opinions about spot market exposure highlight how future earnings stability is viewed by the market.

Explore 4 other fair value estimates on FLEX LNG - why the stock might be a potential multi-bagger!

Build Your Own FLEX LNG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FLEX LNG research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FLEX LNG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FLEX LNG's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLNG

FLEX LNG

Engages in the seaborne transportation of liquefied natural gas (LNG) worldwide.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives