- United States

- /

- Energy Services

- /

- NYSE:FET

Forum Energy Technologies (FET): Losses Narrow but Revenue Decline Tempers Profitability Hopes Ahead of Earnings

Reviewed by Simply Wall St

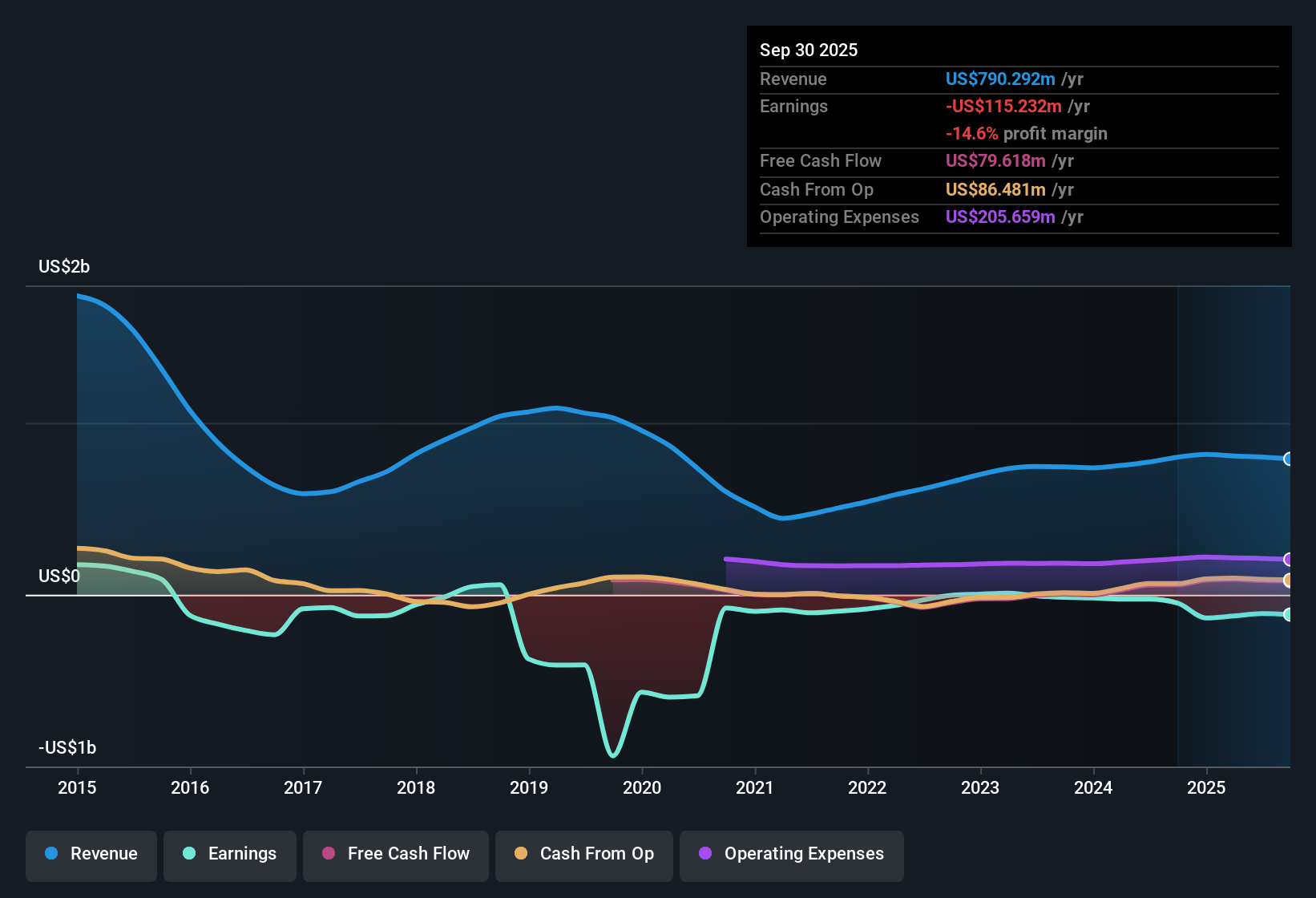

Forum Energy Technologies (NYSE:FET) is still unprofitable but has trimmed its losses by around 3.2% annually over the past five years, and the company is forecast to deliver 32.99% annual earnings growth with a return to profitability expected within three years. Shares trade at $26.78, well below the estimated fair value of $61.09, and the stock’s Price-to-Sales ratio of 0.4x is notably under both its peer and industry averages. Though revenue is expected to dip slightly in the years ahead, investors appear focused on the sharp earnings growth and discounted valuation, viewing these as the key upsides for FET this earnings season.

See our full analysis for Forum Energy Technologies.We’re about to see how these headline results stack up against the most widely discussed narratives. Some expectations may be confirmed while others could be in for a surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow Steadily Across Five Years

- Forum Energy Technologies has reduced its losses by about 3.2% per year over the last five years, a notable pace for a company that remains unprofitable today.

- Positive sentiment about these consistent improvements dominates the current narrative, with the forecast for profitability within three years resonating strongly.

- The steady reduction in annual losses helps support optimism that FET could cross the line to profitability relatively soon, lending credibility to investor hopes for a sustained turnaround.

- Even as FET remains in the red, the consistency of improvements over a multi-year stretch gives weight to bullish claims that the company’s operational strategy is paying off, rather than being a fluke of a single period's results.

Price-to-Sales Hits 0.4x, Undercutting Peers

- FET trades at a Price-to-Sales ratio of 0.4x, a steep discount versus both the peer group average of 1.5x and the US Energy Services industry average of 1x.

- Bulls highlight this valuation gap as a sign of latent upside, while critics point to lingering unprofitability as a reason for caution.

- Supporters believe the deep discount signals undervaluation relative to potential, especially given expectations for a 32.99% annual earnings growth rate, figures that reinforce the notion of catch-up potential if operational momentum persists.

- On the other hand, skeptics can argue that even a bargain multiple may not be enough to attract sustained interest until FET closes the profitability gap, suggesting the discount reflects real risks rather than pure opportunity.

DCF Fair Value Still Far Above Share Price

- The latest DCF fair value estimate for FET stands at $61.09, more than double the current share price of $26.78, a gap that sets the stage for sharp debate.

- According to the prevailing market view, investors see this upside as compelling, but pair it with caution over a projected -0.3% annual revenue decline.

- The disconnect between discounted value and DCF fair value highlights classic value-versus-growth tensions. While the model implies significant capital appreciation from here, the market remains watchful for proof that revenue softness will not derail the long-term case.

- This gap creates a scenario where even modest improvements toward profitability could rapidly narrow the valuation gap, but also invites skepticism over whether declining sales will prevent that rerating from materializing.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Forum Energy Technologies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Forum Energy Technologies faces investor skepticism due to ongoing unprofitability and projected declines in revenue. This is despite encouraging earnings forecasts and a discounted valuation.

If reliable growth matters most to you, use our stable growth stocks screener (2103 results) to find companies consistently delivering steady revenue and earnings, regardless of short-term headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FET

Forum Energy Technologies

Designs, manufactures, and supplies products serving the oil, natural gas, industrial, and renewable energy industries in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives