- United States

- /

- Oil and Gas

- /

- OTCPK:EVVA.Q

Investors Still Aren't Entirely Convinced By Enviva Inc.'s (NYSE:EVA) Revenues Despite 42% Price Jump

Those holding Enviva Inc. (NYSE:EVA) shares would be relieved that the share price has rebounded 42% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 81% share price decline over the last year.

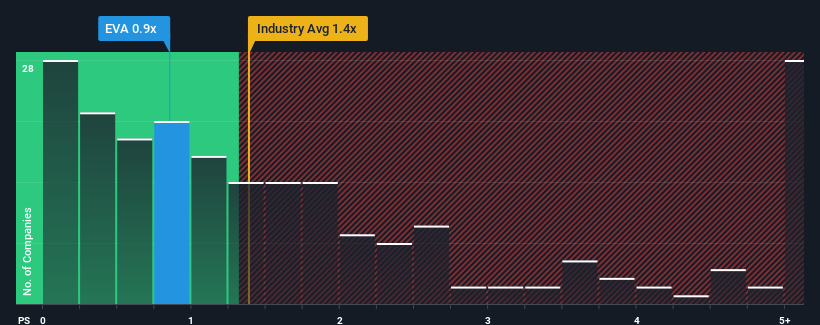

Even after such a large jump in price, when close to half the companies operating in the United States' Oil and Gas industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Enviva as an enticing stock to check out with its 0.9x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Enviva

How Has Enviva Performed Recently?

Enviva could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Enviva will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Enviva?

The only time you'd be truly comfortable seeing a P/S as low as Enviva's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 9.4% gain to the company's revenues. The latest three year period has also seen an excellent 55% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 26% each year during the coming three years according to the five analysts following the company. That would be an excellent outcome when the industry is expected to decline by 4.7% per year.

With this information, we find it very odd that Enviva is trading at a P/S lower than the industry. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

The latest share price surge wasn't enough to lift Enviva's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Enviva's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Enviva (2 can't be ignored) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Enviva, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enviva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:EVVA.Q

Enviva

Produces, processes, supplies, and sells utility-grade wood pellets.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives