- United States

- /

- Oil and Gas

- /

- NYSE:ET

Is Now the Right Moment for Energy Transfer After 1.4% Weekly Price Gain?

Reviewed by Bailey Pemberton

If you have ever wondered whether now is the right time to get involved with Energy Transfer, you are not alone. The stock has seen its fair share of ups and downs recently, making decisions about buying, holding, or selling feel like a game of patience and intuition. In just the last seven days, the price ticked up by 1.4%, offering a hint of optimism after a challenging stretch where the stock slid 3.1% over the past month and remains around 15% lower year to date. Still, the story changes as you zoom out. Energy Transfer’s one-year return clocks in at 10.0%, and over three and five years, the gains are even more impressive, reaching 79.0% and a staggering 345.4% respectively.

Much of the conversation lately has revolved around broader trends in the US energy sector, including expanding infrastructure investments and shifting risk perceptions among investors. While day-to-day headlines have provided some volatility, the underlying fundamentals have kept longer-term investors engaged and even optimistic about future growth potential. These moves have led many to look at Energy Transfer’s value from several different angles.

Here is where things get interesting. Energy Transfer lands a perfect valuation score of 6 out of 6 across key value metrics, suggesting that, from a value investing standpoint, it might just be one of the most compelling names in its space right now. Let us break down these valuation methods to see exactly why Energy Transfer stands out. Later, I will share a perspective that goes beyond the checklists to what really matters for investors like you.

Approach 1: Energy Transfer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach helps determine what a business is truly worth today, based on expectations for its earnings in the years ahead.

For Energy Transfer, the latest twelve months’ Free Cash Flow stands at $7.16 billion, which demonstrates strong cash-generating ability. Analysts have forecasted that annual Free Cash Flow will steadily increase, reaching approximately $8.04 billion by 2029. After the initial five years of analyst projections, further annual cash flows are extrapolated using industry growth expectations, providing a ten-year outlook.

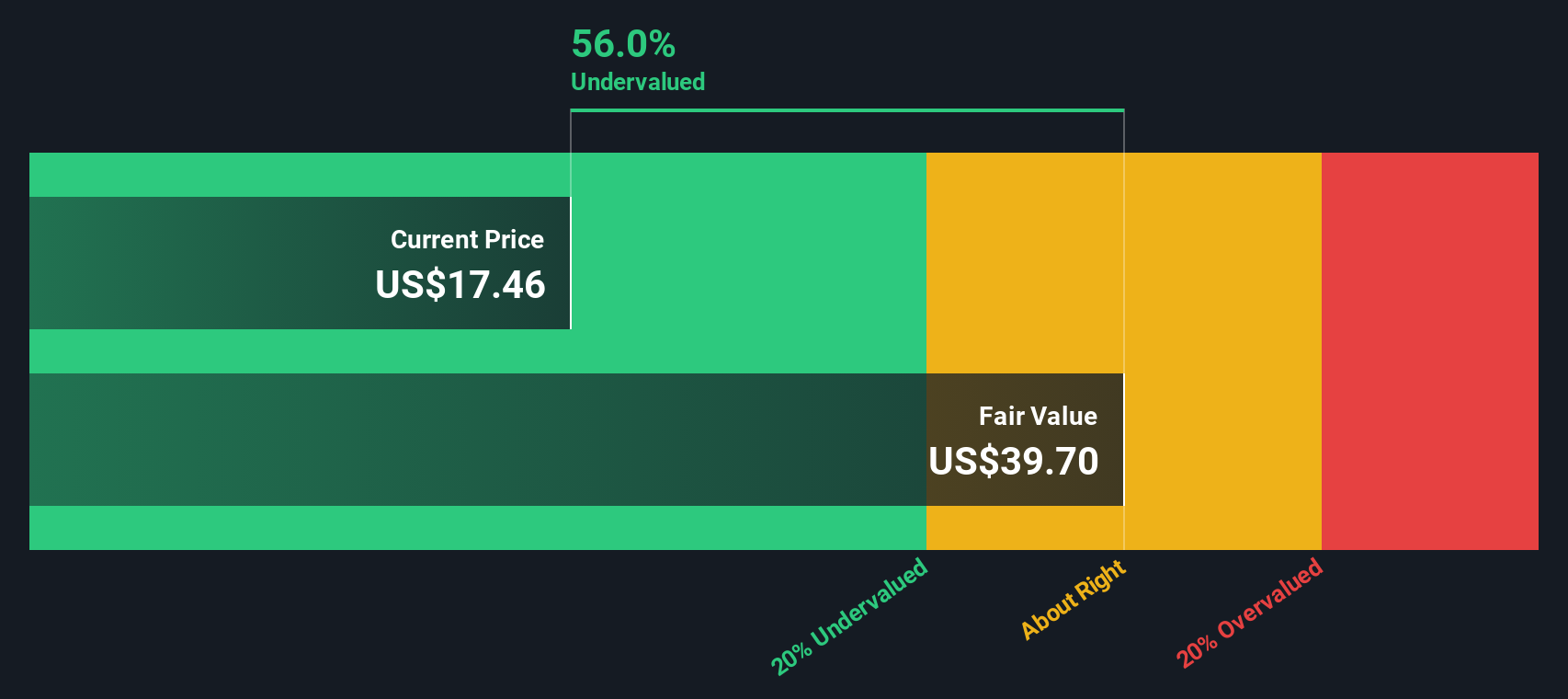

The key takeaway from this analysis is the implied fair value of Energy Transfer’s shares. According to the DCF calculations, the intrinsic value is estimated at $41.57 per share. Currently, the stock trades at a level that suggests it is about 59.7% below this intrinsic value. This indicates considerable undervaluation by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Energy Transfer is undervalued by 59.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Energy Transfer Price vs Earnings

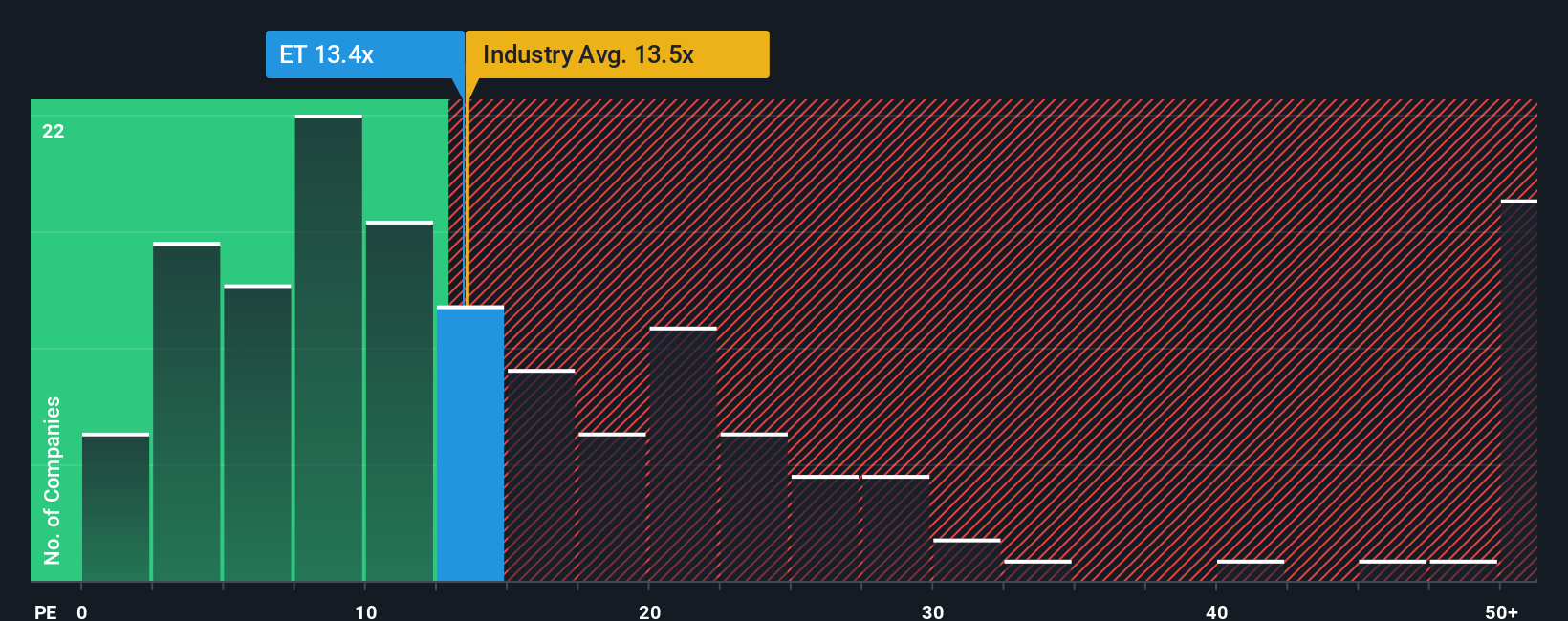

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like Energy Transfer because it ties the share price directly to the earnings a business generates. Investors often use the PE ratio to gauge whether a stock is expensive or cheap relative to its profit-making ability.

A "normal" or "fair" PE ratio is influenced by growth expectations and risk. Generally, companies expected to deliver higher earnings growth, or those considered less risky, can justify higher PE ratios. In comparison, slower-growth or riskier businesses trade at lower multiples.

Currently, Energy Transfer trades at a PE ratio of 12.87x, which is just below the Oil and Gas industry average of 12.91x and well under the average of similar peers at 19.30x. On the surface, this might suggest the stock is comparatively cheap. However, Simply Wall St’s proprietary "Fair Ratio" offers a more nuanced view. The Fair Ratio for Energy Transfer comes in at 19.91x, which incorporates factors such as the company’s earnings growth outlook, industry context, profit margins, market size, and unique risk profile.

This Fair Ratio approach is more comprehensive than simply comparing with industry averages or peers, as it adapts to the company's specific circumstances and the market environment. By weighing these tailored factors, it gives a clearer picture of what a reasonable valuation should be.

Given that Energy Transfer’s current PE ratio of 12.87x is significantly below its Fair Ratio of 19.91x, the valuation suggests the stock is meaningfully undervalued using this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Energy Transfer Narrative

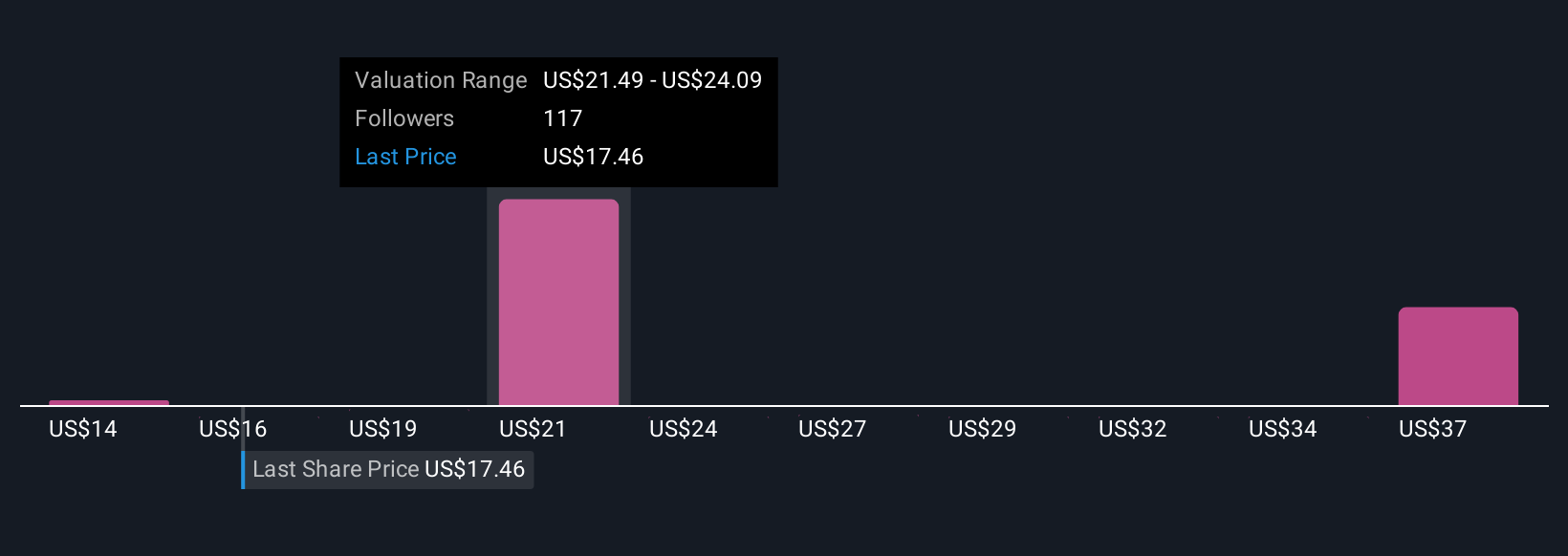

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is essentially your personalized story about a company, explaining the thinking behind your estimates for fair value, future revenues, earnings, and profit margins. By taking the numbers we have explored and linking them with your expectations about Energy Transfer’s future, a Narrative connects the company’s story with a tailored financial forecast and a calculated fair value.

Narratives are designed to be simple and accessible tools, available for free to all investors right on Simply Wall St’s Community page, where millions of others exchange ideas, share forecasts, and track their perspectives. These Narratives help you make smarter decisions by allowing you to compare your own calculated fair value to the current share price, showing when a stock might be overvalued, undervalued, or just right for your approach. Better yet, Narratives update dynamically whenever critical news or earnings data comes in, ensuring your view of the company stays current and relevant.

For example, one investor might use a Narrative expecting Energy Transfer to reach $7.6 billion in earnings by 2028 and see a fair value of $25.00. Another, more cautious investor might predict $4.1 billion in earnings and a fair value closer to $20.00, demonstrating how Narratives empower you to make informed choices based on your unique perspective.

Do you think there's more to the story for Energy Transfer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Transfer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ET

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives