- United States

- /

- Oil and Gas

- /

- NYSE:ET

Did New Data Center Gas Deals and Pipeline Expansion Just Shift Energy Transfer's (ET) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent months, Energy Transfer has moved ahead with expanding its Transwestern Pipeline and signed long-term natural gas supply agreements with major data center operators such as Oracle and Fermi America, aiming to support rising power demand in the U.S. Southwest.

- These moves build on the company’s extensive, mostly fee-based pipeline network and growing distribution payouts, reinforcing its role as an income-oriented midstream operator with substantial contracted cash flow.

- Next, we’ll examine how these new data center gas contracts and pipeline expansion influence Energy Transfer’s broader investment narrative and risks.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Energy Transfer Investment Narrative Recap

To own Energy Transfer, you have to believe its fee-based midstream network and data center-linked gas demand can support durable cash flows and ongoing distributions, despite volume uncertainty in key basins. The latest Transwestern expansion and data center contracts modestly support the near term growth catalyst of filling new projects with long-term commitments, while the biggest current risk remains execution and permitting around its larger, multi-year pipeline and LNG buildout.

Among recent developments, the company’s continued quarterly distribution increases in 2025 stand out alongside the new gas contracts, because they show management allocating growing cash flows back to unitholders while still funding a multi billion dollar growth pipeline. For investors focused on Energy Transfer’s income story, this combination of higher distributions and contracted infrastructure tied to power and data center demand goes straight to the heart of the investment case, but it also raises questions about how resilient payouts are if...

Read the full narrative on Energy Transfer (it's free!)

Energy Transfer's narrative projects $99.8 billion revenue and $6.7 billion earnings by 2028.

Uncover how Energy Transfer's forecasts yield a $21.67 fair value, a 29% upside to its current price.

Exploring Other Perspectives

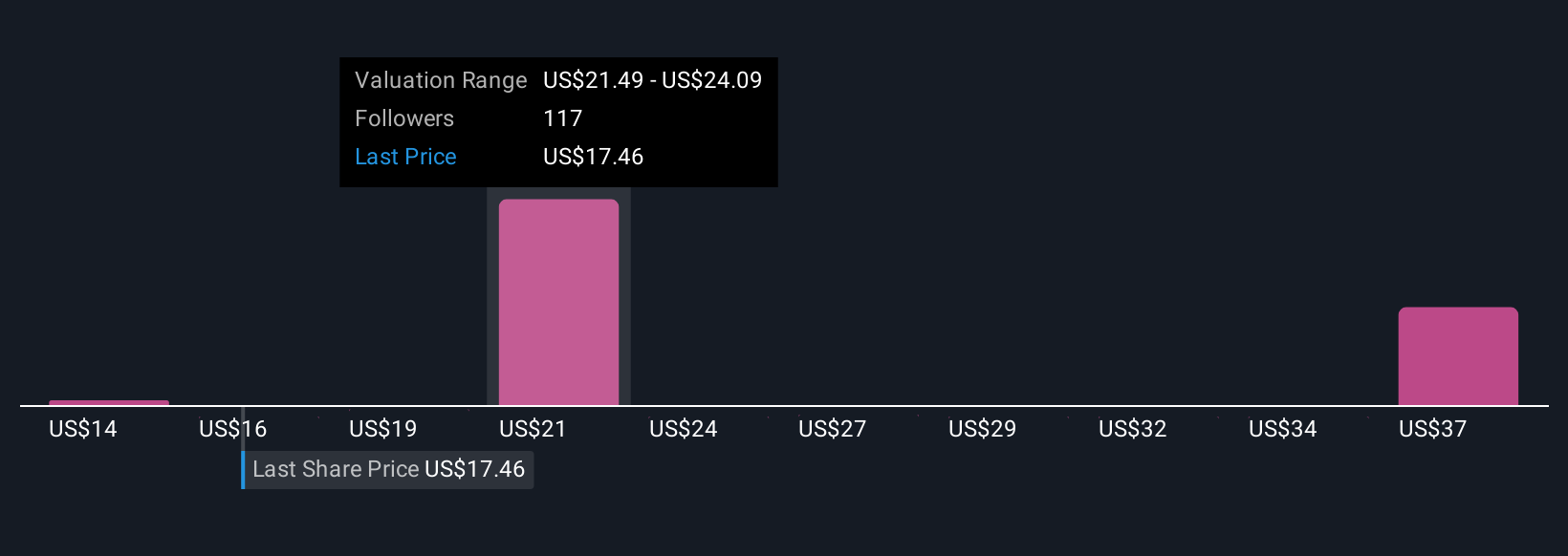

Twenty three members of the Simply Wall St Community currently see Energy Transfer’s fair value anywhere between US$13.78 and US$43.57, clustering in several very different price bands. When you set those views against the company’s heavy reliance on large, long lead time pipeline and LNG projects, it underlines why you may want to compare multiple assumptions about execution risk and long term utilization before deciding where you stand.

Explore 23 other fair value estimates on Energy Transfer - why the stock might be worth 18% less than the current price!

Build Your Own Energy Transfer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Energy Transfer research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Energy Transfer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Energy Transfer's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Transfer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ET

Very undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026