- United States

- /

- Oil and Gas

- /

- NYSE:EQT

EQT (EQT) Earnings Surge 466% Reinforces Bullish Market Narratives on Profitability

Reviewed by Simply Wall St

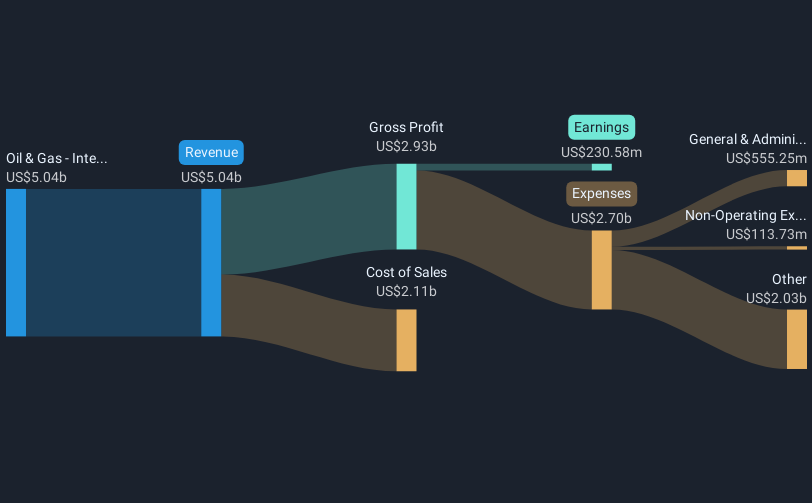

EQT (EQT) reported a striking 466.6% earnings growth in the latest year, sharply outpacing its five-year average annual expansion of 42.2%. Net profit margins jumped from 6.8% to 23.3%, underscoring notable gains in operational efficiency. With annual earnings set to grow 19.7% (ahead of the wider US market's 15.5% forecast), and shares trading at $53.49, well below the estimated fair value of $112.02, the results position EQT as a standout in the oil and gas space with meaningful investor appeal as earnings season unfolds.

See our full analysis for EQT.Now, we’ll see how these headline results stack up against the most widely followed market narratives. Some expectations will be confirmed, while others might be upended.

See what the community is saying about EQT

Margins Accelerate: 23.3% Profit Margin Upside

- Net profit margins reached 23.3% this year, marking a substantial increase from 6.8% last year and highlighting efficiency gains that outstrip typical sector performance.

- Analysts' consensus view is that these margin gains will likely pave the way for durable free cash flow growth, driven by efficiency initiatives and scale.

- They reference long-term gas supply contracts and new infrastructure investments, which are expected to keep margins robust as in-basin demand grows.

- With future profit margins projected to rise further to 38.7% in three years, the consensus sees ongoing cost controls as foundational to this improvement.

- For a full take on what the broader market expects next as new contracts kick in, see the consensus view in the detailed narrative. 📊 Read the full EQT Consensus Narrative.

Debt and Cash Position Strengthens

- Balance sheet deleveraging remains in focus, with targeted net debt reductions to $5 billion or less, supporting an investment-grade profile.

- Analysts' consensus view considers the move to reduce borrowing costs as a key step that enables future share buybacks and dividend growth.

- This lower debt load could bolster future per-share earnings and the company’s valuation multiples.

- Consensus highlights that strategic acquisitions and better cash management are giving EQT more room for opportunistic capital allocation.

Valuation Stands Out Versus Peers

- EQT’s price-to-earnings ratio of 18.7x is higher than the US oil and gas industry average of 12.9x but much lower than the peer average of 37.2x. Shares trade at $53.49, representing a steep discount to a DCF fair value estimate of $112.02 and below the analyst target of $63.55.

- Analysts' consensus view frames EQT as attractively positioned for good value based on multiple valuation metrics, while also noting some disagreement in future price targets among analysts.

- The present discount may reflect uncertainties about long-term natural gas demand and regulatory risks. Improving fundamentals could narrow the valuation gap if growth targets are met.

- Consensus stresses that to justify the price target, investors have to believe in rising earnings to $3.8 billion and sustained growth rates through 2028.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for EQT on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on EQT’s numbers? You can quickly shape your own story and share your insight. It only takes a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EQT.

See What Else Is Out There

While EQT’s valuation is attractive, its long-term performance depends on continued earnings growth and on addressing concerns about sustained natural gas demand and debt levels.

If you want to put capital to work in companies with stronger financial foundations and less debt risk, check out solid balance sheet and fundamentals stocks screener (1980 results) that are built to withstand uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQT

EQT

Engages in the production, gathering, and transmission of natural gas.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives