- United States

- /

- Oil and Gas

- /

- NYSE:EPD

Does Enterprise Products Partners Still Offer Value After Its Strong Multi Year Rally?

Reviewed by Bailey Pemberton

- If you are wondering whether Enterprise Products Partners is still a buy after its long run, you are not alone; this is exactly the kind of business where valuation really matters.

- Even after an impressive 118.4% gain over five years and 69.4% over three years, the units are up a more modest 6.4% over the last year and 6.3% in the past month, while slipping just 0.4% in the last week, a pattern that often signals investors are reassessing the risk reward trade off.

- Recent headlines have focused on Enterprise Products Partners expanding its midstream infrastructure footprint and signing new long term volume commitments, moves that tend to underpin cash flow visibility and support distributions. At the same time, broader market chatter around energy security and US export capacity has kept high quality pipeline operators like Enterprise Products Partners firmly on income investors radar.

- On our framework the partnership scores a strong 5 out of 6 on valuation, suggesting it screens as undervalued across most of the key checks we run. Next we will unpack how different valuation methods back that up, before finishing with a more holistic way to decide what the units are really worth.

Approach 1: Enterprise Products Partners Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in $ terms.

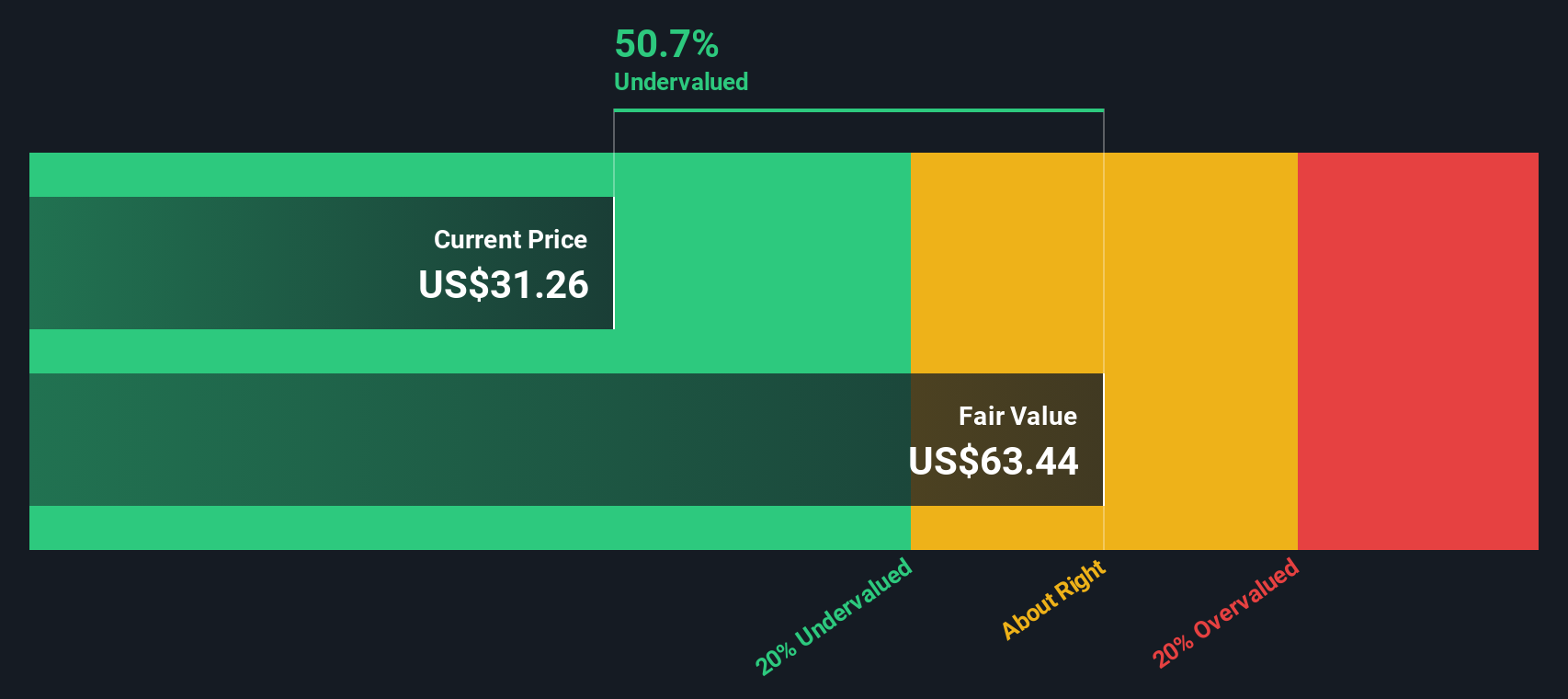

For Enterprise Products Partners, the latest twelve month free cash flow is about $4.2 billion. Analysts and our extrapolations see this rising to roughly $6.9 billion by 2029, using a 2 Stage Free Cash Flow to Equity model that extends those projections over the coming decade. Each of those future cash flows is discounted back to its present value to account for risk and the time value of money.

Adding those discounted values together gives an estimated intrinsic value of about $66.14 per unit. Compared with the current market price, the DCF suggests the units are trading at roughly a 50.7% discount to their calculated fair value, based on the cash flow forecasts used in this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Enterprise Products Partners is undervalued by 50.7%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Enterprise Products Partners Price vs Earnings

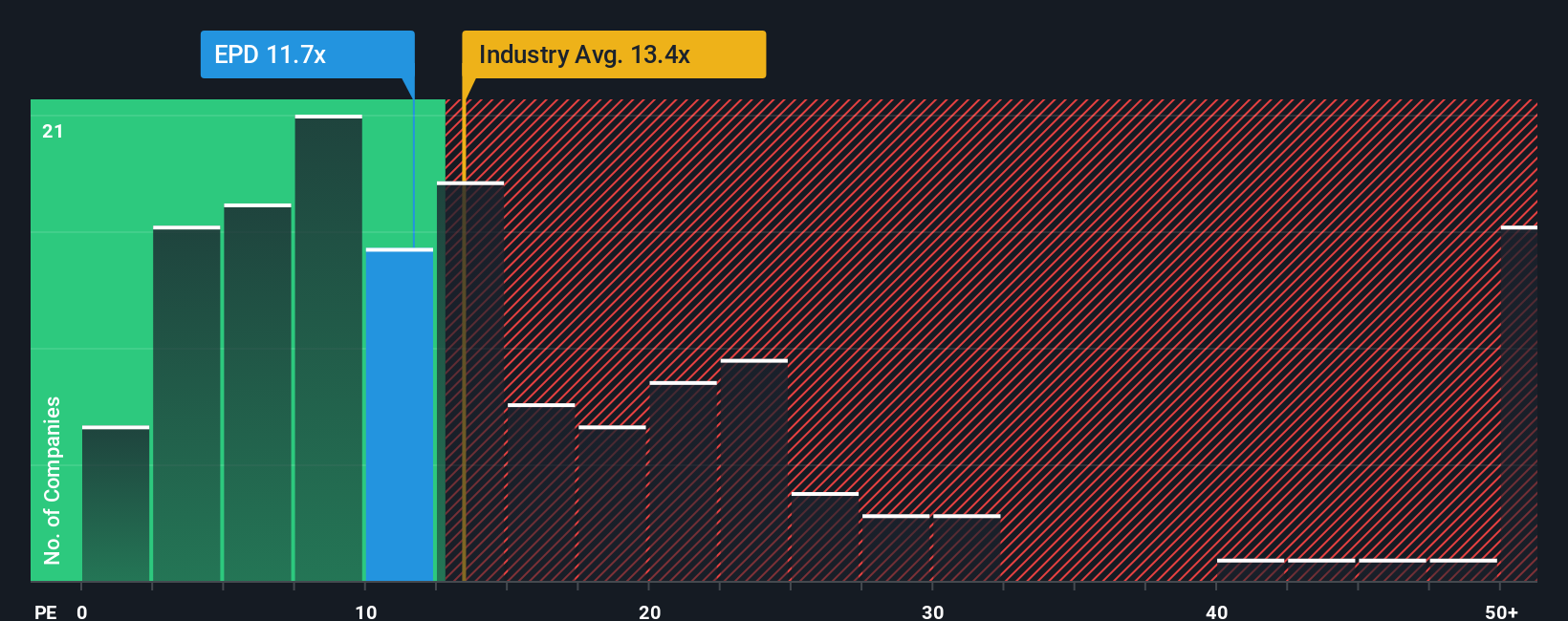

For a consistently profitable business like Enterprise Products Partners, the price to earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. In general, companies with stronger growth prospects and lower perceived risk tend to justify a higher PE, while slower growth or higher risk usually means a lower, more conservative multiple is appropriate.

Enterprise Products Partners currently trades on a PE of about 12.3x. That sits slightly below the broader Oil and Gas industry average of roughly 13.8x, and at a clear discount to the peer group average of around 20.1x, suggesting the market is applying a relatively cautious earnings multiple. To refine that view, Simply Wall St calculates a proprietary Fair Ratio of 21.1x for Enterprise Products Partners, which estimates the PE the company might reasonably command given its earnings growth profile, margins, industry, market cap and specific risk factors. This Fair Ratio is more tailored than a simple comparison with peers or the industry, because it adjusts for the company’s own fundamentals rather than assuming all operators deserve the same multiple. Set against Enterprise Products Partners actual 12.3x PE, the 21.1x Fair Ratio points to the units screening as undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

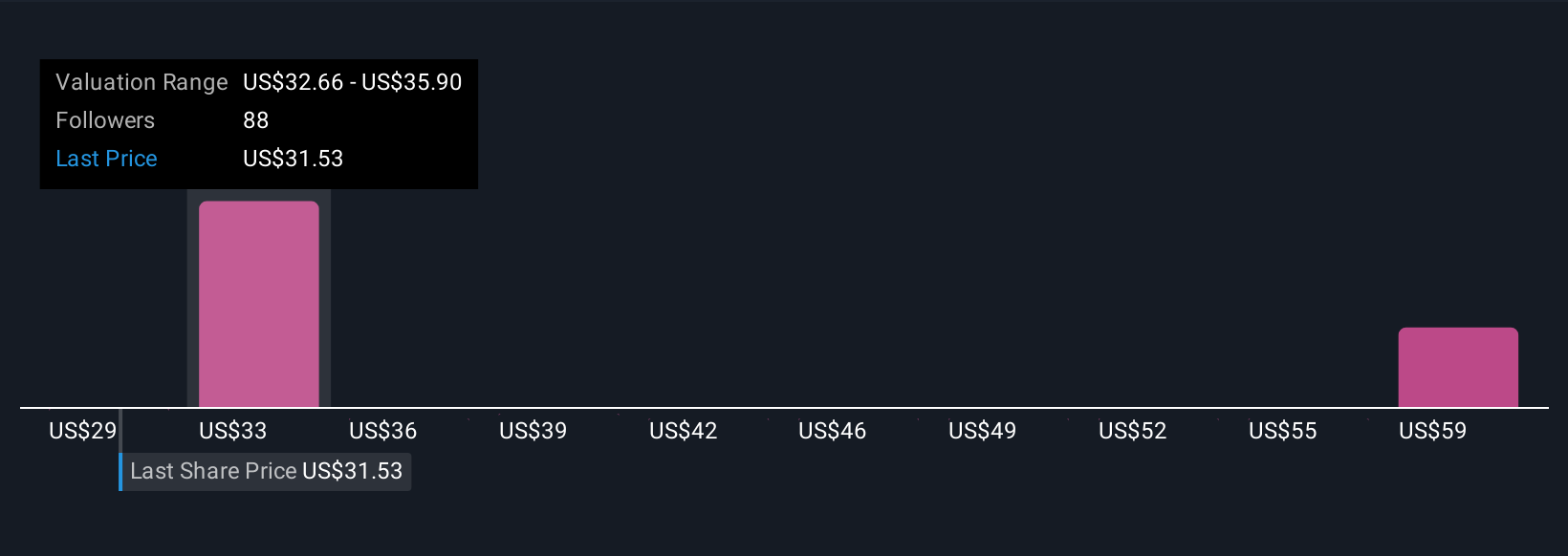

Upgrade Your Decision Making: Choose your Enterprise Products Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to connect your view of Enterprise Products Partners with the numbers by turning your assumptions about its future revenue, earnings and margins into a financial forecast that leads to a fair value. All of this happens inside the Narratives tool on Simply Wall St’s Community page, where millions of investors share their perspectives and track how their fair value compares to the current market price to inform their own decisions. The platform automatically updates each Narrative as new news or earnings are released. For Enterprise Products Partners, you might see one investor build a bullish Narrative around expanding Permian and export infrastructure that supports a higher fair value closer to the most optimistic analyst target of about $40 per unit. Another investor might create a more cautious Narrative that focuses on leverage, commodity headwinds and tariff risks and therefore anchors closer to the most conservative target near $32. Together, these examples can provide a clear, story-driven range to judge your own decision against.

Do you think there's more to the story for Enterprise Products Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Products Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPD

Enterprise Products Partners

Provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026