- United States

- /

- Oil and Gas

- /

- NYSE:EE

Excelerate Energy (EE): Evaluating Valuation Following Steady Growth and Fresh Investor Attention

Reviewed by Kshitija Bhandaru

Excelerate Energy (EE) has made some quiet moves lately, and the stock is catching fresh attention as investors track its recent performance and strong annual growth. The company’s fundamentals, especially revenue and net income growth, indicate a story worth watching.

See our latest analysis for Excelerate Energy.

Excelerate Energy’s share price has seen limited movement recently, but the bigger story is its steady one-year total shareholder return of 13%. This suggests that investors remain optimistic about its growth outlook. With momentum gradually building, the stock’s performance indicates that market confidence is holding up as the company executes on its long-term strategy.

If you’re interested in new opportunities beyond the energy sector, this could be a timely moment to broaden your search and uncover fast growing stocks with high insider ownership

Given solid fundamentals and stable recent returns, is Excelerate Energy trading at a discount, or has the market already priced in the company’s growth? Is there genuine upside left for new investors to capture?

Most Popular Narrative: 22% Undervalued

With Excelerate Energy’s last close at $25.88 and the popular narrative setting fair value near $33.18, projections point to significant upside potential based on future growth momentum.

Ongoing investments in flexible infrastructure, such as new FSRUs, LNG carrier acquisitions, and asset conversions, enable Excelerate to capture further market share as global LNG import demand grows. As countries accelerate plans to replace coal and oil with natural gas, this also strengthens long-term revenue potential.

Want to know what is powering this bullish scenario? The narrative’s foundation is fast-growing earnings, bigger margins, and a future profit multiple normally reserved for the hottest growth stocks. Intrigued by the bold projections and hidden catalysts raising this fair value? Click through to see the precise numbers that put Excelerate in the spotlight.

Result: Fair Value of $33.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as shifting global decarbonization policies and mounting competition in LNG could quickly dampen the optimistic outlook for Excelerate Energy.

Find out about the key risks to this Excelerate Energy narrative.

Another View: Multiples Tell a Different Story

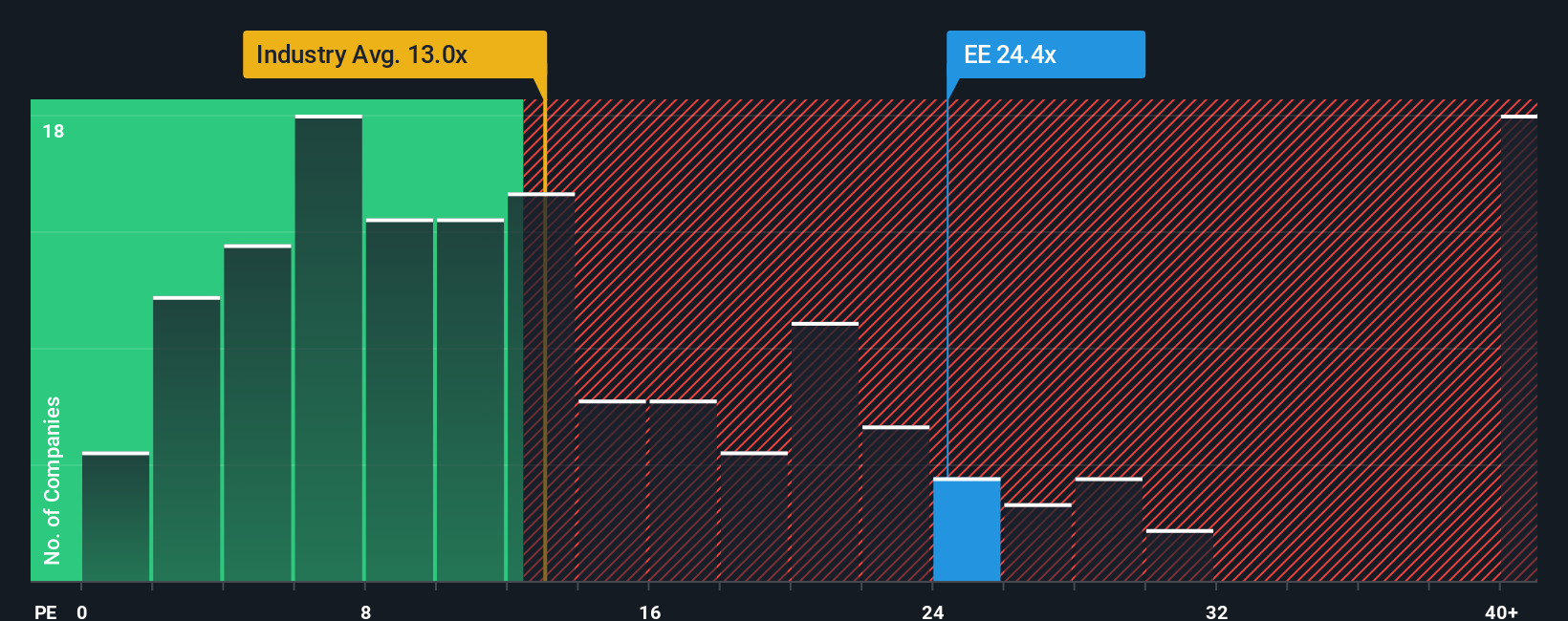

While analysts see Excelerate Energy as undervalued based on future growth and price targets, its current price-to-earnings ratio stands at 23x, which is much higher than both the industry average (13.1x) and its “fair ratio” of 18.1x. This means the stock trades at a premium, hinting that the market might already be pricing in a lot of optimism. Is there really more value left to unlock, or have expectations run ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Excelerate Energy Narrative

If you see things differently or want a personalized angle on Excelerate Energy, you can easily dig into the numbers and build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Excelerate Energy.

Looking for more investment ideas?

Make your next move count. Don’t let great opportunities slip away while others get ahead. The right stock could be just one screen away.

- Uncover fresh high-yield opportunities by targeting these 19 dividend stocks with yields > 3% that consistently deliver strong income potential for your portfolio.

- Spot early-stage innovators shaking up the markets with these 3561 penny stocks with strong financials focused on rapid growth and unique business models.

- Tap into the surge of next-generation healthcare breakthroughs by seeking out these 31 healthcare AI stocks transforming medical technology and outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Excelerate Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EE

Excelerate Energy

Provides liquefied natural gas (LNG) solutions worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives