- United States

- /

- Oil and Gas

- /

- NYSE:EE

Does Excelerate Energy's Recent Price Drop Signal a New Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Thinking of adding Excelerate Energy to your portfolio, but not sure if the price tag is fair? Let's break down whether this stock offers good value or not.

- Even though the share price is up 4.8% in the last year, it is down almost 19% year-to-date. This suggests a mix of optimism and caution among investors.

- Some of this recent volatility has been influenced by headlines about global energy supply shifts and updates on liquefied natural gas (LNG) infrastructure. These factors have put Excelerate Energy in the spotlight for those watching macro trends. For example, market commentary has focused on the company's strategic expansion plans as well as its response to changing demand in the LNG market.

- When it comes to valuation, Excelerate Energy scores 3 out of 6 based on our undervaluation checks. In this article, we will explain what that means, how valuation is measured, and suggest a smarter way to interpret whether this stock is truly undervalued, so you can cut through the noise with confidence.

Approach 1: Excelerate Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This provides a snapshot of what those future earnings are worth in today's dollars, offering a grounded perspective on what investors should be willing to pay.

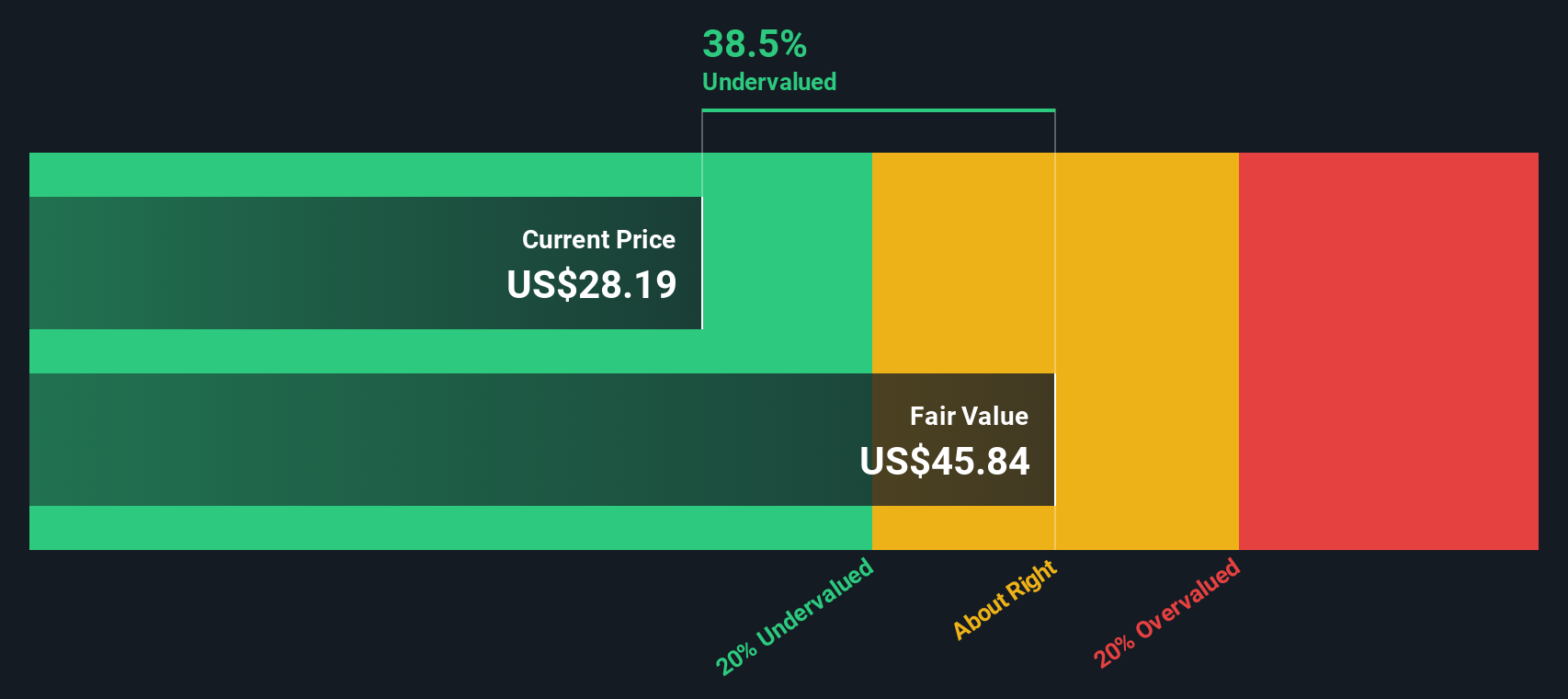

For Excelerate Energy, the DCF analysis uses a 2 Stage Free Cash Flow to Equity model. The company’s current Free Cash Flow stands at $179.97 million. Analysts expect steady growth, with estimates reaching $280.2 million by the end of 2029. While direct analyst projections reach five years out, additional years are extrapolated based on trend and industry context to give a more comprehensive long-term outlook.

This model calculates Excelerate Energy’s estimated fair value at $45.60 per share. Compared to the present market price, the DCF implies the stock is trading at a substantial 43.9% discount to its intrinsic value. This suggests a compelling opportunity for investors who prioritize long-term fundamentals over short-term market swings.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Excelerate Energy is undervalued by 43.9%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Excelerate Energy Price vs Earnings

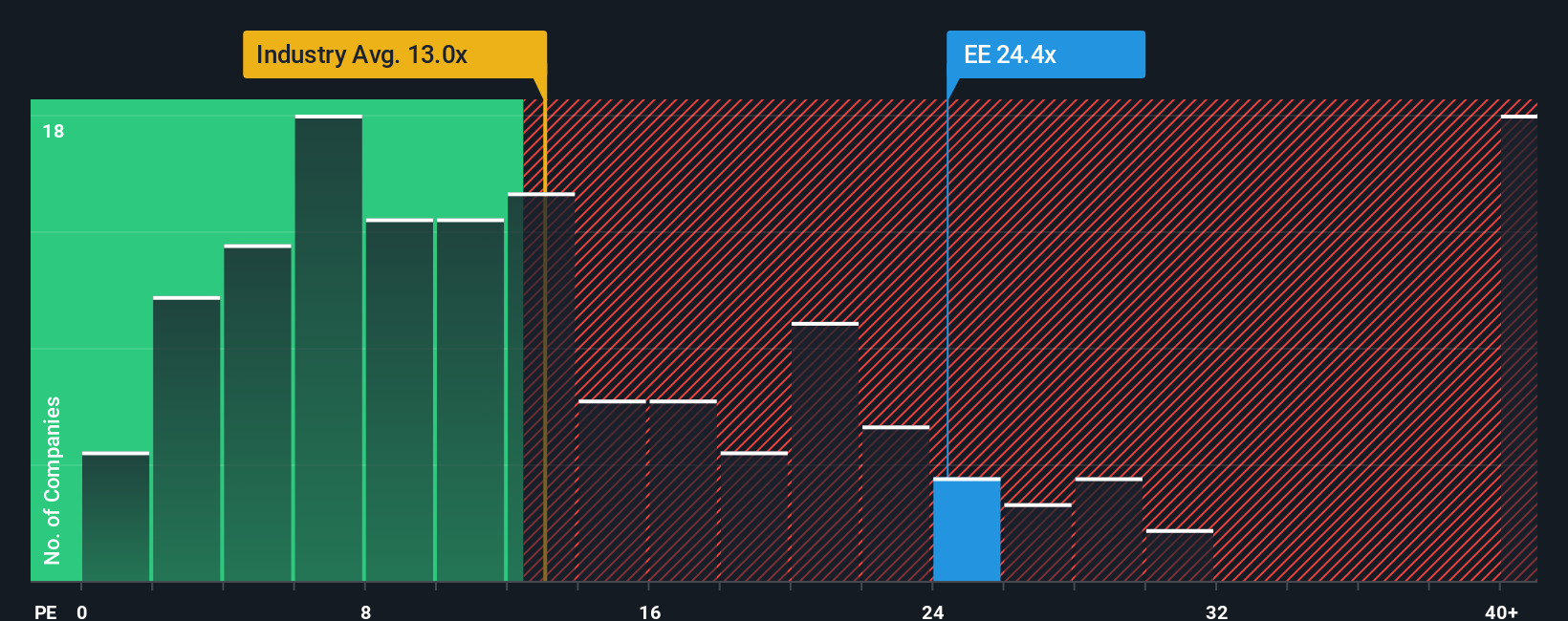

For profitable companies like Excelerate Energy, the Price-to-Earnings (PE) ratio is a reliable yardstick for valuation. This metric shows how much investors are willing to pay today for a dollar of the company’s earnings, making it a quick way to compare value across similar businesses.

The "right" PE ratio isn’t universal, as it shifts depending on the company’s expected growth rate and perceived risks. Fast-growing or lower-risk companies tend to command higher PE ratios. Slower-growing or riskier stocks usually trade at a lower PE.

Excelerate Energy currently trades on a PE ratio of 22.8x, which stands well above both the Oil and Gas industry average of 12.7x and its peer group’s average of 10.6x. At first glance, this premium might cause concern. However, context is key.

That is where Simply Wall St’s proprietary "Fair Ratio" comes in. This fair PE ratio, calculated as 18.6x for Excelerate Energy, incorporates not just industry and peer benchmarks but also factors such as earnings growth, profit margin, company size, and specific risks. By analyzing these deeper attributes, the Fair Ratio offers a more holistic view than basic comparisons to industry or peers.

Comparing Excelerate Energy’s actual PE of 22.8x to its Fair Ratio of 18.6x suggests that the stock is somewhat overvalued relative to its underlying characteristics, even after accounting for its above-average growth and profitability.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Excelerate Energy Narrative

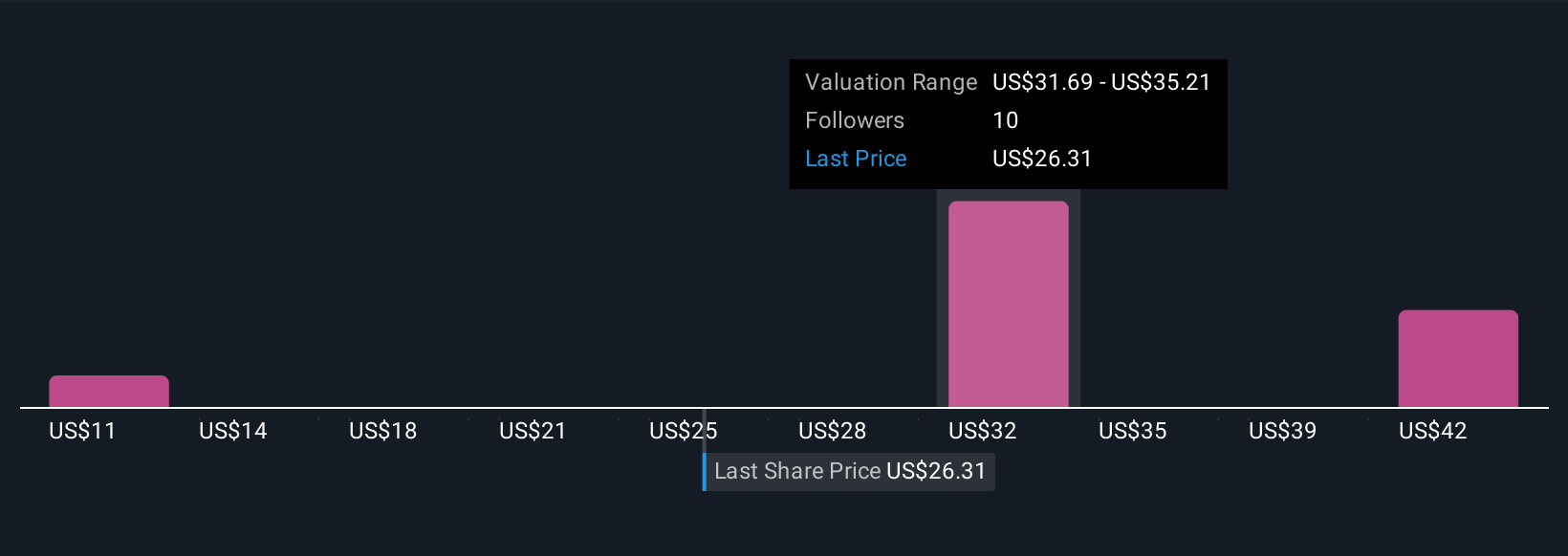

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story, the perspective you bring to the table about Excelerate Energy's future, translated into numbers like assumed fair value, revenue growth, and profit margins.

Narratives allow you to connect the dots between what you believe about the company's strategy, industry shifts, or key risks and a clear financial forecast. Ultimately, this shows what you think the stock is truly worth. Available right on Simply Wall St’s Community page and used by millions of investors, Narratives make it easy for anyone to create, view, and share their outlook without needing to build a spreadsheet from scratch.

By comparing the fair value in your Narrative to today’s market price, you can decide if now is the time to buy or sell, with the added confidence that your thesis automatically stays up to date whenever big news or earnings are released. For example, some investors see Excelerate Energy’s Caribbean LNG expansion as unlocking huge future value (price target: $43.00), while others focus on risks from tighter regulation and competition (price target: $26.00). With Narratives, you can choose the story that best reflects your own view.

Do you think there's more to the story for Excelerate Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Excelerate Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EE

Excelerate Energy

Provides liquefied natural gas (LNG) solutions worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion