- United States

- /

- Oil and Gas

- /

- NYSE:DVN

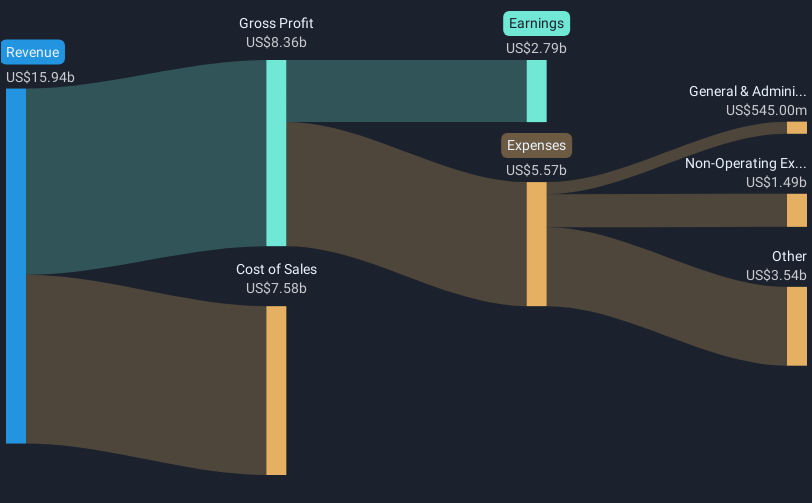

Devon Energy (NYSE:DVN) Reports Q1 Revenue Growth But Net Income Falls to US$494M

Reviewed by Simply Wall St

In the first quarter of 2025, Devon Energy (NYSE:DVN) experienced a notable revenue increase, reaching USD 4,452 million, though net income declined to USD 494 million. In the past month, the company's share price moved by 4%, a change that aligns with mixed market activity where the Dow and S&P 500 saw modest gains while Nasdaq slipped slightly. The company's revenue growth could have amplified market optimism, yet the drop in net income may have balanced investor expectations, maintaining the share price movement alongside broader market trends amidst ongoing trade discussions and the anticipated Federal Reserve interest rate decision.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent revenue increase reported by Devon Energy ostensibly reflects the company's efforts to improve operational efficiencies following the dissolution of its joint venture with BPX. While this move holds promise for cost savings, it remains counterbalanced by the decline in net income, highlighting potential operational challenges ahead. Investors might weigh the new operational landscape in their expectations for the company's future revenue and earnings, particularly as strategic adjustments unfold in areas like the Delaware Basin.

Over a five-year period, Devon Energy's total shareholder return, including dividends, reached 229.14%, demonstrating a very large overall growth. However, in the past year, Devon underperformed relative to both the US Oil and Gas industry, which declined by 10.2%, and the broader US market, which rose by 7.2%. This contrast underscores the need for investors to consider both long-term growth and recent market challenges.

In light of the reported price target, Devon Energy's current share price of US$31.3 represents a 29.3% discount to the analyst consensus price target of US$44.27. This discount could suggest investor caution due to the recent earnings decline and lack of consensus about future growth prospects. The company's revenue and earnings forecasts form a crucial part of the price target estimation, showing a delicate balance between expected operational improvements and existing fiscal challenges.

Click to explore a detailed breakdown of our findings in Devon Energy's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Devon Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVN

Devon Energy

An independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives