- United States

- /

- Oil and Gas

- /

- NYSE:DTM

What DT Midstream (DTM)'s Upgraded 2025 Cash Flow Outlook Means for Shareholders

Reviewed by Sasha Jovanovic

- DT Midstream recently lifted its distributable cash flow guidance for 2025 following in-line third-quarter earnings, attributing stronger projections to lower maintenance costs, reduced interest expenses, and lighter cash taxes.

- The company also reaffirmed its intention to grow its dividend by 5% to 7% annually, maintaining a steady payout and signaling ongoing confidence in future cash flows.

- We’ll consider how the improved distributable cash flow outlook strengthens DT Midstream’s investment case and future growth narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

DT Midstream Investment Narrative Recap

For someone considering DT Midstream, it often comes down to believing in the continued need for natural gas infrastructure, especially as US LNG exports grow and power demand rises across the Midwest and Northeast. The recent lift in distributable cash flow guidance following lower maintenance and interest costs brings some short-term support, but does not fully address the significant long-term risk tied to the company’s sizable capital spending and potential for future underutilized assets if decarbonization efforts accelerate. Among recent developments, the expansion of the Guardian Pipeline is especially relevant. This expansion aligns with expectations for strong pipeline utilization, and if ongoing demand for natural gas remains robust, it has potential to serve as a key catalyst supporting the company’s growth outlook. Yet, contrasted with this positive momentum, investors should also recognize the risk if pipeline investments become stranded assets due to shifting energy markets...

Read the full narrative on DT Midstream (it's free!)

DT Midstream's outlook anticipates $1.6 billion in revenue and $606.6 million in earnings by 2028. This scenario assumes a 12.0% annual revenue growth rate and a $230.6 million increase in earnings from the current level of $376.0 million.

Uncover how DT Midstream's forecasts yield a $120.23 fair value, in line with its current price.

Exploring Other Perspectives

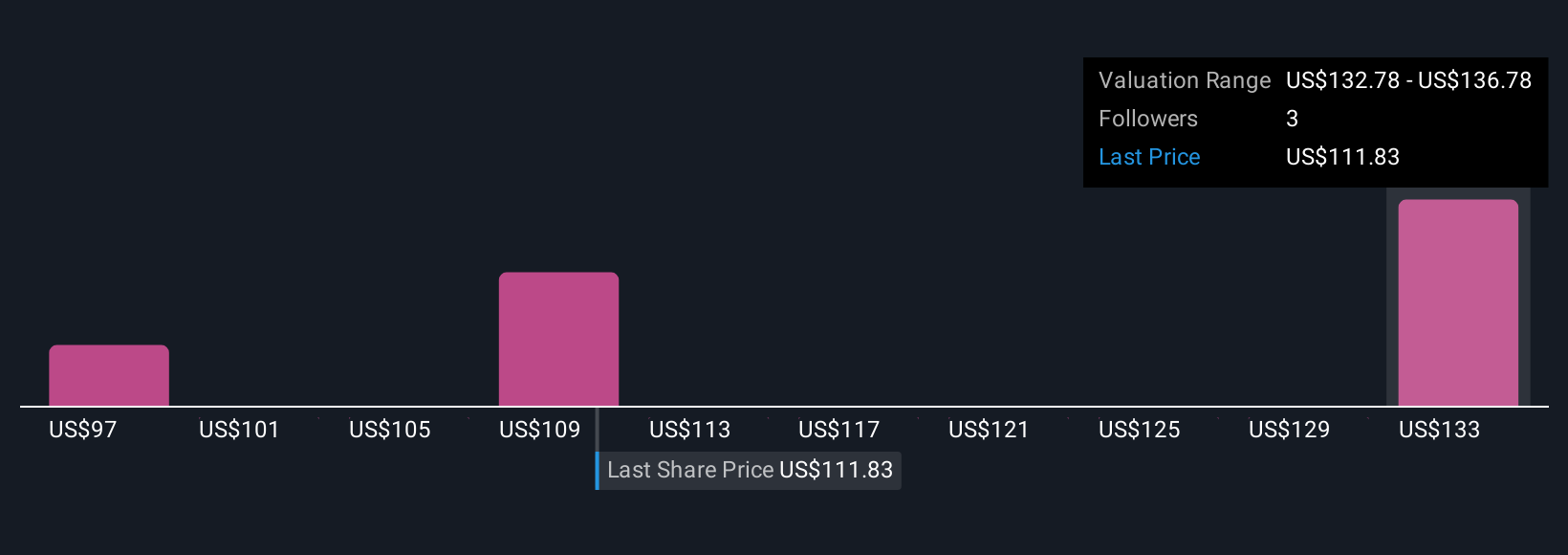

Fair value estimates from three Simply Wall St Community members range from US$42.93 to US$120.23 per share. With substantial capital deployed for modernization and expansion, you may want to consider how changing industry trends could affect asset utilization and cash generation over time.

Explore 3 other fair value estimates on DT Midstream - why the stock might be worth as much as $120.23!

Build Your Own DT Midstream Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DT Midstream research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DT Midstream research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DT Midstream's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTM

DT Midstream

Provides integrated natural gas services in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026