- United States

- /

- Oil and Gas

- /

- NYSE:DTM

The Bull Case For DT Midstream (DTM) Could Change Following Major Guardian Pipeline Expansion Approval – Learn Why

Reviewed by Sasha Jovanovic

- DT Midstream announced it has closed a successful binding open season to award expansion capacity on the Guardian Pipeline in the past week, allocating 328,103 Dth per day to five shippers and targeting an in-service date of November 1, 2028.

- The combined new and previously awarded expansion capacity now totals 536,903 Dth per day, an approximately 40% increase over the pipeline’s current capacity, underscoring rising demand for natural gas transport in Wisconsin and the Upper Midwest.

- We'll explore how this substantial Guardian Pipeline capacity increase influences DT Midstream's long-term revenue visibility and business outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

DT Midstream Investment Narrative Recap

Investing in DT Midstream means believing in the long-term need for reliable natural gas infrastructure, underpinned by growing power and data center demand in its core regions. The Guardian Pipeline expansion signals management’s commitment to securing future cash flows, but as construction won’t conclude until late 2028, it’s unlikely to change the near-term earnings catalysts. However, the expansion does heighten the company’s exposure to infrastructure utilization risks if regional demand shifts or decarbonization accelerates unexpectedly.

Among recent developments, DT Midstream’s appointment of Joseph P. Finland as Chief Accounting Officer stands out as a move to strengthen leadership as the company invests heavily in pipeline expansion. Robust financial controls will be especially important as the Guardian project increases capital commitments and may amplify risks tied to asset utilization, underlining why investors are closely watching both project execution and emerging regulatory trends.

Yet, in contrast, investors should be aware that the substantial capital now committed to Guardian sets the stage for potential stranded asset risk if demand projections don’t materialize...

Read the full narrative on DT Midstream (it's free!)

DT Midstream's outlook anticipates $1.6 billion in revenue and $606.6 million in earnings by 2028. Achieving this will require a 12.0% annual revenue growth rate and an earnings increase of $230.6 million from the current $376.0 million.

Uncover how DT Midstream's forecasts yield a $111.46 fair value, a 3% downside to its current price.

Exploring Other Perspectives

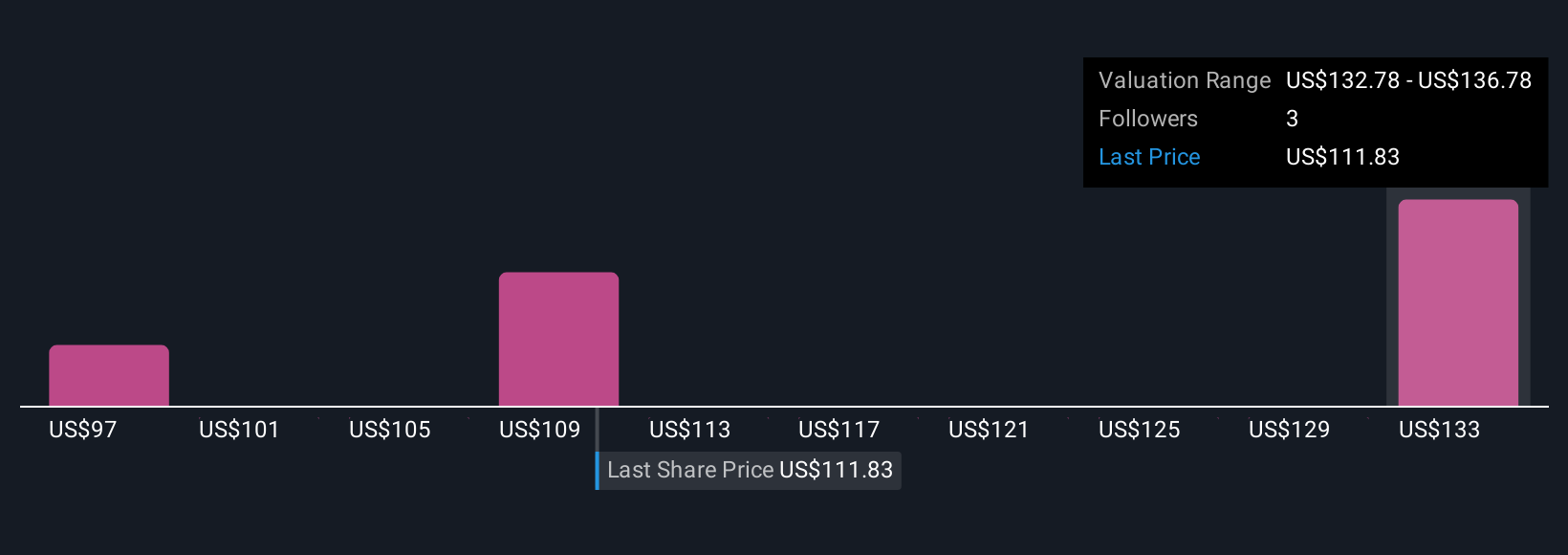

Simply Wall St Community fair value estimates for DT Midstream (US$96.75 to US$137.50, 3 contributors) reflect wide opinion on what the stock is worth. Against this backdrop, future utilization rates for expanded assets could play a significant role in defining DT Midstream’s financial trajectory, explore these perspectives to weigh different expectations for long-term returns.

Explore 3 other fair value estimates on DT Midstream - why the stock might be worth 15% less than the current price!

Build Your Own DT Midstream Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DT Midstream research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DT Midstream research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DT Midstream's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTM

DT Midstream

Provides integrated natural gas services in the United States.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives