- United States

- /

- Oil and Gas

- /

- NYSE:DTM

DT Midstream (DTM): Assessing Valuation After Guardian Pipeline Expansion Secures 40% Capacity Growth

Reviewed by Kshitija Bhandaru

DT Midstream has announced the successful closing of a binding open season for its Guardian Pipeline, awarding new expansion capacity to five shippers. This move increases Guardian’s throughput by 40%, highlighting heightened demand and future growth opportunities.

See our latest analysis for DT Midstream.

DT Midstream’s recent pipeline expansion arrives as momentum continues to build around the stock. After presenting at a major industry conference, the company notched a 1-year total shareholder return of 31.6% and an impressive 134% over three years. This hints at sustained growth and improving investor sentiment.

If large infrastructure moves like this have you curious about what else is happening across the sector, it’s a great moment to explore opportunities using our fast growing stocks with high insider ownership.

With these expansion wins and strong momentum in the stock, the key question is whether DT Midstream remains undervalued by the market or if the recent surge has already factored in all the future growth potential, leaving little room for upside.

Most Popular Narrative: 1.8% Undervalued

With DT Midstream’s fair value now estimated at $111.46 per share, just above the last close of $109.5, the narrative points to a slight gap. This prompts investors to consider what factors might drive continued upside potential.

“Strategic focus on long-term, fee-based contracts with investment-grade counterparties (e.g., 20-year Guardian expansion anchor) reduces earnings volatility and enhances net profit margins, supporting visible, durable cash flow and dividend increases. Modernization and expansion programs not only drive incremental regulated rate base and EBITDA growth, but also position assets as more resilient and reliable amid rising energy security focus, reducing maintenance capex relative to revenue and enhancing long-term net margins.”

Curious about the calculus behind that near-fair value result? The core of this narrative lies in strong margin expansion and the promise of reliable, growing cash flows. Want to see which future financial shifts the market is betting on? Unlock the full story and dig into the numbers driving this valuation.

Result: Fair Value of $111.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, execution risks such as higher capital costs or regulatory hurdles could dampen expansion benefits and shift the narrative if not carefully managed.

Find out about the key risks to this DT Midstream narrative.

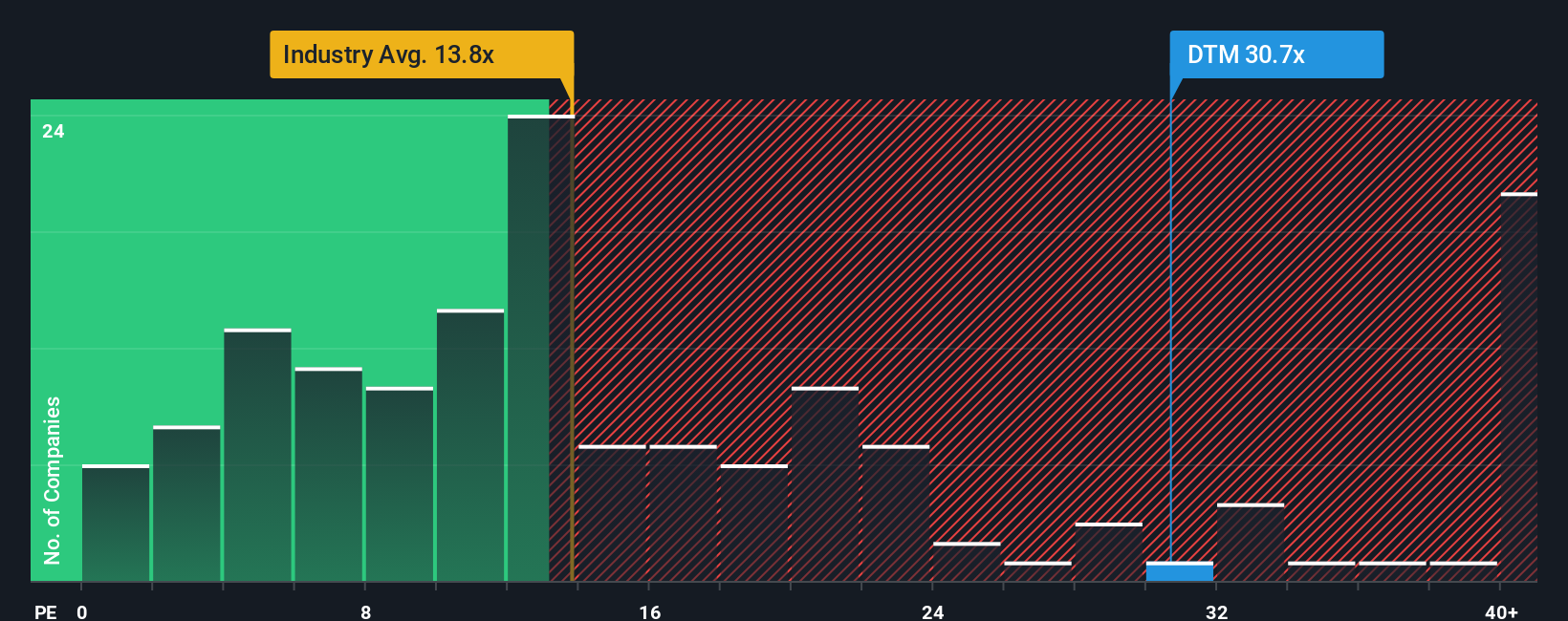

Another View: Market Multiples Reveal Sticker Shock

While the fair value approach suggests DT Midstream may be slightly undervalued, a look at current market ratios paints a more cautious picture. DT Midstream’s price-to-earnings ratio sits at 29.6x, which is more than double the US Oil and Gas industry average of 13.2x and well above peers at 17.3x. Notably, this is also much higher than its fair ratio of 18.7x, implying that the shares are pricing in substantial growth or a premium. Is the market overestimating the company’s prospects, or could quality justify a loftier valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DT Midstream Narrative

If you see things differently or want to dive into the data yourself, it’s easy to shape your own DT Midstream story and analysis in just a few minutes. Do it your way.

A great starting point for your DT Midstream research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why stop with DT Midstream? Take the fast track to top-performing stocks with unique advantages you could be missing if you only follow the headlines.

- Capture high yields and secure steady returns by tapping into these 19 dividend stocks with yields > 3% that offer attractive payouts and proven financial strength.

- Ride the AI wave by targeting innovation leaders among these 24 AI penny stocks who are reshaping industries with artificial intelligence breakthroughs.

- Uncover untapped value and grow your portfolio with these 893 undervalued stocks based on cash flows that are built on robust cash flows and market potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTM

DT Midstream

Provides integrated natural gas services in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026