- United States

- /

- Oil and Gas

- /

- NYSE:DKL

How a Zacks Rank Upgrade Could Shape Delek Logistics Partners’ (DKL) Investment Narrative

Reviewed by Sasha Jovanovic

- Recently, Delek Logistics Partners, L.P. was upgraded to a Zacks Rank #2 (Buy), reflecting an improved outlook as analysts have raised earnings estimates steadily over the past three months.

- This upgrade highlights growing analyst confidence in Delek Logistics' financial prospects, linked to rising earnings expectations and positive sentiment among market observers.

- We'll explore how this analyst-fueled confidence may influence Delek Logistics Partners' investment narrative and growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Delek Logistics Partners Investment Narrative Recap

To be a shareholder in Delek Logistics Partners right now, you need to believe in the ongoing demand for domestic energy infrastructure and the company's ability to generate stable cash flows in the Permian Basin, even as broader energy transition themes play out. The recent Zacks Rank #2 upgrade points to improving analyst sentiment, but does not materially diminish the company’s biggest short-term risk: elevated leverage from recent high-yield debt offerings, especially if future cash flow growth falls short of projections.

Among recent company updates, the upsized US$700 million senior notes offering stands out as most relevant. This significant increase in available capital supports investment and expansion initiatives, which could be a key growth catalyst if the company succeeds in driving higher asset utilization and cash flow, potentially offsetting concerns around leverage and interest coverage.

However, despite this optimism, investors should also consider that if distributable cash flow growth slows, the risk of financial flexibility constraints from high-yield debt...

Read the full narrative on Delek Logistics Partners (it's free!)

Delek Logistics Partners' outlook anticipates $1.1 billion in revenue and $289.6 million in earnings by 2028. This is based on a 6.1% annual revenue growth rate and a $137.8 million increase in earnings from the current $151.8 million.

Uncover how Delek Logistics Partners' forecasts yield a $43.75 fair value, in line with its current price.

Exploring Other Perspectives

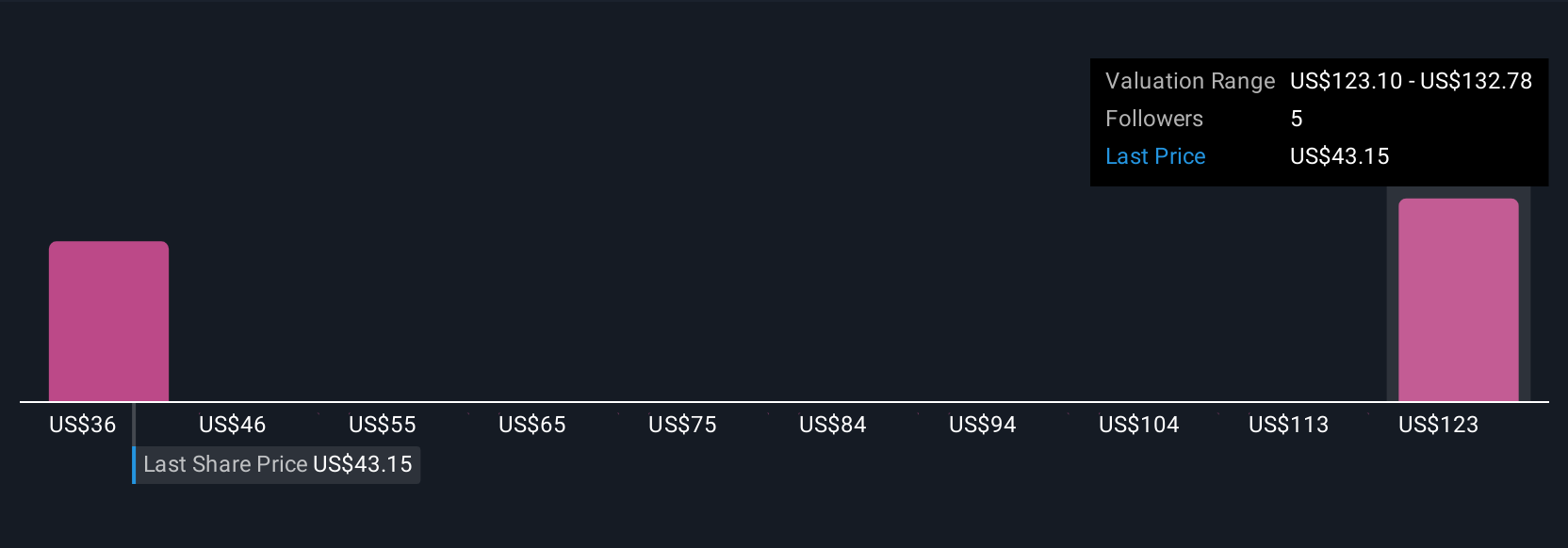

Three members of the Simply Wall St Community place Delek Logistics Partners’ fair value estimates in a wide range spanning US$36 to US$136.75. While community outlooks differ significantly, the ongoing need for robust cash flow to cover new debt costs could shape performance in the months ahead, prompting you to explore several alternative viewpoints.

Explore 3 other fair value estimates on Delek Logistics Partners - why the stock might be worth 20% less than the current price!

Build Your Own Delek Logistics Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delek Logistics Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Delek Logistics Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delek Logistics Partners' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKL

Delek Logistics Partners

Provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, terminalling water disposal and recycling customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives