- United States

- /

- Oil and Gas

- /

- NYSE:DKL

Does Delek Logistics Partners’ Recent Stock Performance Signal More Growth Ahead in 2025?

Reviewed by Bailey Pemberton

If you have been eyeing Delek Logistics Partners lately, you are not alone. With shares closing at $44.78 and climbing a hefty 143% over the last five years, DKL is a name that has rewarded long-term holders. Even zooming in on the past 12 months, the stock is up 10.9%, and so far this year, it shows a solid 6.4% gain, hinting at some real momentum in the energy logistics space. While the most recent 7-day dip of -0.5% might raise an eyebrow, the broader context reveals a stock that tends to shrug off short-term noise and march to its own beat.

This kind of price action often gets people asking whether the growth is based on real improvements or shifting investor appetites, especially as broader market dynamics put a spotlight on energy infrastructure plays. In the case of Delek Logistics Partners, recent performance seems to reflect a mix of optimism about long-term demand and changing perceptions about risks and opportunities in the sector. It is exactly the type of stock where understanding valuation—how much you are paying for those prospects—matters more than ever.

So where does DKL stand in terms of value? According to our composite valuation score, which adds a point for each of six major undervaluation checks passed, Delek Logistics Partners clocks in at 3 out of 6. That means it is undervalued in half of the key methods most investors care about, but there are also areas where it does not shine as brightly. Up next, let us break down those valuation approaches. Stick around, because there might just be a more insightful way to judge DKL's true worth by the end of our review.

Approach 1: Delek Logistics Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the present value of a company by forecasting its future cash flows and discounting them back to today's dollars. For Delek Logistics Partners, this approach takes current and projected Free Cash Flows (FCF) and calculates what those streams are worth right now.

Delek Logistics Partners generated $56.5 million in Free Cash Flow over the last twelve months, and analysts expect this figure to grow substantially over the coming decade. Projections show FCF reaching $300.3 million by 2027, with further estimates, extrapolated by Simply Wall St, taking that number up to $508.8 million by 2035.

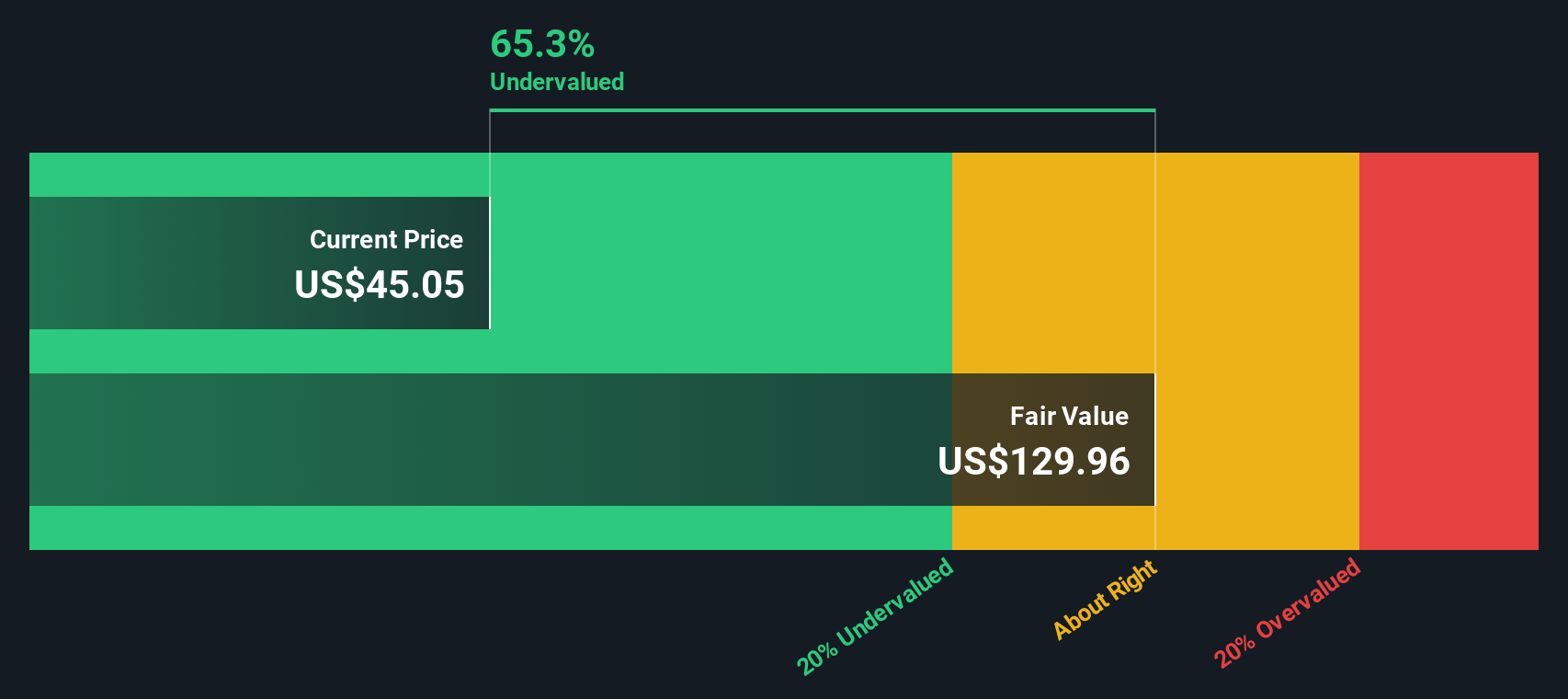

Using these projections, the DCF analysis sets Delek Logistics Partners' intrinsic value at $136.66 per share. Compared to its recent share price of $44.78, this implies that the stock is approximately 67.2% undervalued by this model.

In summary, if you trust these cash flow forecasts, Delek Logistics Partners appears to be a significant bargain at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Delek Logistics Partners is undervalued by 67.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Delek Logistics Partners Price vs Earnings

The Price-to-Earnings (PE) ratio is the preferred valuation tool for assessing established, profitable companies like Delek Logistics Partners. This metric helps investors gauge how much they are paying for each dollar of earnings, making it particularly useful when profits are stable and recurring.

Growth expectations and perceived risk play a big role in defining what a “normal” or “fair” PE ratio should be. Higher growth companies or those with greater resilience often deserve higher PE ratios, while riskier or slower-growing peers tend to trade at lower ones.

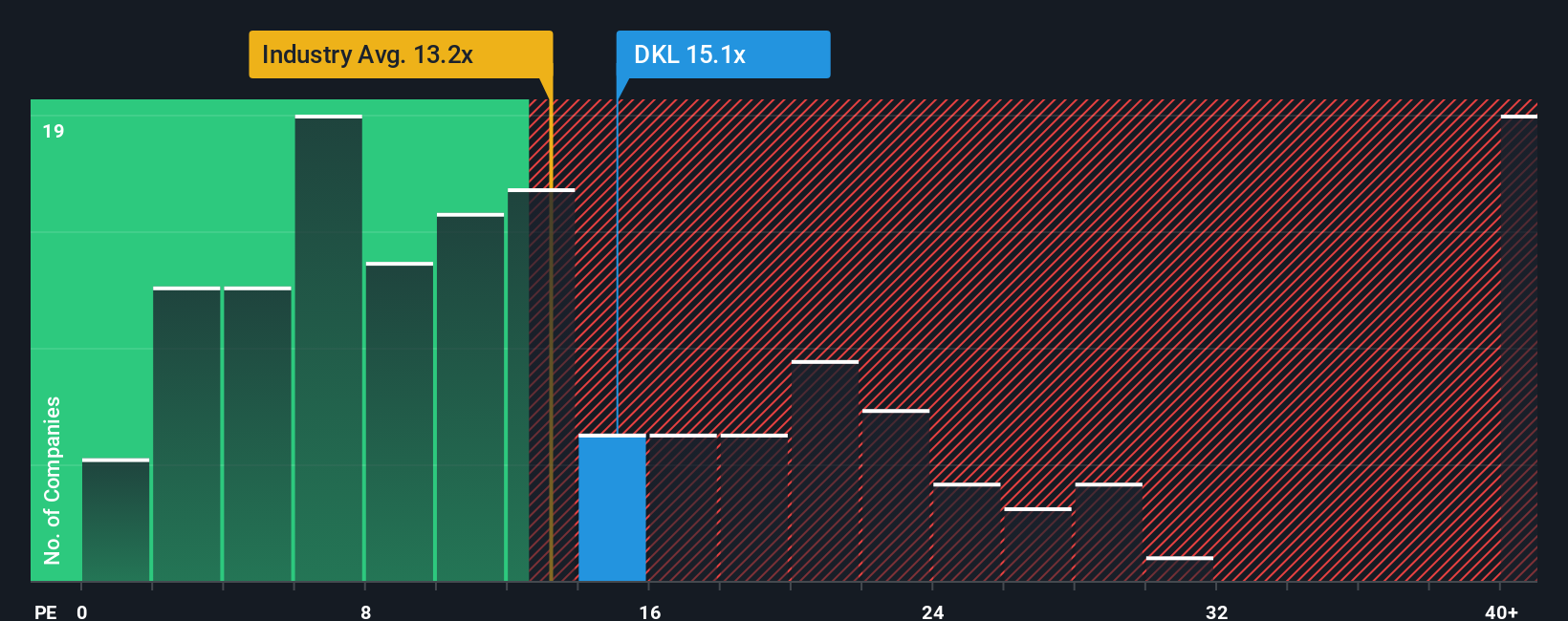

Currently, Delek Logistics Partners trades at a PE ratio of 15.77x. This is above the Oil and Gas industry average of 13.37x and also higher than the average of close peers, which stands at 10.28x. At first glance, this might make the stock look expensive, but simple PE comparisons may not tell the full story.

Simply Wall St’s “Fair Ratio” refines this benchmark, suggesting a PE of 18.10x is warranted for DKL, after accounting for its earnings growth prospects, industry setting, profit margins, company size, and overall risk. This proprietary measure goes further than basic peer or sector averages by considering the unique factors likely to affect the company’s future profitability and valuation.

With DKL’s current PE ratio of 15.77x notably below its Fair Ratio of 18.10x, the shares appear to be undervalued on this basis. This indicates there may be room for further upside if the company delivers on expectations.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Delek Logistics Partners Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a clear, personalized story that explains your perspective on a company’s underlying business, linking your forecasts on future revenue, profit margins, and risks to an estimated fair value. All of this is supported by your reasoning about the company’s prospects.

Instead of relying just on ratios or models, Narratives let you connect the company’s real-world developments to its numbers. This approach shows how changing circumstances might impact future performance and what you believe Delek Logistics Partners is actually worth. Narratives are available on Simply Wall St’s Community page, where millions of investors contribute and revise their views, making it accessible and easy to compare different perspectives on the same company.

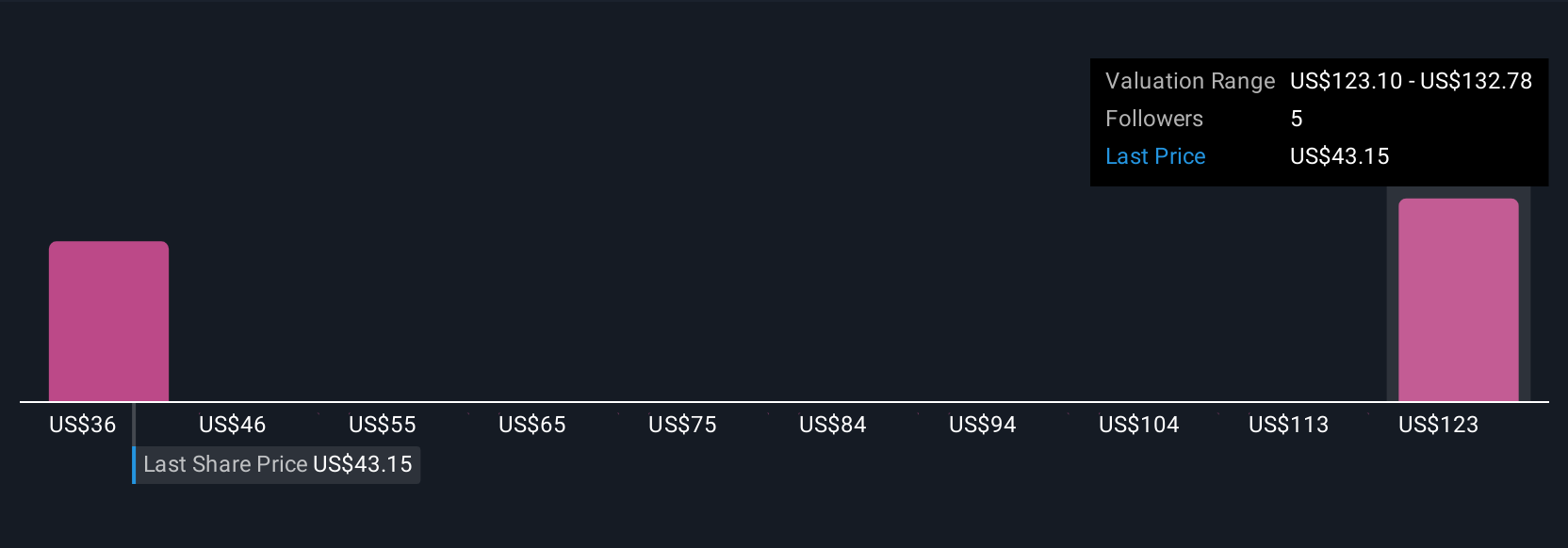

By creating or reviewing a Narrative, you can quickly see whether you think DKL is a buy or a hold by comparing your fair value to today’s price. Because they automatically update when news or earnings are released, your assessment always stays current. For example, some investors currently see Delek Logistics Partners’ fair value as high as $47.00, while others are more cautious with estimates as low as $36.00. This reflects different stories, expectations, and risk tolerances.

Do you think there's more to the story for Delek Logistics Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKL

Delek Logistics Partners

Provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, terminalling water disposal and recycling customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives