- United States

- /

- Oil and Gas

- /

- NYSE:DKL

Delek Logistics Partners (DKL): Evaluating Valuation After Upbeat Earnings Growth and Higher Analyst Estimates

Reviewed by Simply Wall St

If you are wondering what to make of Delek Logistics Partners (DKL) right now, you are not alone. After a stretch of coverage highlighting its accelerating earnings growth and a sudden move up in analyst earnings estimates, the stock has been getting fresh attention. Investors have taken note, as the company’s upbeat outlook and improved fundamentals seem to be translating into rising confidence in its future prospects.

This uptick in optimism has coincided with DKL outperforming its Oils-Energy sector peers. Over the past year, the stock has delivered a 15% total return, putting it ahead of many in the space. In the last month, shares climbed 4% which hints at building momentum alongside the improved outlook. While gains over the past three years were more modest, the recent run suggests perceptions may be shifting around DKL’s growth story and risks.

But does this renewed interest and solid performance signal a true buying opportunity, or has the stock already priced in the future growth investors are expecting?

Most Popular Narrative: Fairly Valued

According to the widely followed narrative, Delek Logistics Partners is trading close to its projected fair value, with analysts estimating only a minimal discrepancy between the current price and consensus target. The stock is judged to be neither aggressively discounted nor notably expensive based on expected future performance.

The analysts have a consensus price target of $43.75 for Delek Logistics Partners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $47.0, and the most bearish reporting a price target of just $36.0.

Want to know the true engine behind this fair value? There is one number, hidden among analyst assumptions, that could flip the script for DKL’s valuation. The secret to its steady price? Dig into the narrative and discover which performance lever analysts are watching as the company’s story unfolds.

Result: Fair Value of $43.75 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising debt burdens or a sharp drop in long-term fossil fuel demand could quickly put this fair value narrative to the test.

Find out about the key risks to this Delek Logistics Partners narrative.Another View: Discounted Cash Flow Offers a Different Take

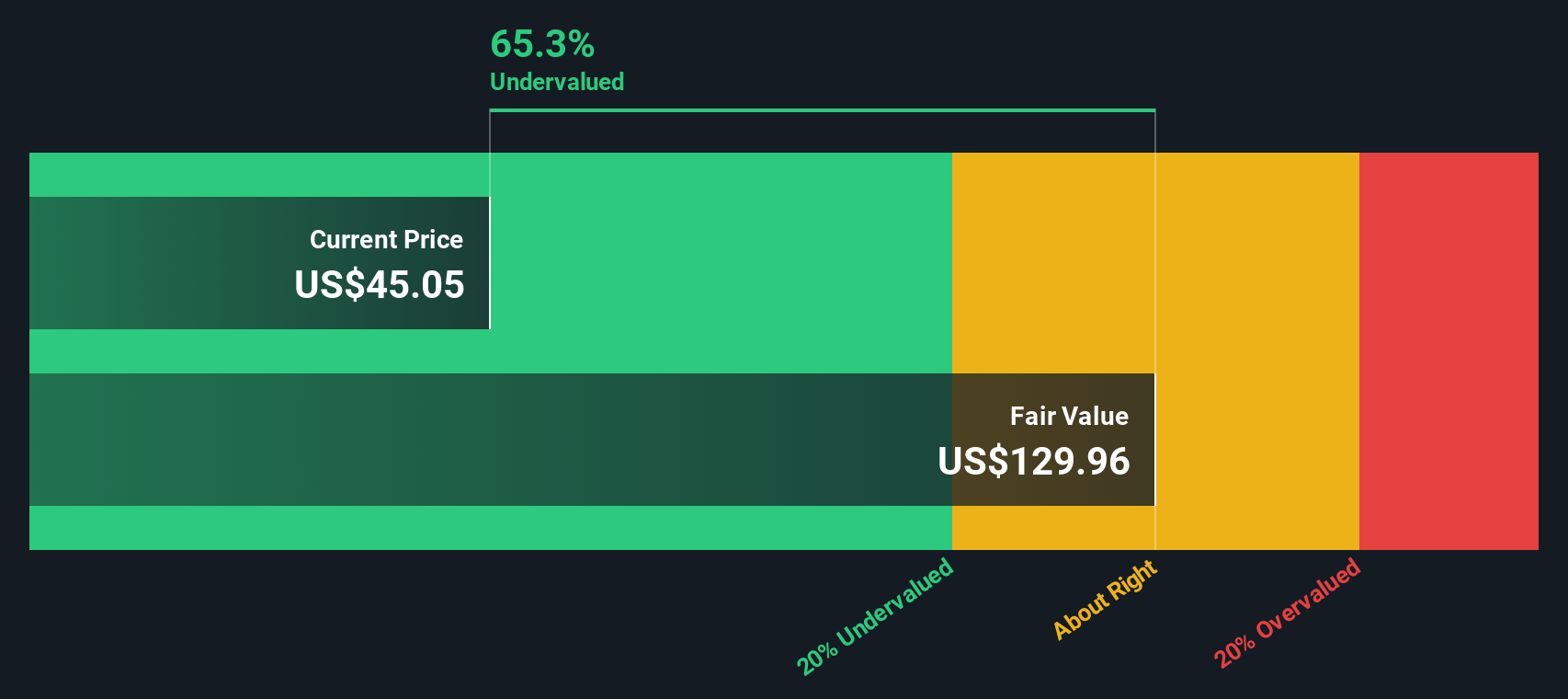

While analysts land near fair value using future earnings estimates, our DCF model tells a surprisingly different story. It suggests Delek Logistics Partners may actually be much more attractively priced. Which method deserves your trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Delek Logistics Partners Narrative

If you would rather follow your own reasoning or see different potential paths for DKL, you can create your own narrative quickly and easily. Do it your way.

A great starting point for your Delek Logistics Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your strategy to one company when the right tools can reveal your next big move? Put yourself ahead by tapping into these handpicked opportunities:

- Unleash growth potential by scanning for undervalued businesses, where hidden gems await in our undervalued stocks based on cash flows.

- Capture tomorrow’s breakthroughs and fuel your portfolio with companies harnessing artificial intelligence using our AI penny stocks.

- Strengthen your income stream by targeting stocks offering robust yields, all found via our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKL

Delek Logistics Partners

Provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, terminalling water disposal and recycling customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives