- United States

- /

- Oil and Gas

- /

- NYSE:DK

Three Undervalued Small Caps With Insider Buying To Watch

Reviewed by Simply Wall St

Amid recent volatility in global markets, small-cap stocks have faced significant swings, with the S&P 600 Index reflecting broader concerns about economic growth and consumer demand. Despite these challenges, certain small-cap companies with insider buying activity present intriguing opportunities for investors seeking value. In this context, a good stock often combines strong fundamentals with signs of confidence from company insiders, making it worth watching even in uncertain market conditions.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.3x | 0.9x | 44.16% | ★★★★★★ |

| Titan Machinery | 3.7x | 0.1x | 35.49% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.2x | 32.93% | ★★★★★☆ |

| Norcros | 7.4x | 0.5x | 4.22% | ★★★★☆☆ |

| Trican Well Service | 8.0x | 1.0x | 7.58% | ★★★★☆☆ |

| Hemisphere Energy | 6.7x | 2.4x | 15.51% | ★★★★☆☆ |

| Franklin Financial Services | 9.6x | 1.9x | 40.35% | ★★★★☆☆ |

| Information Services | 23.7x | 2.1x | -63.67% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Sagicor Financial | 1.2x | 0.4x | -71.56% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings operates in the energy sector with business segments including refining, logistics, and retail, and has a market cap of approximately $1.32 billion.

Operations: The company generates revenue primarily from its refining, logistics, and retail segments, with refining being the largest contributor at $14.98 billion. The net income margin has shown significant variability over time, peaking at 5.26% in Q1 2019 and dropping to -8.37% in Q4 2020.

PE: -13.0x

Delek US Holdings, a company recently added to several Russell indices, reported a second-quarter net loss of US$37.2 million on sales of US$3.42 billion, reflecting challenges in the current market environment. Despite these results, the Board approved a slight dividend increase to US$0.255 per share for August 19, 2024. Insider confidence is evident with recent share purchases in July 2024. The company's guidance projects crude throughput between 290,000 and 305,000 bpd for Q3 2024.

- Click here to discover the nuances of Delek US Holdings with our detailed analytical valuation report.

Explore historical data to track Delek US Holdings' performance over time in our Past section.

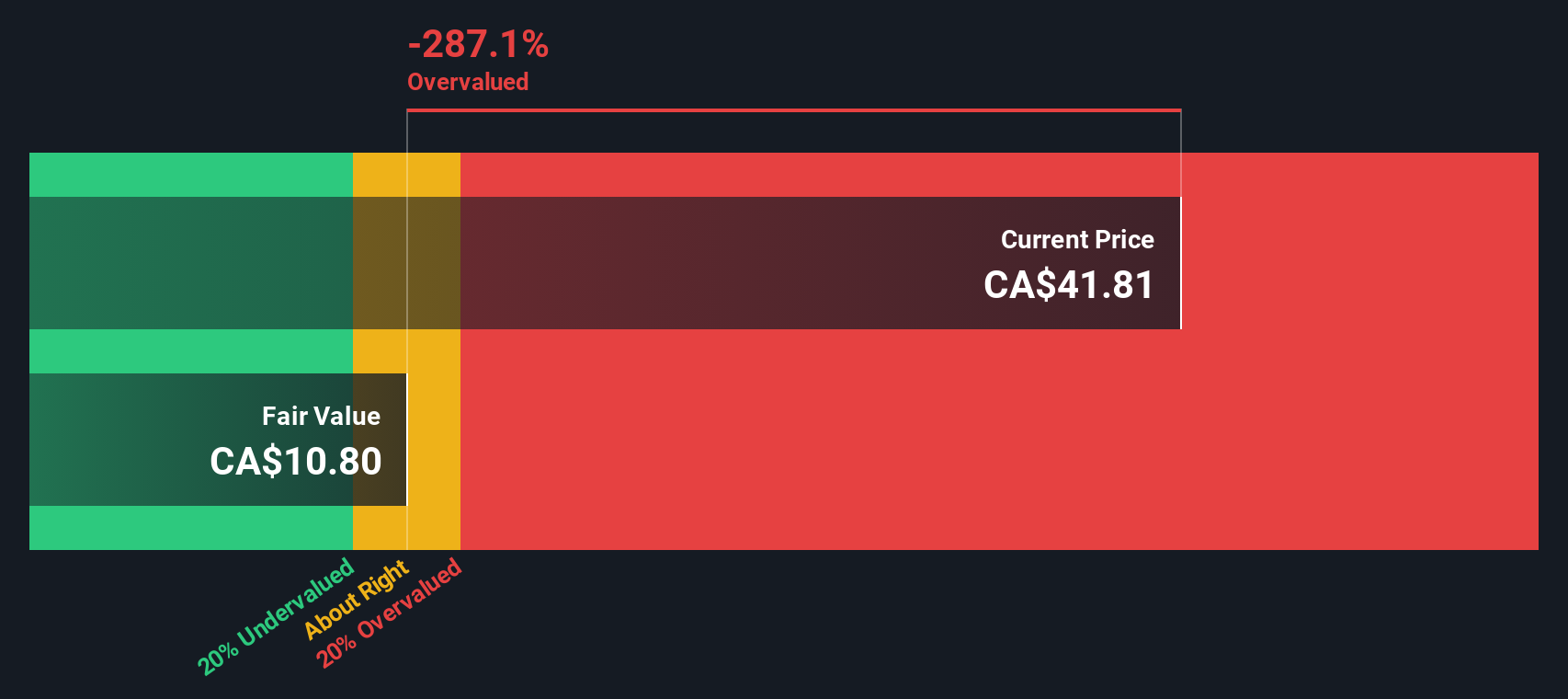

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Centerra Gold is a mining company focused on gold and copper production with operations primarily in Turkey, Canada, and the USA, boasting a market cap of approximately C$1.60 billion.

Operations: Centerra Gold's revenue streams are primarily derived from its Öksüt, Molybdenum, and Mount Milligan segments. The company's cost of goods sold (COGS) has varied significantly over the periods analyzed, impacting its gross profit margins. Notably, the gross profit margin reached a high of 58.82% in Q3 2019 but fell to 14.42% in Q1 2023 before recovering to 44.22% in Q2 2024.

PE: 10.9x

Centerra Gold’s recent performance highlights its undervalued status among smaller companies. For Q2 2024, the company reported sales of US$282.31 million and net income of US$37.67 million, a significant improvement from last year's net loss. Insider confidence is evident with recent share purchases from January to March 2024 totaling 1,783,800 shares for US$10 million. Despite earnings forecasted to decline by an average of 13.7% annually over the next three years, Centerra's solid production guidance for gold and copper suggests potential resilience in the market ahead.

- Click to explore a detailed breakdown of our findings in Centerra Gold's valuation report.

Evaluate Centerra Gold's historical performance by accessing our past performance report.

MDA Space (TSX:MDA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MDA Space is a Canadian company specializing in advanced space technology and services, with a market cap of approximately CA$1.20 billion.

Operations: MDA Space generates revenue primarily through its services, with the latest reported figure at CA$860.80 million for the period ending 2024-08-13. The net income margin has shown variability, with a recent value of 5.53% as of 2024-06-30. Gross profit margins have also fluctuated, reaching up to 44.51% in early periods but settling at around 32.41% by mid-2024 due to changes in cost structures and operating expenses.

PE: 36.4x

MDA Space recently reported Q2 2024 earnings with sales of C$242 million, a rise from C$196 million the previous year. Net income increased to C$11 million from C$9.9 million. The company also raised its full-year revenue guidance to between $1.02 billion and $1.06 billion, reflecting strong growth prospects. Notably, insider confidence is evident as Independent Chairman Brendan Paddick purchased 85,000 shares worth over C$1 million in July 2024, indicating belief in the company's future performance and potential value appreciation.

- Get an in-depth perspective on MDA Space's performance by reading our valuation report here.

Review our historical performance report to gain insights into MDA Space's's past performance.

Summing It All Up

- Click here to access our complete index of 203 Undervalued Small Caps With Insider Buying.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DK

Delek US Holdings

Engages in the integrated downstream energy business in the United States.

Average dividend payer and fair value.