- Finland

- /

- Auto Components

- /

- HLSE:TYRES

Three Undervalued Small Caps With Insider Activity To Watch

Reviewed by Simply Wall St

In recent weeks, global markets have shown mixed performance, with small-cap and value shares outpacing large-cap growth stocks. Economic indicators have painted a varied picture, highlighting both challenges and opportunities for investors. In this environment, identifying undervalued small-cap stocks with insider activity can offer potential advantages. These companies often present unique opportunities for growth and resilience amid market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tokmanni Group Oyj | 14.7x | 0.5x | 45.16% | ★★★★★★ |

| Dundee Precious Metals | 8.5x | 2.9x | 32.59% | ★★★★★★ |

| THG | NA | 0.4x | 42.89% | ★★★★★☆ |

| Bytes Technology Group | 25.6x | 5.8x | -1.51% | ★★★★☆☆ |

| Nexus Industrial REIT | 2.8x | 3.4x | 13.95% | ★★★★☆☆ |

| Sagicor Financial | 1.1x | 0.3x | -80.21% | ★★★★☆☆ |

| Columbus McKinnon | 24.3x | 1.1x | 42.94% | ★★★★☆☆ |

| PowerCell Sweden | NA | 4.3x | 43.29% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.2x | -227.32% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

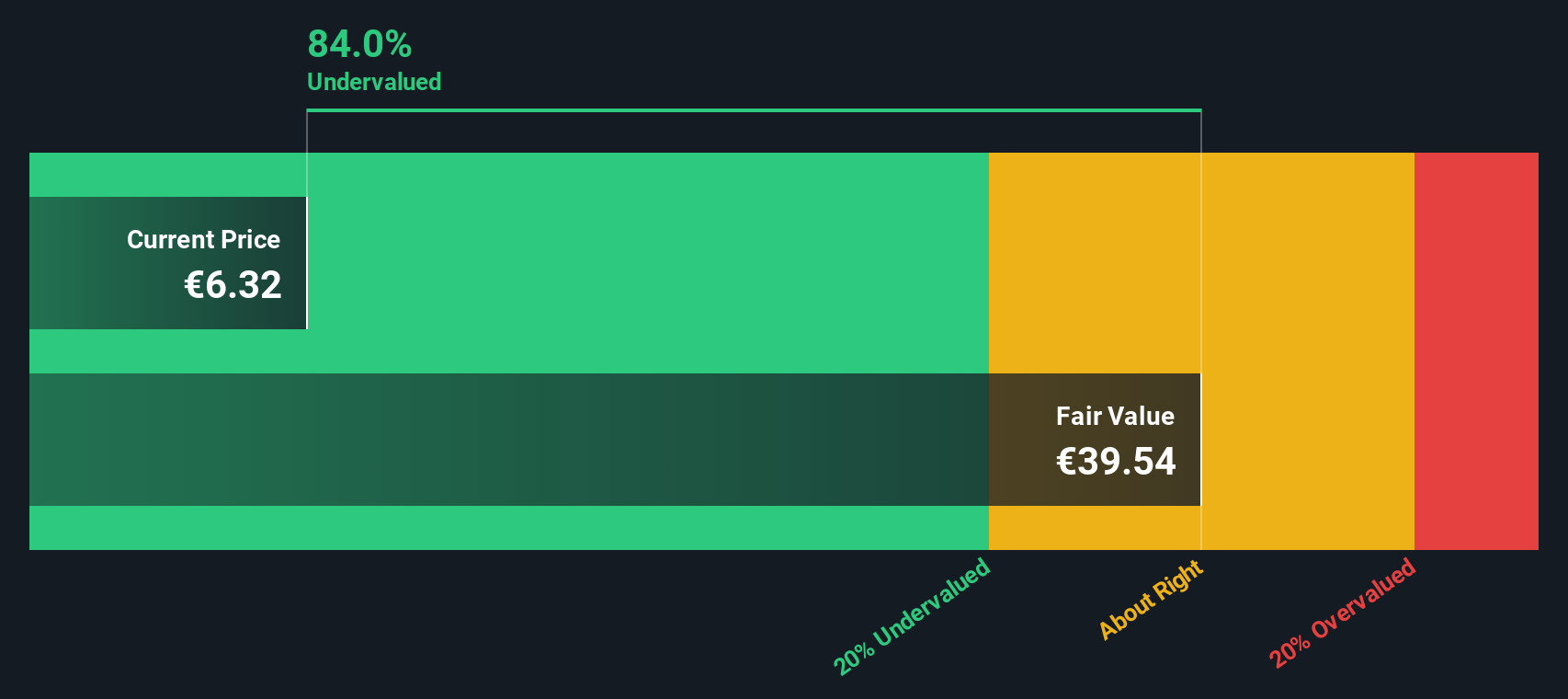

Nokian Renkaat Oyj (HLSE:TYRES)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nokian Renkaat Oyj specializes in manufacturing and selling tires for passenger cars, heavy vehicles, and operates the Vianor tire service chain, with a market cap of approximately €2.02 billion.

Operations: The company's revenue streams are primarily derived from Passenger Car Tyres (€699.40 million), Vianor (€345.50 million), and Heavy Tyres (€236.70 million). Over recent periods, the net income margin has shown significant fluctuations, reaching a high of 27.70% in Q1 2019 and a low of -3.80% in Q2 2023.

PE: 196.2x

Nokian Renkaat Oyj, a small cap in the tire industry, has shown signs of growth with sales reaching €324.6 million in Q2 2024, up from €293.1 million the previous year. Despite a net loss of €24.6 million for H1 2024, insider confidence is evident as company executives have been actively purchasing shares throughout the year. The recent appointment of Paolo Pompei as CEO and their innovative partnership with UPM Biochemicals for sustainable tires highlight potential future growth avenues.

- Dive into the specifics of Nokian Renkaat Oyj here with our thorough valuation report.

Gain insights into Nokian Renkaat Oyj's past trends and performance with our Past report.

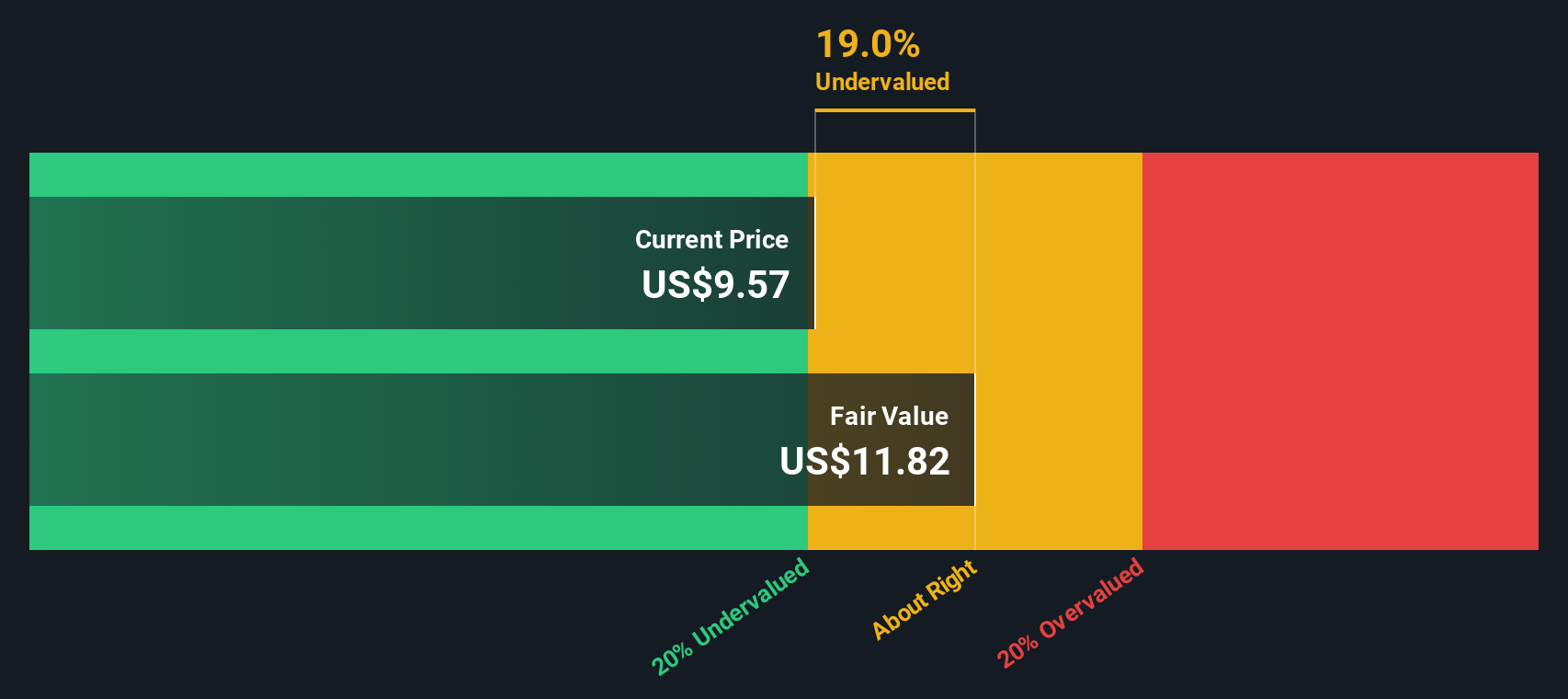

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings operates in the energy sector with key segments in refining, logistics, and retail, and has a market cap of approximately $1.27 billion.

Operations: The company's primary revenue streams are from refining ($15.72 billion), logistics ($1.03 billion), and retail operations ($871.2 million). The cost of goods sold (COGS) for the latest period was $15.28 billion, resulting in a gross profit of $938.6 million and a gross profit margin of 5.79%.

PE: -19.9x

Delek US Holdings, a notable player in the energy sector, has recently been added to multiple Russell indices as of July 1, 2024. Despite reporting a net loss of US$32.6 million for Q1 2024 compared to a net income of US$64.3 million last year, the company shows insider confidence with recent share repurchases totaling US$485.21 million since November 2018. Additionally, Delek increased its quarterly dividend to US$0.25 per share in May 2024, signaling potential shareholder value ahead.

- Unlock comprehensive insights into our analysis of Delek US Holdings stock in this valuation report.

Assess Delek US Holdings' past performance with our detailed historical performance reports.

Leggett & Platt (NYSE:LEG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Leggett & Platt is a diversified manufacturer that designs and produces engineered components and products for various industries, with operations in bedding products, specialized products, and furniture, flooring & textile products, having a market cap of approximately $4.38 billion.

Operations: Leggett & Platt generates revenue primarily from Bedding Products ($1.91 billion), Specialized Products ($1.28 billion), and Furniture, Flooring & Textile Products ($1.46 billion). The company's cost of goods sold (COGS) significantly impacts its gross profit margin, which was 17.83% as of Q2 2024.

PE: -11.4x

Leggett & Platt, a small-cap company recently added to the S&P 600, has seen significant changes in its leadership with Karl Glassman returning as CEO and President. Despite reporting lower Q1 2024 earnings of US$31.6 million compared to US$53.5 million last year, the company maintains stable long-term prospects with a focus on strategic acquisitions and debt reduction. Insider confidence is evident from recent share purchases by executives, signaling potential growth opportunities ahead.

Taking Advantage

- Explore the 215 names from our Undervalued Small Caps With Insider Buying screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokian Renkaat Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:TYRES

Nokian Renkaat Oyj

Develops and manufactures tires for passenger cars, trucks, and heavy machineries in Nordics, the rest of Europe, the Americas, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives