- United States

- /

- Oil and Gas

- /

- NYSE:DHT

DHT Holdings (NYSE:DHT): Valuation Check After Major Stakeholder Share Sales by Scorpio Tankers and BW Group

Reviewed by Simply Wall St

Substantial Stakeholder Sales Put DHT Holdings in the Spotlight

The recent shakeup at DHT Holdings (DHT) has investors talking, and for good reason. Scorpio Tankers and BW Group, two influential players in the shipping sector, just cashed out more than $40 million in DHT shares. When big holders rethink their positions like this, it often sparks questions about what is next, especially since there were no major company announcements or industry shakeups reported at the same time. For anyone watching this stock, it is a moment that raises as many questions as it answers.

Despite this, DHT Holdings has not exactly taken a hit. The stock is up 10% over the month and 18% in the past year, with a three-year return of an impressive 73%. While there has been a little turbulence in the past week, momentum has generally built over the longer term. Thanks to annual increases in revenue and a solid jump in net income, it is clear that underlying fundamentals remain in focus for many investors.

So after these recent insider sales, is DHT Holdings trading at a discount compared to its long-term prospects, or is the market already factoring in its future growth?

Most Popular Narrative: 13.8% Undervalued

According to the most widely followed narrative, DHT Holdings is trading below its estimated fair value, suggesting the market may be missing key aspects of the company's outlook.

Modern fleet renewal and a disciplined capital strategy strengthen earnings stability, operational efficiency, and resilience through market cycles. Geopolitical shifts and tightening vessel supply create favorable conditions for higher utilization, stable cash flows, and improved profitability.

DHT's valuation story might surprise you. What hidden assumptions drive this double-digit discount? Analysts are considering everything from future earnings strength to evolving profit margins and a leaner share count. Interested in which drivers push the fair value so far above current prices? Explore the full narrative to see the precise forecasts and lively debate behind the numbers.

Result: Fair Value of $14.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent pressure from renewables adoption or DHT's high dividend payout could quickly shift the outlook and challenge long-term profit growth.

Find out about the key risks to this DHT Holdings narrative.Another View: SWS DCF Model Perspective

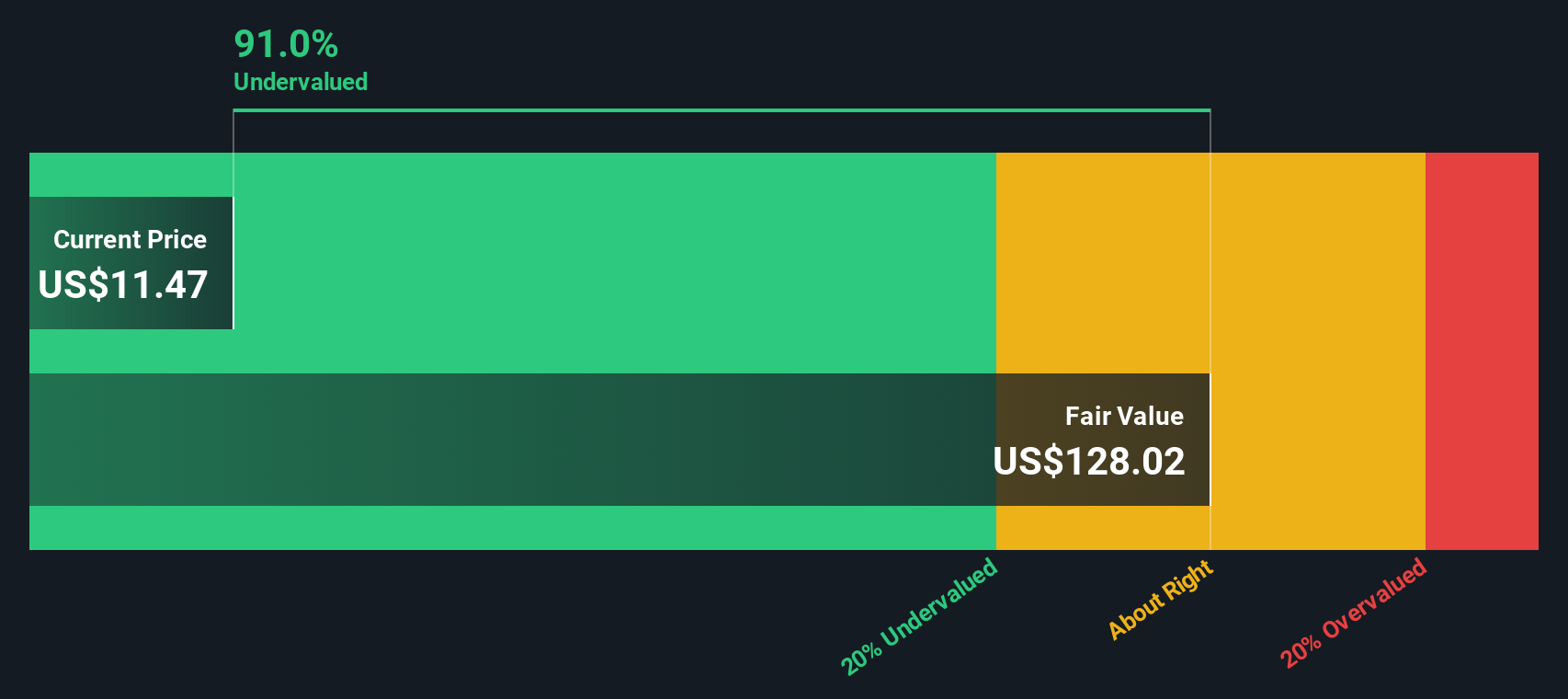

To challenge the market discount narrative, our DCF model offers a fresh lens. This approach, which forecasts future cash flows, also points to the stock being undervalued. It raises the question of whether both methods might be overlooking key risks or upside.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DHT Holdings Narrative

If you have a different perspective or want to dig deeper, you can craft your own narrative for DHT Holdings in just a few minutes. Do it your way

A great starting point for your DHT Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for one perspective. Take charge of your portfolio by zeroing in on stocks primed for growth, overlooked by the market, or frontrunners in future-ready sectors.

- Power up your search with opportunities in undervalued stocks based on cash flows to spot stocks trading below their true worth.

- Elevate your returns by pinpointing dividend stocks with yields > 3% offering attractive yields for investors focused on steady income.

- Ride the next tech surge by uncovering AI penny stocks at the forefront of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives