- United States

- /

- Oil and Gas

- /

- NYSE:DHT

DHT Holdings (NYSE:DHT) Announces Dividend Decrease Amid Earnings Call

Reviewed by Simply Wall St

DHT Holdings (NYSE:DHT) announced a dividend decrease and scheduled an earnings call, indicating transparency and ongoing shareholder engagement. During the last quarter, the company's stock price saw a 1.07% increase, largely unaffected by the broader market's volatility. While major indices like the S&P 500 and Nasdaq faced steep declines due to global tariff uncertainties, DHT's stability perhaps stemmed from its strong earnings report and consistent dividend policy, highlighting its resilience in a tumultuous market. This stability contrasts sharply with the broader market's recent downturn and widespread concerns over economic impacts from escalating trade tensions.

Buy, Hold or Sell DHT Holdings? View our complete analysis and fair value estimate and you decide.

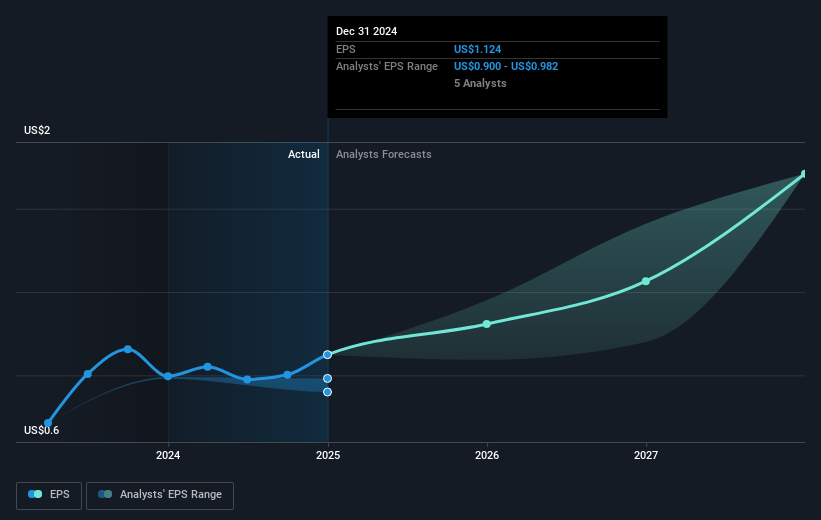

Over the last five years, DHT Holdings has delivered a total shareholder return of 123.43%. This remarkable return comes amid evolving strategies and market conditions, underscoring its resilience and adaptation in an often volatile industry. A significant factor was the deployment of new Very Large Crude Carriers (VLCCs) amid a market supply squeeze. This strategic move was complemented by a series of ship sales and reinvestments into debt reduction and newer vessels, potentially optimizing asset performance and securing future revenue. Additionally, consistent customer interest in long-term charters for new, fuel-efficient vessels also bolstered revenue streams.

Notably, DHT has engaged in share buyback programs, repurchasing over 2.2 million shares valued at US$18.8 million. Despite a year of underperformance compared to the US Oil and Gas industry, the company's commitment to enhancing fleet efficiency and financial health reflects a focus on long-term growth. Recent dividend fluctuations and the appointment of Ms. Ana Zambelli to the Board highlight ongoing corporate governance and strategic oversight, fostering a robust operational framework.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade DHT Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives