- United States

- /

- Oil and Gas

- /

- NYSE:DHT

DHT Holdings (DHT): Margin Surge Reinforces Bullish Value Narrative Despite Dividend Concerns

Reviewed by Simply Wall St

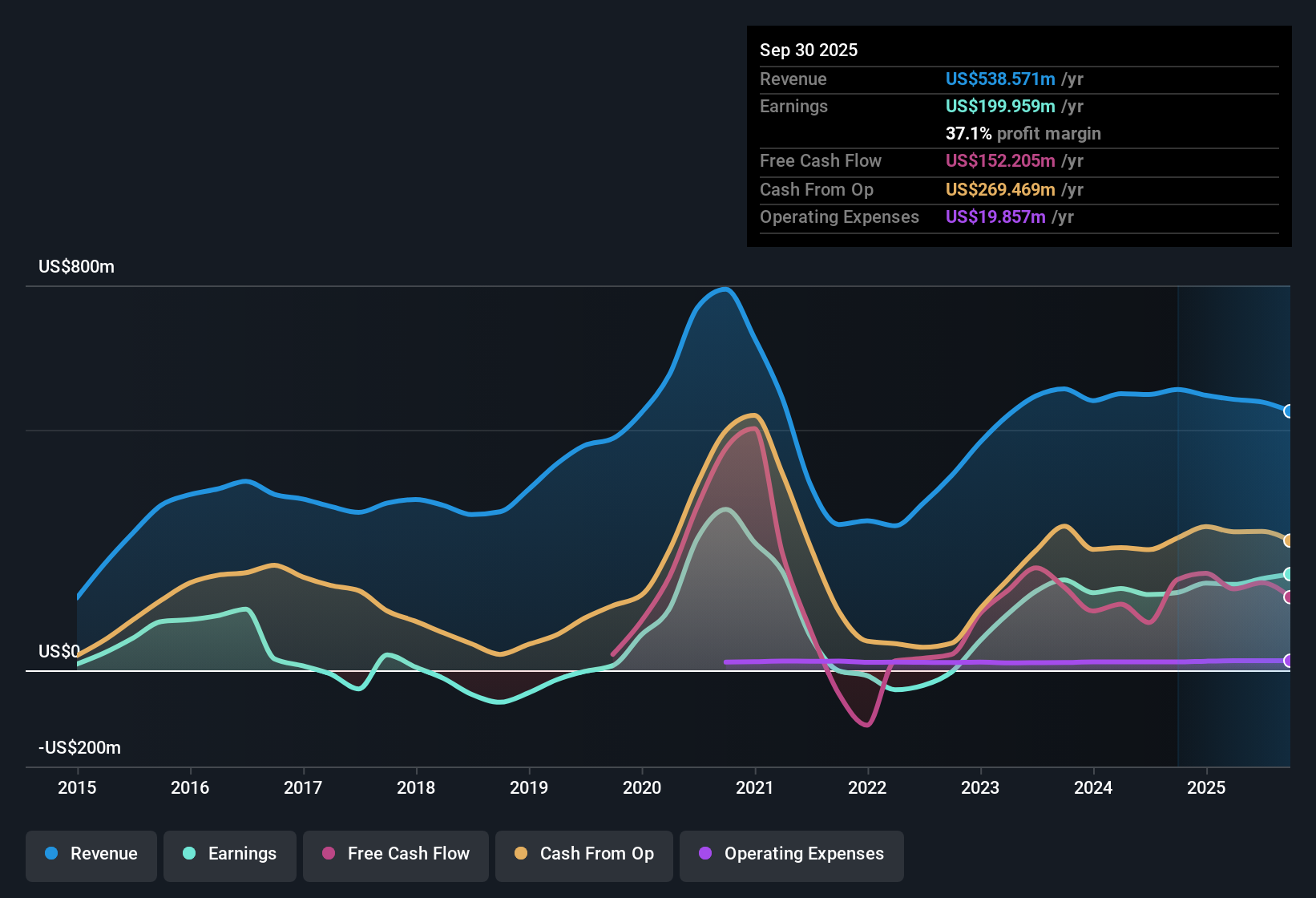

DHT Holdings (NYSE:DHT) posted a net profit margin of 37.1%, increasing from 27.7% last year, with earnings accelerating to 23.6% annual growth, well above the five-year average of 8.5%. Revenue is forecast to grow at 6.4% per year while earnings are projected to rise 14.2% annually. Both figures trail the broader US market growth rates, and the stock currently trades at a Price-To-Earnings ratio of 10.5x, notably lower than industry peers and its estimated fair value. With sustained margin expansion and robust earnings momentum, investors are likely to view the latest results as a strong signal, even as questions about dividend sustainability remain in the background.

See our full analysis for DHT Holdings.Up next, we’ll see how these results hold up when set against the major narratives driving sentiment. Here’s where the headlines match up, and where they might get challenged.

See what the community is saying about DHT Holdings

Margin Expansion Drives Stability

- Net profit margin jumped to 37.1%, up from 27.7% last year. Analysts expect it to rise even further to 56.5% within three years, highlighting a positive structural shift.

- According to the analysts' consensus view, DHT's push for a modern, fuel-efficient fleet and careful capital management is expected to reinforce both high margins and stable long-term earnings.

- Modern vessel upgrades and disciplined strategy help absorb rising regulatory costs, supporting the margin trend.

- Stable cash flows from charter contracts and high utilization rates could lock in margin gains even when top-line growth lags.

What’s interesting is that the way DHT reinvests in newer ships appears to offset a lot of the margin risks the bears worry about. The market might be underestimating that.

Dividend Discipline and Risks Ahead

- DHT continues to pay out up to 100% of net income as dividends, but dividend sustainability is a flagged risk due to potential pressures on earnings and high ongoing capital requirements.

- Analysts' consensus narrative emphasizes that while the company’s heavy dividend approach has rewarded investors lately, it may limit how much DHT can reinvest in future fleet renewal or withstand market cycles.

- Large quarterly payouts boost short-term shareholder returns but reduce flexibility during periods of weak freight rates or unexpected costs.

- Aggressive payouts could delay vital investments in eco-friendly technology as regulations tighten, putting future earnings resilience at risk.

Discount Versus Peers Remains Wide

- With a current share price of $13.10, DHT trades at a Price-To-Earnings ratio of 10.5x, which is well below the US oil and gas industry average of 12.6x and notably under the consensus analyst price target of $14.83.

- Analysts' consensus view argues DHT’s margin trajectory and stable cash flow profile could justify closing the valuation gap, especially as the company’s modern fleet and tight vessel supply backdrop both support future profitability.

- As margin expansion outpaces revenue growth, valuation rerating could occur even if industry growth is slow.

- While being cheaper than sector peers, DHT’s operational strengths counter typical “value trap” concerns, suggesting the stock’s risk-reward balance remains attractive.

Bulls and bears alike are watching to see if DHT’s cheap valuation and robust margins finally attract broader market attention, or if dividend risks scare off long-term investors. 📊 Read the full DHT Holdings Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for DHT Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Build your viewpoint and share your narrative in just a few minutes. Do it your way

A great starting point for your DHT Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite robust margins, DHT’s aggressive dividend policy raises real concerns about long-term sustainability and reinvestment in fleet renewal.

If consistent and reliable yields are essential for your investment goals, check out these 2003 dividend stocks with yields > 3% to discover companies offering attractive dividends along with stronger long-term security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion