- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Is Chevron Stock a Bargain After Recent Gains and Industry Deal Buzz?

Reviewed by Bailey Pemberton

- Wondering if Chevron is truly worth its current price, or if there is deeper value just waiting to be uncovered? You are in the right place for a closer look at what the numbers are really saying.

- The stock has climbed 1.7% in the last week, 3.6% over the past month, and is up 7.4% year-to-date. Over five years, it has delivered a solid 124.7% return. However, growth has not been smooth every step of the way; the stock recorded only a modest 2.1% gain in the last twelve months and a slight dip over three years.

- Chevron’s recent price movement comes in the wake of growing optimism around energy demand and ongoing global discussions about supply stability. Notably, headlines spotlighting major oil deal negotiations and industry consolidation have kept the company in focus and contributed to shifting investor sentiment.

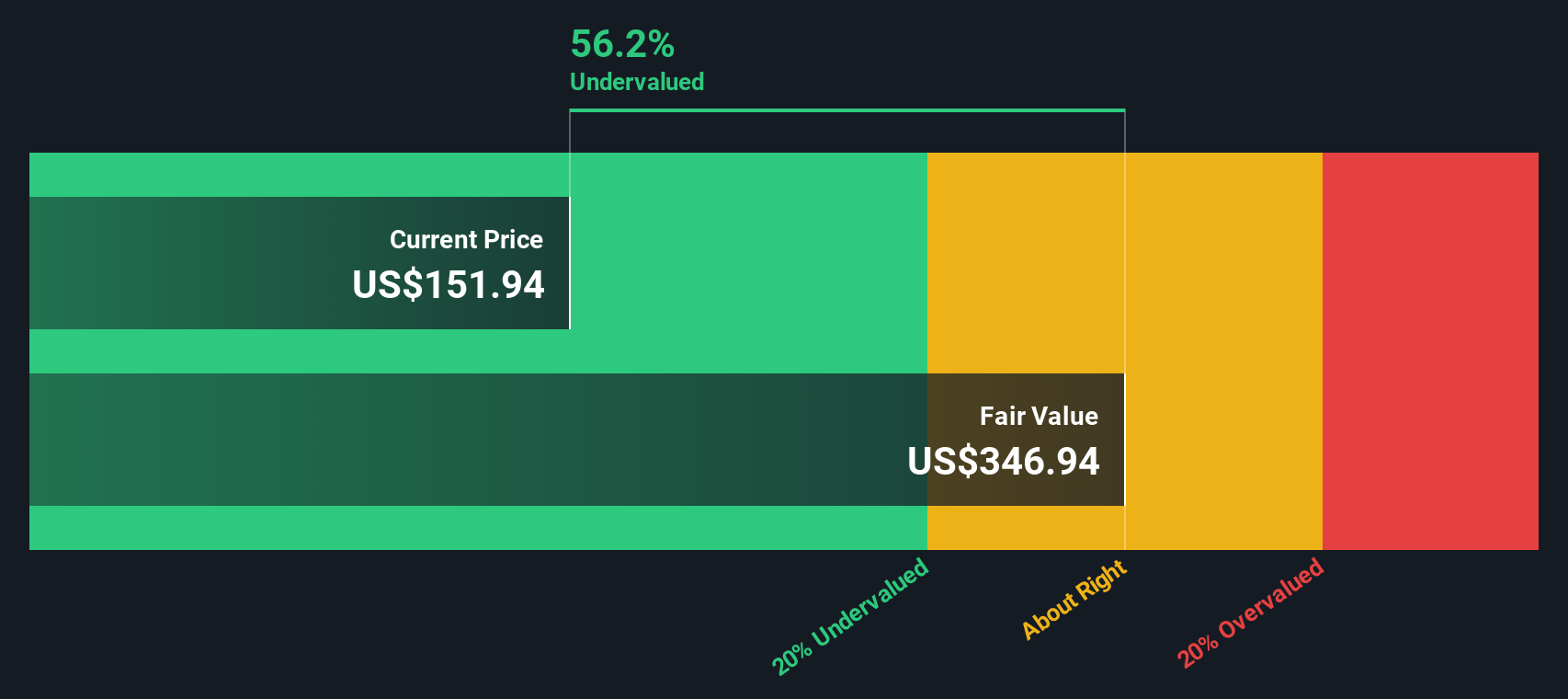

- In our valuation checks, Chevron scores a 2 out of 6 for being undervalued, which you can review in detail here. Next, we will break down how analysts and different methods value Chevron, and at the end, we will share a perspective that gives you an even clearer sense of its real worth.

Chevron scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Chevron Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors determine what a business is intrinsically worth based on its expected long-term cash generation, rather than just near-term performance or market trends.

Chevron’s current Free Cash Flow comes in at $16.3 billion. Analysts forecast cash generation to ramp up over the coming decade, with future projections (including analyst estimates and systematic extrapolation) showing Free Cash Flow could reach $26.6 billion in 2029, and even as high as $32.4 billion by 2035. These projections incorporate a moderate annual growth rate that gradually levels off over time as estimated by the DCF model.

According to this DCF-based valuation, Chevron’s estimated fair value stands at $325.49 per share. This suggests the stock is trading at a 51.6% discount to its intrinsic value, indicating it is significantly undervalued according to cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Chevron is undervalued by 51.6%. Track this in your watchlist or portfolio, or discover 877 more undervalued stocks based on cash flows.

Approach 2: Chevron Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Chevron, as it reflects how much investors are willing to pay for each dollar of earnings. This makes it especially suitable for well-established businesses with consistent profits.

What counts as a "normal" or "fair" PE ratio depends on how quickly a company is expected to grow and how much risk investors see in its future. Higher expected growth or lower risk usually justifies a higher PE, while slower growth or greater uncertainty warrants a lower one.

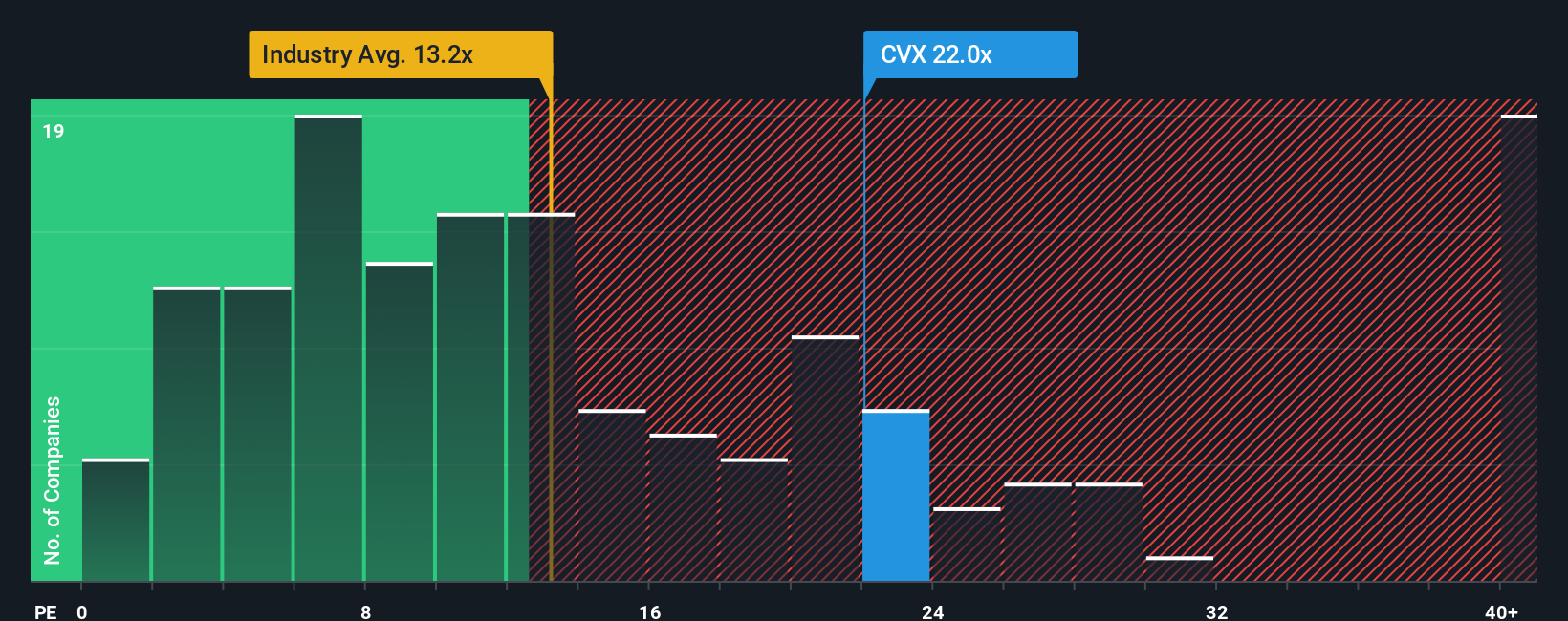

Chevron currently trades at a PE ratio of 24.9x. To put this in context, the Oil and Gas industry averages 14.3x, and Chevron's peer group sits at 22.5x. At first glance, Chevron appears priced above its typical industry and peer benchmarks.

To get a clearer sense of value, Simply Wall St calculates a "Fair Ratio" for Chevron. This proprietary metric incorporates factors such as the company's earnings growth, profit margin, risk profile, industry characteristics, and market cap. This approach goes well beyond simple peer or industry comparisons and provides a more tailored benchmark for Chevron’s unique profile.

Chevron's Fair Ratio is estimated at 23.8x. Since the company's actual PE of 24.9x is only modestly above this fair valuation, the price looks close to fair value based on earnings. The difference is small and within a reasonable margin.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chevron Narrative

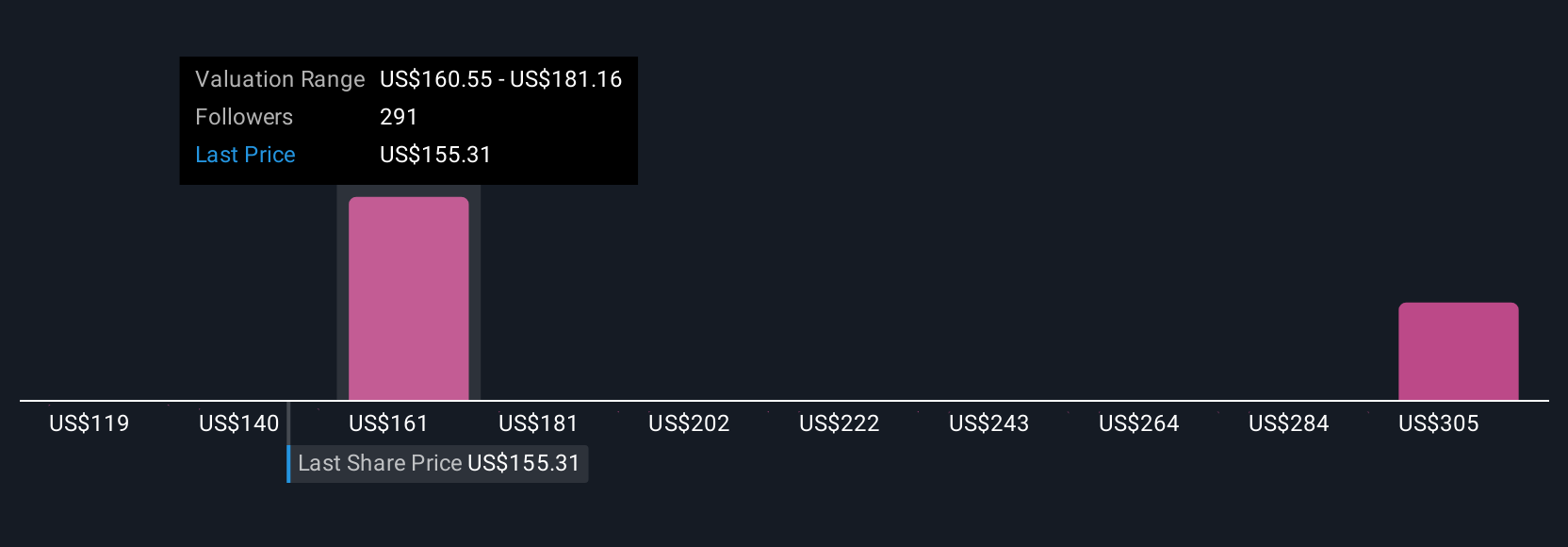

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you tell about Chevron’s future, combining your perspective on where the company is heading with real numbers like expected revenues, earnings, and profit margins. Rather than just analyzing ratios or forecasts in isolation, Narratives help you connect Chevron’s specific business drivers, risks, and industry changes directly to a financial forecast and ultimately to a fair value estimate.

With Narratives, you do not need to be a finance expert. This tool, available on Simply Wall St’s Community page (trusted by millions of investors), lets you build or explore investment stories, see how others view the stock, and react quickly as new news or earnings arrive and automatically update the underlying numbers.

For example, some investors believe Chevron’s strengths in low-cost production and big acquisitions will drive earnings up to $26.1 billion by 2028, supporting a high price target of $197 per share. Others worry about slow renewables transition and forecast just $15.7 billion in earnings and a $124 price target. Narratives put these differences side by side so you can compare each story’s fair value with the current share price and decide if now is a good time to buy or sell, all in one place and always up-to-date.

Do you think there's more to the story for Chevron? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives